When he learned that several prominent American newspapers had published his obituary, Mark Twain, the still very much alive and kicking author of Tom Sawyer and Huckleberry Finn, was in London on a world tour. He took time out to send the following brief cable: “The reports of my death are greatly exaggerated.”

No kidding. He went on to write several masterpieces after the press had buried him. Early fake news or just an honest mistake?

Which is how some modern day civil servants, who’ve become self-made millionaires on decent-but-modest salaries, must feel when they read they are living in a bubble. In fact, during the 11-year run of what was the longest bull market in U.S. history experts predicted it couldn’t and wouldn’t last and they should all remain in their financial bomb shelters. Those experts were, of course, right. Markets go up and markets go down. They react and are impacted by events, like wars, volcanoes in Iceland, low-priced oil, high-priced oil, and pandemics.

What the experts always miss, except for the occasional lucky guess, is when the markets will hit bottom vs. when they have peaked. This makes market timing — knowing when to sell and just as importantly when to return — so difficult. As many investors found out during the Great Recession of 2008-2009 when hundreds of thousands left the C, S and I stock indexed funds of their TSP for the safety of the treasury securities G fund.

Checkout three key dates in recent Thrift Savings Plan activity:

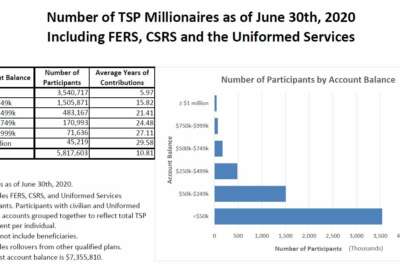

- As of Dec. 31, when the stock market was riding high, the 5.6 million participants in the TSP included 49,620 current and former investors whose TSP accounts ranged from $1 million to $7.3 million in value. That was before the pandemic hit.

- By March 31, the number participating in the TSP had grown to 5.7 million. But the number of TSP millionaires had dropped to 27,212. End of story, right? Those who had cast their lots with the high risk, high reward stock funds were paying their long-over due bills, right? Except —

- By June 30, just a couple weeks ago, the 5.8 million TSP participants could count 45,219 among their ranks with accounts of $1 million to $5.8 million. Down but far from out, and many had continued to buy shares in the C, S and I funds which, at least when they are down, are on sale. That’s assuming, of course, they go back up.

So how are investors handling the current, very unstable and sometimes scary market? First we talk to a TSP millionaire. He’s a NASA worker who plans to retire sometime this summer. Here’s what he said:

“All is well in quarantine land as NASA is no closer to opening back up for everyone. I expect I won’t be around to see that day as I still plan to retire this summer after 30-plus years. Yes, I’m one of the TSP millionaires and, in fact, maxed out my contributions with everything going into the C&S funds in March. I love buying low. My overall portfolio does contain some G&F funds — just enough to make sure the 10-year rate of return average stays above 6.5%. At this percentage my TSP account will last me past 2060 (even though I might not).” — Steve

What about those nowhere near retirement? Here’s how a relatively young but wise-beyond-her-years Agriculture Department employee, based on the West Coast, sees it:

“[I] have changed my strategy this time … Last time I rode the whole rollercoaster down 57%. I have a lot more skin in the game this time, so here is what I am doing.

“Keep investing every two weeks in the L2050 20% of my income plus the government 5% match. Once the stocks recovered in late March or early June — forget the date — I moved 50% into the G fund. I will be reinvesting this money in the fall or winter of 2020. I do not think company balance sheets will be able to recover long term with this level of unemployment.

“Remember after Lehman failed in October 2008 the stocks did not hit rock bottom until March 2009 — it took a good six months for the impact to set in. You should read ‘The Big Short’ by Michael Lewis, then ‘Stress Test’ by Timothy Geithner. This might explain a lot of my thinking.

“Overall, our family is healthy and doing ‘normal’ things … Our normal, gardening, riding bikes, pool etc. Teleworking has been working great for me. I need to schedule leave but I am not going anywhere.” — E

Nearly Useless Factoid

By Amelia Brust

They’re not just for soup — oyster mushrooms have also been used to clean up oil spills. Groups have used the fungi to soak up petroleum in the Amazon rainforest, because they produce enzymes that break down hydrocarbons and soak up heavy metals like mercury. Another Amazonian fungus has also been found to eat polyester polyurethane.

Source: Vice

Copyright

© 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.