Federal Report

-

In addition to the ever-present threat of a shutdown, it’s when federal workers go shopping for next year’s all-important heath insurance.

August 30, 2019 -

Shouldn’t the feds responsible for programs impacting crops, cattle and minerals be closer to the taxpayers who produce, manage and depend on them?

August 29, 2019 -

Most experts say it is essential that people under the Federal Employees Retirement System put at least 5% into the Thrift Savings Plan.

August 28, 2019 -

Thanks to the ups and downs in the global markets, some of the 37,612 feds who were Thrift Savings Plan millionaires at the end of June may be back to six-figure balances.

August 27, 2019 -

When the Federal Employees Retirement System was being developed in Congress, most people didn’t switch even though they probably should have.

August 26, 2019 -

Many current and former feds remember whistleblowers in their agency. Often times the people who knew them best are the best judges of their actions, impact and motives.

August 23, 2019 -

Since the 1980s some federal offices and postal stations have been divided by a form of pension envy between CSRS and FERS.

August 22, 2019 -

No matter how humble your salary, job, habits and possessions you have an estate.

August 21, 2019 -

Are you a fed who needs more realistic investing guidance? Look at your own Thrift Savings Plan account and those or your 5,690,000 fellow account holders.

August 20, 2019 -

So what if the government gave current CSRS employees a choice: retire by a to be determined date and get full CSRS credit for their annuity, or continue in their jobs but with future benefits compiled under the less-generous FERS system. Which would you choose?

August 19, 2019 -

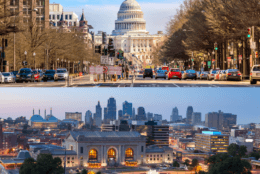

Workers in the Washington-Baltimore locality pay area are paid considerably more than feds in the same grade, doing the same job, in Kansas City, where the USDA plans to relocate two bureaus.

August 16, 2019 -

With two critical months to go in the cost of living adjustment countdown, federal, military and Social Security retirees are in line for an inflation catch-up.

August 15, 2019 -

Most current federal retirees, and a small percentage of folks still on the payroll, are under the old Civil Service Retirement System. It offers a generous lifetime annuity that is based on salary and length…

August 14, 2019 -

Would you move your family from the suburbs of Washington, D.C., to those of Kansas City to take a lower-wage job — as in $5,000 to $15,000 per annum lower?

August 13, 2019 -

The size and purchasing power of your 2020 biweekly paycheck or monthly annuity payment will be decided in a couple of months. The good news about the January 2020 COLA for federal, military and Social Security retirees is that there almost certainly will be one.

August 12, 2019