Federal Report

-

Senior Correspondent Mike Causey thought he had a scoop that the Social Security Administration was offering buyouts to long-time employees but he explains why that's a misunderstanding.

April 05, 2019 -

Federal retirees and folks who get Social Security benefits may be among the few people in the country who get anxious when crude oil prices drop.

April 04, 2019 -

Benefits expert Tammy Flanagan, will be Mike Causey's guest today on Your Turn, airing 10 a.m. EDT, streaming on www.federalnewsnetwork.com or on 1500 AM in the Washington, D.C., area.

April 03, 2019 -

Did the recent shutdown do at least one constructive thing: Spotlight the lack of federal workers?

April 02, 2019 -

Given the fact that Uncle Sam doesn’t do retail, mostly a highly professional and administrative operation, folks who contend feds are underpaid are probably closer to the truth.

April 01, 2019 -

With Democrats back in control of the House of Representatives, unions and groups representing workers, retirees, managers and executives are increasingly confident they can deliver a substantial raise to white collar feds next year.

March 29, 2019 -

The treasury securities G Fund continues to be the favorite of feds investing for retirement, while the Trump administration wants to lower its payout.

March 28, 2019 -

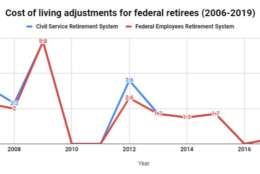

Some politicians have been after the Federal Employees Retirement System since it replaced the more generous Civil Service Retirement System program during the Reagan administration.

March 27, 2019 -

The Republican party could possibility retake control of the House in 2020 and might not have lost it in 2018 if more of its middle-America politicians learned a few things about federal bureaucrats.

March 26, 2019 -

Retirement planning is essential for just about everyone but if you work for Uncle Sam, a few things can cost you once you’ve switched from larger biweekly paychecks to a smaller monthly annuity deposit.

March 25, 2019 -

Years after the buyout surge of the 1990s some still-working feds are hanging on until the next round of buyouts. But that could take a while.

March 22, 2019 -

Retirement expert John Grobe, himself a former fed, said the length and uncertainty of the recent shutdown has a lot more people thinking about retirement, or just leaving government for greener pastures.

March 21, 2019 -

John Grobe, president of Federal Career Experts, specializes in prepping feds for retirement and is Mike Causey's guest on today's episode of Your Turn.

March 20, 2019 -

Allan Roth, founder of Wealth Logic and a nationally syndicated financial columnist, said that when it comes to investing, his motto is "Dare to be dull," as in boring.

March 19, 2019 -

Of the eligible Federal Employees Retirement System participants who have Thrift Savings Plan accounts, January participation rates rose by less than 1 percent because of missed contributions due to the partial government shutdown.

March 18, 2019