TSP

-

When they eventually retire, 99% of all current federal-postal workers will depend on their Thrift Savings Plan to provide a substantial portion of their future lifetime income.

July 16, 2020 -

Facing the possibility of furloughs next month, some employees at U.S. Citizenship and Immigration Services are looking for temporary work or a new job altogether. Others plan to tap into their retirement savings and Thrift Savings Plan to stay afloat.

July 15, 2020 -

How are investors handling the current, very unstable and sometimes scary market? Mike Causey heard from two TSP investors.

July 14, 2020 -

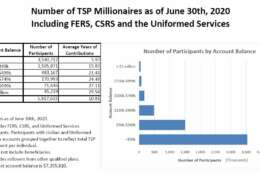

Thanks to the coronavirus' hit on the world economy, the number of federal workers and retirees with million-dollar Thrift Savings Plan accounts now stands at 47,219.

July 07, 2020 -

While your still working for the federal government, the Thrift Savings Plan is a great place to watch your retirement nest egg grow, while you are paying some of the lowest administration fees in the business.

July 02, 2020 -

Employees overwhelmingly see the importance and value in existing federal health and retirement benefits, and in many cases, these programs are a top recruitment and retention incentive, a new Office of Personnel Management survey found.

July 01, 2020 -

Some of the smartest people in the nation work for Uncle Sam and belong to the Thrift Savings Plan. For some it is a nice option. For most, it is their primary retirement nest egg.

June 23, 2020 -

The six new lifecycle funds represent a shift toward five-year increments rather than the usual 10. The Thrift Savings Plan will also retire the L 2020 fund, with a plan to automatically roll L 2020 fund participants into the L income fund starting June 30.

June 22, 2020 -

Many people investing for retirement know that it is risky, dangerous and stupid to try to time the market.

June 17, 2020 -

When Congress set up the TSP it told the managers to keep it simple, keep it cheap to users with low administrative fees, and to keep it apolitical.

June 16, 2020 -

If your like most active and retired federal investors you have little or no money in the I fund of the Thrift Savings Plan.

June 11, 2020 -

Now that more states and jurisdictions are easing social distancing rules, millions of people are stumbling back to pre-COVID-19 normalcy - if you can remember what that was like.

June 10, 2020 -

While most feds oppose WEP and GPO, today’s guest columnist said he’s looked at the background, crunched the numbers and in his opinion they are fair.

June 02, 2020 -

Rep. Gerry Connolly (D-Va.) accused the Trump administration of politicizing the Federal Retirement Thrift Investment Board, which recently deferred plans to move the international fund to a new, China-inclusive index.

June 01, 2020 -

What Stein can diagnose are sick and healthy financial trends, pointing out that for 11 years, leading up to the virus-driven crash, the stock market was in bull-market territory longer than any time in the country’s history.

May 21, 2020