TSP

-

When financial times get tough and a bear market rears its ugly head many Thrift Savings Plan investors head for the safety of the bond index F Fund or, more likely, the super-safe never has a bad day G-fund.

June 12, 2018 -

Stephen Zelcer, a financial advisor for federal employees, explains how the changes to the TSP in 2019 will impact you and what you should keep in mind.

June 12, 2018 -

The number of federal/postal workers with Thrift Savings Plan accounts worth at least $1 million jumped nearly 600 percent between April 2016 and April 2018. The value of the biggest account grew by nearly 30 percent in that time.

June 12, 2018 -

As of April 3, the number of federal and postal workers and retirees with million-dollar-plus Thrift Savings Plan accounts had grown to 23,098.

June 11, 2018 -

When most people focus on millionaires in government they are talking about a relatively small number of super-rich political appointees. But there is a larger group who did it by saving and investing in the Thrift Savings Plan.

June 08, 2018 -

About 9.1 percent fewer retirement claims were received in May than the month before and nearly 26.4 percent fewer retirement claims processed last month than in April, according to the Office of Personnel Management.

June 06, 2018 -

The Federal Retirement Thrift Investment Board, the agency that administers the TSP, is planning a series of sweeping changes to withdrawal rules and installment payments for participants by September 2019.

May 30, 2018 -

One of the complaints some Thrift Savings Plan investors have is what they consider a lack of investment options.

May 29, 2018 -

The amount of money the White House is proposing to cut from federal workers' take-home pay and the future inflation protection benefits for retirees closely mirrors the balance of the F, I and S funds in the Thrift Savings Plan as of Dec 31.

May 25, 2018 -

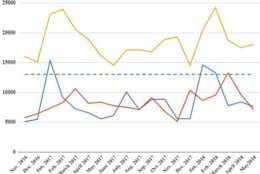

Tracking the stock market and making long-term decisions based on day-to-day changes is not the way to build a retirement nest egg.

May 24, 2018 -

About half of all thrift savings plan account holders move their money to an outside IRA or other investment option when they leave federal service. So who is right, and what is your plan?

May 23, 2018 -

Big changes are coming to the Thrift Saving Plan. Kim Weaver, director of External Affairs for the TSP, joins host Mike Causey on this week's Your Turn to talk about the changes, which include making it easier for participants to make withdrawals from their accounts. May 23, 2018

May 21, 2018 -

The Professional Managers Association is telling fed-postal-retirees to stay alert as federal retirement contribution changes are proposed by the Trump administration.

May 18, 2018 -

Jeff Neal, former DHS CHCO, looks at the recent proposals from OPM and OMB that would freeze federal pay for a year and decrease federal employee compensation.

May 17, 2018 -

When it comes to the federal Thrift Savings Plan, financial planner Arthur Stein says the average doesn't tell you everything because TSP stock funds do not have many "average" years.

May 16, 2018