TSP

-

Although the Federal Employees Retirement System (FERS) was launched in the 1980s, it is still considered the “new” plan by workers who remained in the old Civil Service Retirement System (CSRS).

February 06, 2020 -

Nobody likes to think about dying. But it happens and if you don’t do some advance planning it can cause even more longer lasting pain and grief.

February 05, 2020 -

The Federal Retirement Thrift Investment Board has launched a social science program over the past year, with the goal of sending messages and reminders to targeted groups of participants to prompt them to contribute and save more with the TSP.

February 04, 2020 -

Despite high returns for the TSP’s stock index funds last year, a majority of federal workers have most of their nest egg money in the G fund.

February 03, 2020 -

The decision to pull the plug depends on the job, your family situation, health, financial goals and, maybe, whether you’re a glass-half-full versus glass-half-empty type.

January 29, 2020 -

Some experts in retirement planning believe that many feds with memories of the Great Recession of 2008-2009 are working longer than they have to.

January 28, 2020 -

The TSP option is a nice but not absolutely essential thing to have for those under the more generous CSRS retirement program with its higher benefit and full protection from inflation.

January 23, 2020 -

Starting in the mid-1990s various experts looked at the aging federal workforce and concluded that the end, for many of them, was near.

January 23, 2020 -

The S and I funds of the TSP had bad years in 2018 but bounced back big time last year. Mike Causey asked financial planner Arthur Stein why?

January 21, 2020 -

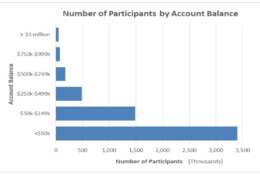

While there is a lot of interest in those who are self-made Thrift Savings Plan millionaires, the fact is most investors will never hit seven-figure status.

January 20, 2020 -

In today's Federal Newscast, the Congressional Budget Office found federal employees are contributing and saving more for retirement, due to two Thrift Savings Plan policy changes.

January 16, 2020 -

But the one way to anger many feds is to tell them or remark that they are lucky to have such a good pension — then stand back.

January 16, 2020 -

Thanks to the booming stock market the number of federal-postal workers with $1 million or more Thrift Savings Plan accounts jumped to 49,620 at the end of 2019.

January 14, 2020 -

Many people decided to ride out the Great Recession so they could miss the downside and return to the TSP's C, S and I stock funds when things got better. Eleven years later, some still haven’t returned.

January 13, 2020 -

For many January is a hope-springs-eternal transition time. But there are things members of the federal family can, and should, be doing that will save money.

January 10, 2020