Bumper crop of TSP millionaires ahead?

Unless the stock market tanks, big time, during the next 51 days the number of federal Thrift Savings Plan millionaires is expected to skyrocket.

Unless the stock market tanks, big time, during the next 51 days the number of federal Thrift Savings Plan millionaires is expected to skyrocket.

At the current pace, some long-time federal investors with relatively modest salaries will become double millionaires. And a few will move into the $3 million-plus category, or move into the $3 million club.

As of June 30, 2021 there were 98,879 millionaires. That was up from 45,219 in June of 2020.

With few exceptions, their investment “secret” is not much of a secret. Buy and hold, through good times and bad. Max out contributions to ensure you get the full 5% match offered most workers who are under the FERS retirement plan. And Stick with the stock indexed C-fund ( S&P 500 large cap stocks) and the small cap market represented by the S-fund.

During the 2008-9 Recession, tens of thousands of TSP holders moved from stocks into what many felt was a much safer — as in less volatile — place: The G-fund. They invested in special government securities.

Many also shifted their future allocations to the G-fund, even as the others — especially the C-fund and S-fund — were on “sale” (compared to their pre-recession value) by more than 30%. Many who rode out the recession entered it with modest account balances, but emerged with massive gains.

And now, number of federal and postal workers/retirees on the verge of millionaire status is staggering.

Between June 30 of last year and June 30 of 2021, the number of feds with accounts worth $750,000 to $999,999 went from 71,636 to 99,708. Hundreds could make the switch if the markets continue to rise or remain steady between now and the end of September.

During the same period, the number of workers/retirees with half a million to $749,999 moved from 170,993 in mid-2020 to 212,110 in June of this year.

The driving force, in addition to steady investing and time (average investor has been at it nearly 30 years), is the stock market itself.

In a column here last week, financial planner Arthur Stein explained why he advises most clients NOT to put all or most of their TSP account in the treasury securities G-fund. He encouraged his active and retired federal clients not to put all or most of their investments in the super-safe/super-dull Treasury securities G fund.

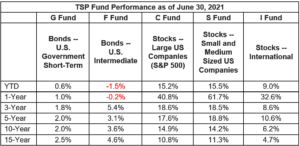

While it is safe in the sense that it has never had a loss, many pros believe that its rate of return isn’t enough to keep pace with inflation and actual living costs in retirement. Between January and June 30 of this year, the G-fund rate return was 0.6%. The F-fund (bonds) was down 1.5%, while large stocks (C-fund) were up 15.2%; small stocks (S-fund) were up 15.5%, and the higher risk/higher reward international stock (I-fund) returned 9%.

Over the last 15 years, the G-fund returned 2.5%, the F-fund was up 4.6%, and the C-fund, S-fund and I-fund were up 10.8%, 11.3% and 4.7%, respectively.

Here’s The TSP performance chart, courtesy of Arthur Stein:

TSP Stock Funds Reach New Highs During the First Half of 2021

Share prices for the TSP stock funds (C, S and I) rose to record highs during the second quarter as a substantial decline in U.S. COVID-19 cases, increased vaccinations, economic re-openings, low interest rates (as a result of Quantitative Easing (QE) by the Federal Reserve) and fiscal stimulus led a surge in the economy. C Fund share prices hit a record high on June 30. The S-fund and I-fund peaked a few days earlier.

YTD and 1-year returns are Total Return for the period. One, three, five, ten, and fifteen-year returns are calculated as Compound Annual Returns. This is for illustrative purposes only.

An investment cannot be made directly into an index. Past Performance is no guarantee of future performance. All investments involve various risks including loss of capital and volatility. Returns are rounded to tenths of a perfect. Returns include reinvestment of all income and do not account for taxes. The bond funds did not do as well. For the first six months of 2021, the F-fund declined 1.5% and the G-fund increased only 0.6%. The bond fund returns were less than the rate of inflation.

Nearly Useless Factoid

By Jonathan Tercasio

23-ounce cans of Arizona iced tea have been sold for 99 cents since 1992. They’re even cheaper, on average, than bottled water.

Source: MarketWatch

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED