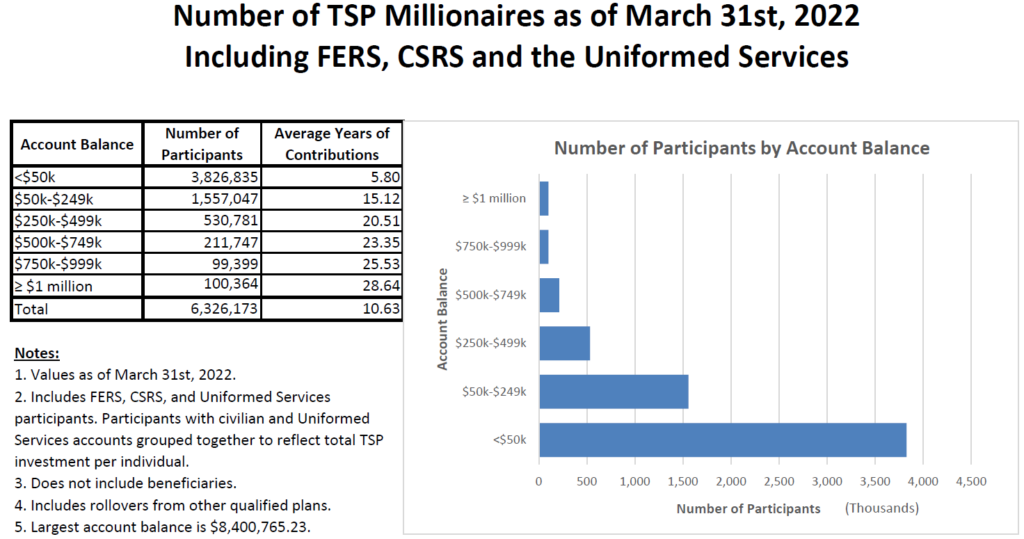

Thanks to the it-had-to-happen-sometime downturn in the stock market, the number of Thrift Savings Plan millionaires dropped to 100,364 in March.

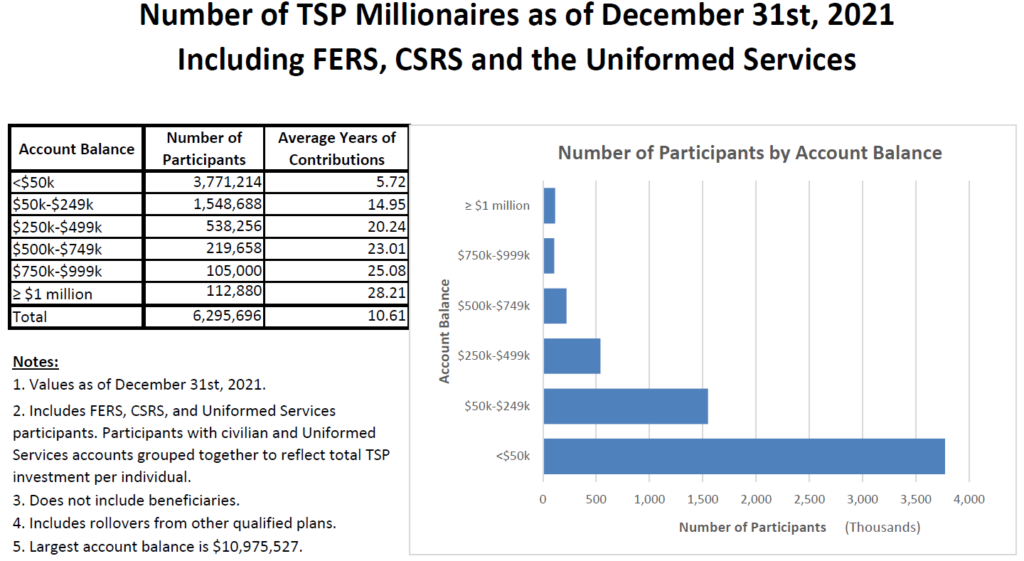

Thanks to the it-had-to-happen-sometime downturn in the stock market, the number of Thrift Savings Plan millionaires dropped to 100,364 in March. That’s down from the federal 401(k) plans high-water mark at the end of 2021. At that time there were 112,880 current, former and/or retired feds with account balances in excess of $1,000,000. A number had built accounts exceeding $3 million.

With the exception of some wealthy politicians, political appointees or lawyers-turned-federal judges, most of the $1 million club members did it the old way. They invested at least enough to get the 5% government match. They put their money in the TSP’s higher-risk, higher-reward C and S stock funds. And let it ride. They continued to invest in the stock index funds, especially in hard times (like the 2008-9 recession) when stocks were on sale. After a spectacular and record long run of good returns, the market turned down this year for a variety of reasons, from the invasion of Ukraine to supply chain problems, shortage-induced inflation and higher prices for gas and oil.

On Wednesday’s Your Turn show, financial investor Arthur Stein talked about the market downturn. This column also provided readers with a series of charts showing how well (or not) the market has done over the past 15 years. Meantime, here’s a snapshot of the TSP today:

And here’s where it stood at the end of last year:

In Oklahoma, until 2018, it was illegal to sell beer with an ABV of more than 3.2% cold. It had to be sold at room temperature.

Source: Public Radio Tulsa

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED