Pay & Benefits

-

Tom Schatz, president of Citizens Against Government Waste, says the government is paying for private employees' retirements has been a legitimate business expense for years under cost-accounting standards.

February 21, 2012 -

After 18 months of inactivity and extended vacation, Congress exhibited a blinding burst of speed last week before it left on yet another vacation. The bad news is that the action it took was aimed at future federal workers and you, well into your career, may be next, Senior Correspondent Mike Causey says.

February 21, 2012 -

Federal workers who have been paying attention to the various plans to have them finance unemployment benefits, highways and tax cuts must be confused, if not in a state of shock, Senior Correspondent Mike Causey says. Could it be that the only people who are happy are those who haven\'t been paying attention?

February 17, 2012 -

Federal pension contributions would increase under a compromise deal to extend a payroll tax cut and pay for jobless benefits through 2012.

February 16, 2012 -

Director John Berry said the proposition in the 2013 budget request to increase pay by 0.5 percent and increase the contributions employees pay to their retirement by 0.4 percent is \"responsible\" and \"protects the benefit.\" OPM also would have to figure out how best to meet its mission with a flat budget next year. Berry said his top priority is reducing the backlog of retirement claims.

February 16, 2012 -

Over 20 bills affecting federal employees\' pay, benefits, and pensions have been introduced by members of Congress in the past year. Federal employees tell Federal News Radio those are the kinds of things directly affecting their morale and motivation. What does Congress think about that? Federal News Radio asks both Republicans and Democrats as part of our series, \"Managing Morale.\"

February 16, 2012 -

Federal Times Editor Steve Watkins, Senior Writer Sean Reilly,and NARFE Legislative Director Julie Tagen will discuss how government employees will be affected by proposed cuts to the federal budget. February 15, 2012

February 15, 2012 -

Two federal unions, the American Federation of Government Employees and the National Treasury Employees Union, say lawmakers removed the increase in federal employee contributions from the payroll tax extension, but added it to the unemployment insurance extension, which is part of the overall deal. The unions say if the provision becomes law, feds would see a pay decrease while everyone else would see an increase.

February 15, 2012 -

When you think of federal workers, the term \"swinger\' isn\'t the first thing that pops into your head. But after some of the changes politicians want to make, anything could happen.

February 15, 2012 -

The provision — part of a larger transportation bill — would allow retiring federal employees to put their unused annual leave toward their TSP.

February 14, 2012 -

The personnel proposals included in the 2013 Defense Department budget include hikes to healthcare fees, cutbacks in both uniformed and civilian personnel. DoD also plans to save money through continued efficiencies and plans to increase the acquisition workforce.

February 13, 2012 -

President Obama\'s fiscal 2013 budget request released today ends the two-year federal pay freeze but increases contributions feds will have to make toward their retirement benefits.

February 13, 2012 -

The House bill — H.R.3813 — would require federal workers to contribute 1.5 percent more of their salaries toward retirement over three years and end a supplemental payment for early retirees under the Federal Employee Retirement System.

February 13, 2012 -

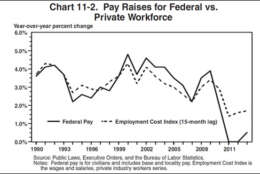

White-collar federal workers on average are either overpaid by about 16 percent or paid an average of 26.3 percent less compared to their private-sector counterparts. Those numbers confirm that there is a pay gap. But that\'s about it, Senior Correspondent Mike Causey says. Could they both be right? Or wrong?

February 13, 2012 -

Congress is taking a new road, literally, in its drive to trim federal retirement benefits and force civil servants to kick in more to their pension plan, Senior Correspondent Mike Causey says. This time its the so-called highway bill ...

February 10, 2012