TSP

-

Some experts in retirement planning believe that many feds with memories of the Great Recession of 2008-2009 are working longer than they have to.

January 28, 2020 -

The TSP option is a nice but not absolutely essential thing to have for those under the more generous CSRS retirement program with its higher benefit and full protection from inflation.

January 23, 2020 -

Starting in the mid-1990s various experts looked at the aging federal workforce and concluded that the end, for many of them, was near.

January 23, 2020 -

The S and I funds of the TSP had bad years in 2018 but bounced back big time last year. Mike Causey asked financial planner Arthur Stein why?

January 21, 2020 -

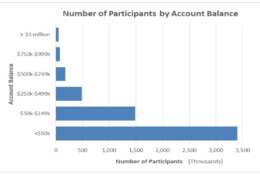

While there is a lot of interest in those who are self-made Thrift Savings Plan millionaires, the fact is most investors will never hit seven-figure status.

January 20, 2020 -

In today's Federal Newscast, the Congressional Budget Office found federal employees are contributing and saving more for retirement, due to two Thrift Savings Plan policy changes.

January 16, 2020 -

But the one way to anger many feds is to tell them or remark that they are lucky to have such a good pension — then stand back.

January 16, 2020 -

Thanks to the booming stock market the number of federal-postal workers with $1 million or more Thrift Savings Plan accounts jumped to 49,620 at the end of 2019.

January 14, 2020 -

Many people decided to ride out the Great Recession so they could miss the downside and return to the TSP's C, S and I stock funds when things got better. Eleven years later, some still haven’t returned.

January 13, 2020 -

For many January is a hope-springs-eternal transition time. But there are things members of the federal family can, and should, be doing that will save money.

January 10, 2020 -

While your income will likely go down in retirement, moving to a more tax-friendly state could increase the cash value of your annuity.

January 08, 2020 -

Mike Causey asked Abraham Grungold, a 34-year civil servant, why so many TSP investors have account balances that are so relatively small?

January 07, 2020 -

To protect their annuities from the ups and downs of the stock market, many active and most retired federal-postal workers have a major chunk of their Thrift Savings Plan account in the Treasury securities G fund.

January 02, 2020 -

Most people know the rule is buy low, sell high. If you buy that, the problem is knowing when the market has peaked or bottomed out.

January 01, 2020 -

Ask yourself if, when you start tapping your TSP you’ll be glad you invested pre-tax, or do you wish you had taken the Roth option?

December 31, 2019