TSP tactics: Are you managing the market? Or is it playing you?

Many investors know the conventional thing to do, when times are good. But when things go south, which they do regularly, the fight-or-flight instinct kicks in.

What does a Las Vegas gambling expedition have in common with timing the stock (or bond) markets? Often the same thing: In many/most cases people let their emotions rule whether at a casino or home monitoring Wall Street. Nervous folk zig when they should have zagged. They were lost before they left the starting gate.

So how should you handle what counts most — your retirement nest egg, the TSP — during these, uh, interesting times? A time period of unknown duration. A series of situations, from the war in Ukraine to record inflation and rising gas prices, are likely to get worse before they get better. Maybe lots worse! And for most feds, their TSP account is most vulnerable in troubled times. Remember, it could provide anywhere from one-third to one-half of the money you have to spend in retirement. And the bigger the amount, and the later you start spending it, the better.

The 100,000-plus TSP millionaires (as of December, 2021) had a couple of things in common:

- Most, except for some politicians, political appointees and federal judges, were NOT already millionaires.

- Most spent an average of just under 30 years investing regularly in the TSP’s stock funds, especially in hard times (2008-9) when the markets were down. Market timers sold low, as it turned out, while those steady-as-she-goes investors bought stocks at bargain prices.

Many investors know the conventional thing to do, when times are good. But when things go south, which they do regularly, the fight-or-flight instinct kicks in. Times like now. So we asked D.C. area financial planner Arthur Stein what he’s telling active and retired clients these days. Several of them are self-made TSP millionaires, which is a very good sign. He’s going to be my guest today at 10 a.m. (EDT) on our Your Turn radio show. That’s 1500 AM locally or on our home page. So you can listen live today or catch it later. As usual we asked him to write-up a sneak preview of today’s show which he did. Here goes:

The TSP Has a double dose of down

All the TSP funds — except G — fluctuate in value. That means down as well as up. And last quarter was a double dose of down as both the stock and bond funds — except G — declined.

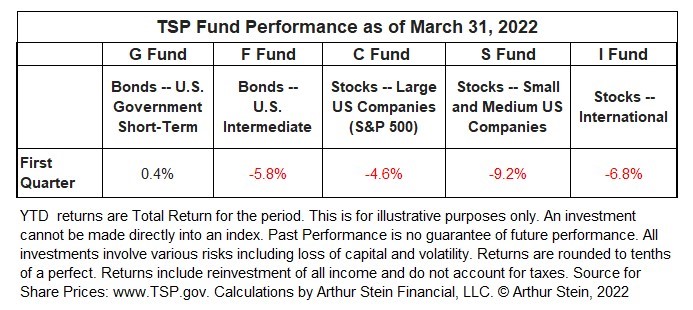

How bad was it? Here are the first quarter returns for the five traditional funds:

Also, all L Funds declined in the first quarter, including L Income.

According to the April 1, 2022 Wall Street Journal, bond markets declined at a rate not seen in over 40 years and stocks suffered their worst quarter in two years. Reasons include:

- Interest rate tightening by the Federal Reserve,

- Inflation surging to its highest level in forty years,

- Russia’s invasion of Ukraine, and

- A slowdown in the Chinese economy.

Both bond and stock markets continued declining during the first week of April.

So that’s scary. But what does it mean for TSP participants?

It means that participants need to concentrate on longer-term returns for funds they will need to spend five years and more in the future. Past performance is no guarantee of future performance but longer-term returns for the U.S. stock funds strongly outperformed bonds and international stocks.

For employees who are not near retirement, the declines are a reminder of two investment risks: volatility and market declines. But the declines are also an opportunity to “buy low” with bi-weekly contributions.

Retirees withdrawing from the TSP to supplement their Annuity and Social Security payments should try to withdraw from their G Fund balances until the other funds recover. Unfortunately, the TSP does not allow participants to withdraw from just one of the funds where they are currently invested. Withdrawals are made from each of the funds a participant owns, in the same proportion as their current allocation. If you have 50% in G and 50% in C, half of a withdrawal is coming from G and half from C.

There are several workarounds to this, which I will discuss on the show.

Nearly Useless Factoid

Dolphins do not possess vocal cords.

Source: PBS

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED

Related Stories

What’s your TSP investment style: Roller coaster or merry-go-round?