The General Services Administration expects to release the draft RFP in early 2023 with the final one coming by March 2023.

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

Just when you thought government contracting was about to get fun, again, the General Services Administration decided boring is the right approach.

That’s right, I’m saying government procurement and fun in the same sentence because we had an upcoming contract that had so many possibilities intertwined with it. GSA has been planning the follow-on to its highly popular and successful OASIS contract for the past year. It started by calling the vehicle BIC MAC—best-in-class multiple award contract. Oh the possibilities there!

The agency moved to Services MAC for the last few months. And with both of those names, unlike its more traditional and unexciting names like Alliant or Millennial or 8(a) STARS, these names had so much potential for fun in headlines and leads and so much more.

But GSA decided — and I’ll blame the lawyers here, only because it’s always fun to blame lawyers — to pick the name OASIS+, or maybe Oasis-Plus, for the new governmentwide contract, ending any real chance of bringing fun back to federal procurement.

“The name echoes a successful brand that our customers have come to know and trust, reflects the expanded scope of services that will be available through the new program, and embodies the contract’s flexible domain-based structure,” wrote Tiffany Hixson, the assistant commissioner in GSA’s Office of Professional Services and Human Capital Categories in the Federal Acquisition Service, in a blog post from June 15. “The new program will have a broad scope. As their respective ordering periods conclude, the new program will be able to fulfill requirements currently met by GSA’s One Acquisition Solution for Integrated Services (OASIS); Human Capital and Training Solutions (HCaTS); and Building, Maintenance, and Operations (BMO) contracts. In addition, new scope areas include environmental, intelligence services, and large enterprise solutions. Plus, we’ll build-in the flexibility to expand scope as customers identify new federal services needs.”

All kidding aside to the good folks at GSA, the decision around OASIS+/Oasis-Plus is seems small, but important. It’s clear there is recognition in FAS that the current contract is popular, in part because GSA has spent the better part of a decade promoting, creating a brand and working with everyone from the Air Force to the Homeland Security Department to the Army to commit to putting hundreds of millions of dollars through OASIS.

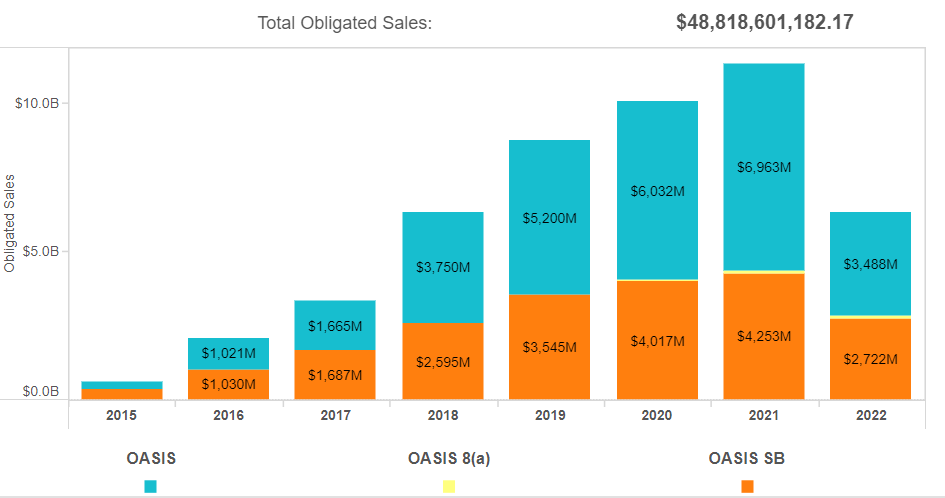

Since 2015, agencies have spent $48.8 billion on OASIS, OASIS small business and OASIS 8(a) through more than 3,200 task orders.

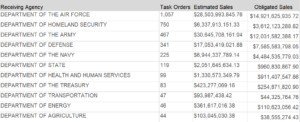

The Air Force remains the largest user, issuing more than 1,000 task orders worth more than $28 billion. The Army is the largest user by total sales with more than $30 billion across 458 task orders.

The updated vision for OASIS+ also recognizes the struggles of the HCATS contract.

GSA awarded HCATS to 109 vendors in May 2016. The 10 1/2 year contract has a ceiling of $11.5 billion and replaced the Training and Management Assistance (TMA) contract run by the Office of Personnel Management for the last two decades. After a series of bid protests, GSA finally issued the notice to proceed for HCATS in September 2016. Over the last almost six years, agencies have not used the contract like may believed they would, awarding 300 task orders worth $764 million.

Sheri Meadema, the acting assistant commissioner of GSA’s Office of Professional Services and Human Capital Categories in the Federal Acquisition Service, said during the Coalition for Government Procurement spring conference that the changes to OASIS-Plus also acknowledges what GSA’s customers have said about the draft details of the new contract over the last few months.

“We had originally envisioned one contract with small business reserves, and working closely with the Small Business Administration and our Office of Small and Disadvantage Utilization Office and our customers, quite frankly, we ended up switching that strategy. So the plan is to now award six separate contracts, five of those being for small businesses and the six being unrestricted,” she said. “The second change is scope. Oasis will cover all of the scope areas in Oasis currently today, plus HCATS and building maintenance and operations as those contracts expire. In addition, in the initial stages of the contract, there are additional scope areas that we’re adding on to include environmental intelligence services and a domain we’re calling enterprise solutions, which will be unique to the unrestricted vehicle. That domain is for very large, complex, high-dollar value, non-commercial type work.”

The domains is another change for OASIS+. GSA will add or remove domains based on customer needs and usage throughout the life of the contract.

That gives us a lot more flexibility as things change and customers’ needs change to introduce new scope areas,” Meadema said. “We are trying to keep the solicitation open continuously after we initially close it to deal with solicitation protests. This is all about our ability to onboard industry partners at any time during the contracts life.”

The onramp for OASIS was far from a smooth process, beset by protests and delays.

Meadema said the new contract will make it easier for companies who grow out of the small business size standard to apply to get on the OASIS+ unrestricted version.

“The evaluation criteria will drive the highly qualified pool of vendors that we’re trying to attract. We’re not recreating the Multiple Award Schedules. We are setting the bar relatively high,” she said. “That being said, we are giving careful consideration to how high we set the bar for unrestricted. So again, we can allow companies who re-represent their size to move on to another vehicle.”

As part of the evaluation factors, GSA will be applying the authority it received under Section 876 of the 2018 Defense Authorization bill, where price is most important at the task order level, not at the main contract level.

GSA stated in recent answers to industry questions that OASIS-Plus will not have a total dollar ceiling attached to it, joining Polaris as the only other contract do deviate from the Federal Acquisition Regulations in the last nine years.

Meadema said GSA expects to release some new or updated draft sections of OASIS-Plus for industry comment over the summer and then release the full draft request for proposals in early fiscal 2023. GSA expects to issue the final solicitation in the second quarter of 2023.

The new name, scope and domain changes are important steps for GSA in this journey, but they still don’t necessarily answer all the questions about how OASIS+/OASIS-Plus isn’t just creating a new type of schedule contract. The Coalition has expressed concern over the last year about possible duplication with the schedules, cross-walking what OASIS+ will include and what the schedules already provide.

The next key stop in this journey is when GSA releases the draft RFP for industry comments to see how it differentiates from the schedules and whether it alleviates any concerns in industry about duplication. Most would agree that last thing industry or government needs is another contract that doesn’t add value and meet agency needs.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED