3 things to know about the TSP this year

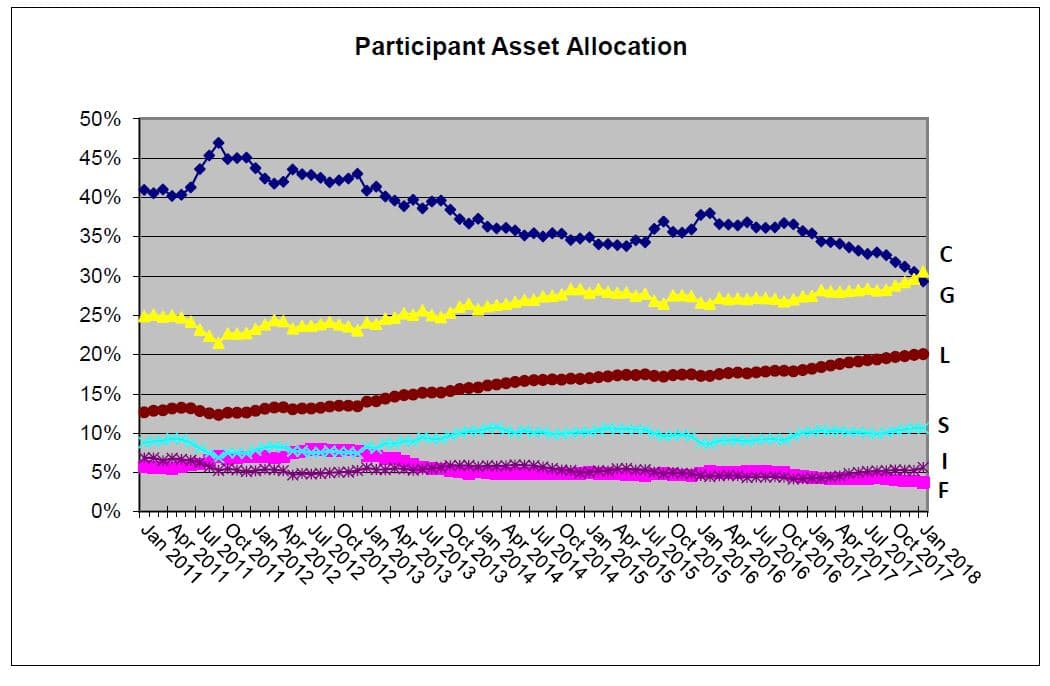

For the first time, total assets in the Thrift Savings Plan's C fund matched total assets in the G fund.

1. C fund matches G fund

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

For the first time, total assets for the Thrift Savings Plan’s C fund matched those in the G fund back in January.

By the end of the month, total assets for the TSP’s C fund reached $205.4 billion, equal to that of the G fund, according to recent data from the Federal Retirement Thrift Investment Board, the agency that administers the plan.

More than 36 percent of TSP plan assets are in the C and G funds, something that financial planners have never seen before.

The Federal Retirement Thrift Investment Board said it could offer a few guesses as to why C fund total assets matched the G fund for the time, but it didn’t have a clear answer.

A dramatic rise in S&P 500 in 2017 could be one reason, said Sean McCaffrey, the agency’s new chief investment officer. Or TSP participants are finally applying best practices for long-term investments, he posited.

While Greg Klingler, director of wealth management at GEBA, also named several reasons for the change, he said he’s seeing more TSP participants become comfortable with long-term investments.

“We see a lot of people in their 50s, 60s and their 70s, [and] they’re now finally starting to get comfortable with the market,” he said. “They took their lumps [losses] in 2008 and 2009 during the Great Recession, and now they’re starting to get comfortable. We’ve had nine years of pretty consistent growth, and they’re starting to jump into the equities with both feet, primarily into the C fund. The C fund is the fund that has equity exposure that people understand.”

Organic growth in the C fund has also outpaced growth of the G in recent years. While the C fund averaged an 8.5 percent return in the last 10 years and a nearly 16 percent return in the last five, the G fund averaged 2.4 percent and 2.1 percent in the last 10 and five years, respectively, Klingler said.

“The TSP, from an asset allocation standpoint, really is changing pretty dramatically and has been for the last 10 years or so,” he said.

The addition of the L funds as professionally diversified, managed options for TSP participants is another factor.

“Now they’re investing in things that they may not have invested in the first place. 20 percent of all plan assets now are located in one of the multiple L funds out there, and that is bringing more investment in the S fund and the I fund in particular, but also you’re seeing some investments in the C fund out of the L fund as well.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED

Related Stories