A new survey of 5,000 participants found 87% are happy with the Thrift Savings Plan, a slight dip from 2017, the last year the Federal Retirement Thrift Investm...

The vast majority of participants are still largely pleased with the Thrift Savings Plan, but satisfaction lags among the TSP’s newest members from the uniformed service blended retirement system.

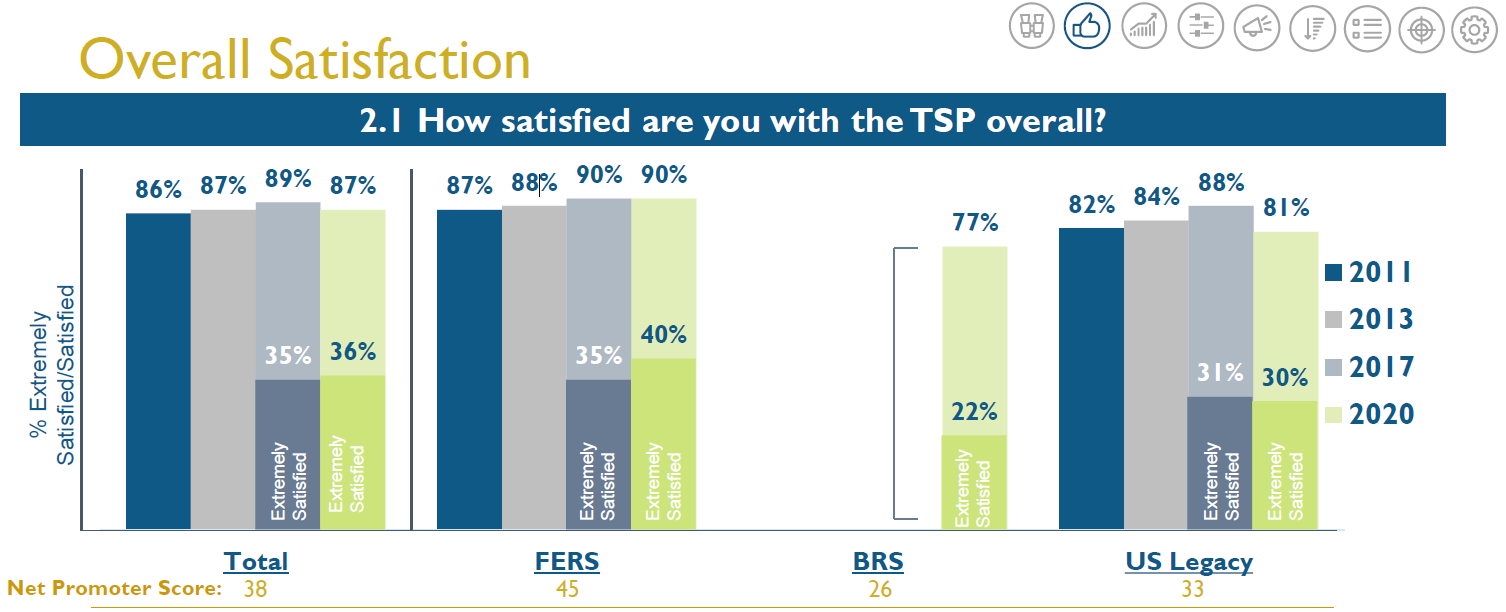

According to a new survey of roughly 5,000 TSP participants, 87% are satisfied with the plan, compared with an 89% satisfaction rate from 2017, the last year the Federal Retirement Thrift Investment Board conducted a similar survey.

“The surveys that we do every few years provide us with great insight into what our participants are thinking,” Ravi Deo, the FRTIB’s executive director, told the TSP board Monday. “They give us clues as to where we should focus our efforts so as to have maximum impact on our participants and make their lives easier, which is, of course, ultimately our goal.”

The TSP again partnered with Gallup to survey a sample of some 36,000 participants. Employees in the Civil Service Retirement System were not surveyed this year, because the CSRS population is rapidly declining.

The agency attributed the slight decline to a few factors.

First, TSP conducted the survey from March 20 through May 11, the earliest days of the coronavirus pandemic when the stock market plunged and participants’ retirement accounts took a hit.

“What we’ve found over the years is that market conditions and TSP satisfaction levels are highly correlated,” Dennis McNulty, a FRTIB strategic performance manager, said.

Second, this year’s survey also included blended retirement system (BRS) participants for the first time, many of whom were automatically enrolled in the TSP and are still new to the plan. According to the TSP survey, 77% of BRS participants are satisfied with the TSP, with 22% “extremely satisfied.”

Few BRS participants — 3% — responded to the TSP survey. This wasn’t especially surprising because many surveys were returned to the TSP through the mail, McNulty said. The FRTIB also has far fewer email addresses available for BRS participants, in part, because the majority of members haven’t yet signed on to their online TSP accounts.

The low response rate and decline in satisfaction among BRS participants show there’s room for the TSP to conduct more outreach with the military population, the agency acknowledged. The FRTIB will consider hosting focus groups with military members to learn more about their own needs and will explore stronger partnerships with the service branches to better market and educate the BRS population, McNulty said.

And despite lower overall marks this year, satisfaction among TSP participants still outpaces that of other private sector retirement plan holders, the FRTIB said.

According to a January retirement confidence survey from the Employee Benefit Research Institute (EBRI), 80% of employees said they were satisfied with their retirement plans. EBRI conducted a second survey in April, where satisfaction dropped to 76% among retirement plan holders.

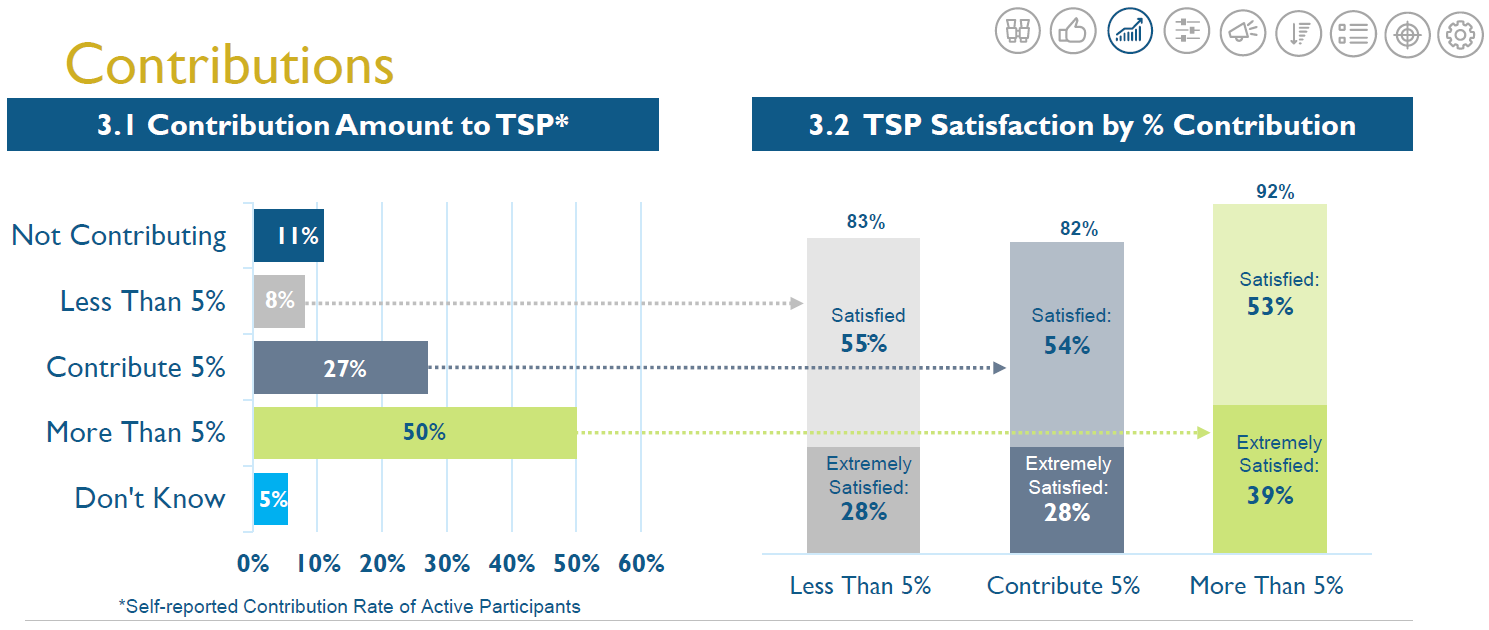

Participants who contribute 5% or more of their direct pay to the TSP are more satisfied overall with the plan.

About 50% of survey respondents said they contributed more than 5% of their pay to the plan, with 27% contributing 5%.

Slightly more participants, 11%, don’t contribute anything to the plan, compared to 8% who contribute under 5%.

Those who do contribute more tend to be more satisfied with the plan.

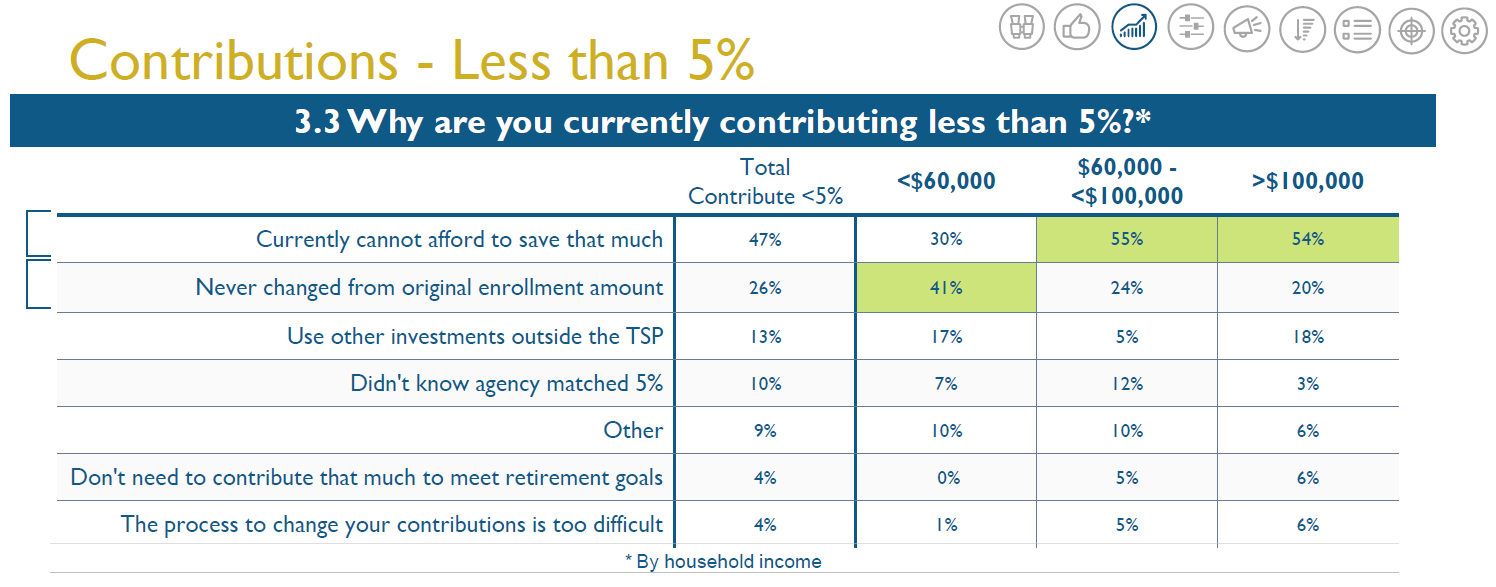

Interestingly enough, TSP participants with higher incomes were more likely to cite affordability as the main reason why they weren’t contributing at least 5% of their pay to the plan.

For participants whose households earned between $60,000 and $100,000, 55% said they couldn’t afford to contribute 5% to the TSP. Roughly 54% of participants making $100,000 or more said they too couldn’t afford to max out TSP contributions.

And though 30% of participants earning less than $60,000 a year said they too couldn’t afford to save that much, 41% said they simply never changed their original enrollment amount.

The FRTIB acknowledged the responses from their participants were a bit counter-intuitive based on their income levels but said the data proved inertia was a top reason for low contribution rates.

The agency also views the data as a promising sign ahead of an upcoming policy change. The TSP will automatically enroll new participants at a 5% contribution rate starting Oct. 1. Based on the survey data, the FRTIB doesn’t anticipate many participants will opt out of 5% contribution.

Previous TSP surveys found participants looking for more flexible options to withdraw funds from their accounts. The FRTIB added a series of new options last fall, and so far most participants are happy with them.

About 62% of participants are satisfied with the range of withdrawal options, compared to a 60% satisfaction rate back in 2017.

When asked specifically about the new withdrawal options, 88% said they were either satisfied or extremely satisfied with them.

But relatively few participants — about 39% — actually knew about the new options.

“This is an area where we’ll continue to emphasize with our participants,” McNulty said. “Not surprisingly we found the older participants are more likely to know about the withdrawal options.”

Even though awareness of the new TSP withdrawals is still relatively limited after a year, the FRTIB believes the options have or will contribute to higher retention rates in the plan.

In 2017, participants more frequently cited more flexible withdrawal options as the top reason for transferring funds out of the plan. Today, participants more often described a desire to consolidate their retirement accounts and better investment choices as top reasons for transferring money out of the TSP.

The TSP plans to administer a second survey, this time focused on participants’ financial wellness and retirement readiness later this year.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED