The U.S. Department of Defense has 150 active “other transaction” agreements, or OTAs, on its books, which combined have generated $5.8 billion in spending ...

This content is provided by Bloomberg Government.

The U.S. Department of Defense has 150 active “other transaction” agreements, or OTAs, on its books, which combined have generated $5.8 billion in spending to date, according to a Bloomberg Government analysis. With a combined ceiling value of $48 billion, these contracts represent key revenue streams for defense contractors and consortia, even if they generate only a fraction of that total over the next two decades.

For years, the Pentagon has looked for ways to streamline the process of acquiring emerging technologies. Lately, OTAs have proven a popular approach. OTAs allow defense agencies to quickly award small research and prototyping contracts to nontraditional suppliers without the need to engage in a months-long competitive bidding process.

Because OTAs aren’t subject to traditional acquisition regulations, they carry a greater risk of project failure, as well as a greater risk of fraud, waste, and abuse. For that reason, Pentagon officials have sought to control these risks by keeping the size of awards low and by being transparent about OTA spending.

To help subscribers understand government spending using OTAs, Bloomberg Government has created a market definition that captures these types of transactions. According to BGOV data, the Pentagon obligated $2.1 billion toward OTAs in fiscal 2017, a 50 percent increase above the previous year’s figure. The U.S. Army accounts for more than half of the Pentagon’s OTA spending, with $3.7 billion in total obligations since fiscal 2014.

An analysis of all 150 active contracts shows that the Pentagon awards OTAs to two types of recipients: either to companies directly, or through what’s known as a consortium, referring to a group of companies organized around issue-areas like electronic warfare or advanced manufacturing. Contracts awarded to consortia are typically then subcontracted to a member company or companies.

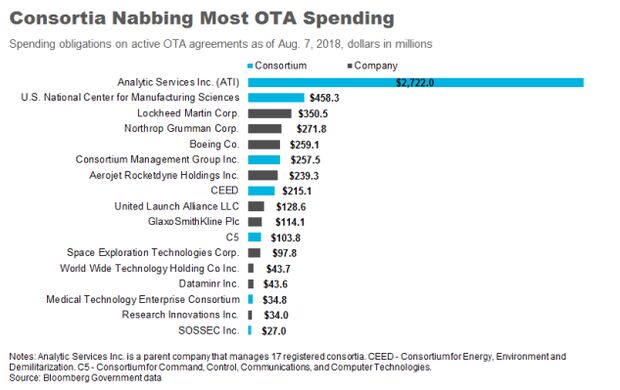

Of the $5.8 billion spent on active OTAs to date, about one-third ($1.9 billion) has been issued to individual companies, while about two-thirds ($3.8 billion) were through consortia or consortium management companies.

The single largest recipient of OTA funding is Analytic Services Inc., a holding company for Advanced Technology International (ATI), which manages more than a dozen consortia, including the Medical Technology Enterprise Consortium and the Information Warfare Research Project. The National Armaments Consortium, the most lucrative of ATI’s consortia, has generated $2.3 billion since fiscal 2014.

Also represented in the top five are three of the world’s largest defense contractors: Lockheed Martin Corp. ($350.5 million), Northrop Grumman Corp. ($271.8 million), and Boeing Co. ($259.1 million). These figures represent OTAs awarded directly and do not account for revenue these and other firms receive indirectly through consortia. The amounts they receive through consortia may be substantial and are not publicly reported.

This illustrates why some experts are concerned that OTAs offer large contractors a way to build revenue streams in a way that is unconstrained by most acquisition regulations. This would seemingly conflict with the original intent of offering the Pentagon a way to solicit innovation from nontraditional defense suppliers.

An ATI spokesperson told Bloomberg Government that the Pentagon prohibits it from publicly disclosing how OTA revenues are divided among members of its consortia, but said that the process is both fair and transparent.

“The growth in the number and size of consortia speaks to the confidence in the OTA consortium model by the Government and industry partners using the model,” the spokesperson said. “We do not believe there is a lack of transparency as we routinely aggregate and report at the same, or greater, level of detail than traditional FAR contracts.”

THE CONSORTIUM PIPELINE

Bloomberg Government has identified more than two dozen consortia representing hundreds, if not thousands, of companies are now angling for Pentagon OTA awards in areas ranging from countering weapons of mass destruction to advanced submersibles.

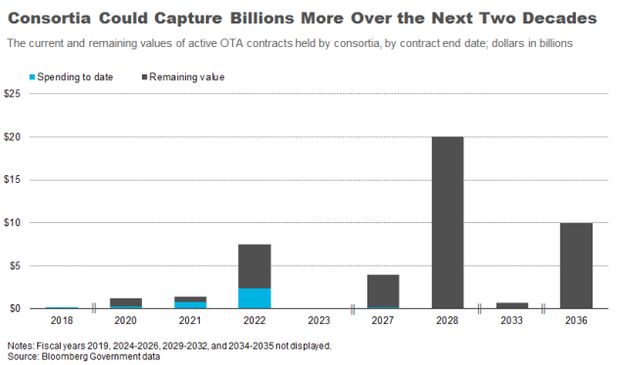

In contrast to the smaller, shorter OTA agreements the Pentagon reaches with individual contractors, consortium contracts more closely resemble broad agency announcements (BAAs) in that they remain open for years or even decades, and can be worth billions. The total ceiling value of OTA contracts held by consortia or their management companies, such as ATI or the Consortium Management Group Inc., is currently $45 billion, compared to just over $3 billion for OTAs awarded directly to contractors.

In the last two and a half years, the Pentagon has awarded ATI three OTA contracts with ceiling values of $10 billion, one for the Medical Technology Enterprise Consortium, one for the National Armaments Consortium, and one for the Countering Weapons of Mass Destruction Consortium. Although none of the three has yet surpassed even 1 percent of their ceiling values, each one could generate billions over the course of their 10-20 year lifespans.

Similarly, there is $3.2 billion of the original $5.5 billion left on a separate ATI contract for the National Armaments Consortium, which doesn’t end until in March 2022. More than 90 percent of the two $2 billion contracts (here and here) awarded to the Consortium for Command, Control, Communications, and Computer Technologies (C5) is up for competition between now and April 2027.

With substantial values remaining on active consortium contracts and the possibility of additional contracts in future years, small or midsized companies may want to consider joining consortia as an alternative way to bring their prototypes to the federal market.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.