GSA’s new approach to small business matchmaking

GSA’s Alliant 3 contract includes an evaluation factor to encourage large businesses to meet with small firms in one of 11 emerging technology areas.

The General Services Administration is putting the final touches on its solicitation for the Alliant 3 IT services contract.

But one of the sections that GSA is already finished with is a new approach to attracting small businesses with new or emerging technology capabilities.

Large businesses can get started today on meeting the requirements of GSA’s small business emerging technology solutions engagement requirements under Alliant 3 contract.

Paul Bowen, the director of the center for GWAC programs at GSA, said this evaluation factor is among the first of its kind.

“There’s an opportunity for an ‘other than small business’ offeror to engage with small businesses that have eligible emerging technology solutions in any of these 11 areas. So if I’m an other than small business company, I have the opportunity to go out and interact with up to five small businesses that have emerging technology solutions, meet with them, have them sign a form that shows that we met, we had an engagement and that we spoke,” Bowen said at an event sponsored by ACT-IAC on Friday. “The small business has to provide the proof that they have the eligible product, and then when the other than small business submits it to GSA. The other than small business would receive 200 points for each of the five engagements up to a total maximum of 1,000 points.”

As part of the draft solicitation for Alliant 3 issued last December, GSA detailed this new approach to hold large businesses accountable for learning about small businesses in specific emerging technology areas. The 11 areas included such as big data, cloud, cyber, AI, zero trust and quantum computing.

GSA highlights 11 emerging tech areas

What the small business emerging technology solutions engagement requires is for large businesses to meet with at least five small businesses who work in one of these 11 areas. The 11 emerging tech areas came from work GSA’s IT Category office has been and continues to do.

Bowen said GSA isn’t being prescriptive about how the engagements work or what may or may not come from them.

“GSA does not dictate how these meetings are set up, how long they last, the terms of them. It’s entirely for you to all figure out how you want to do it and to come to terms with each other, whether it’s a phone call, whether it’s a meeting, whether it’s a demonstration, however you work it out, you work it out,” he said. “There’s no expectation that you will have done business in the past. Nor is does it create an obligation in GSA’s eyes that you’ll do business together in the future. It’s a way to match make.”

GSA, however, put some parameters on the size of the emerging small businesses. The firm has to have done at least $100,000 worth of business or being a part of the Small Business Innovation Research or Small Business Technology Transfer (SBIR/STTR) programs.

Under the terms of the program, the large business may only get credit for meeting with a different small business for all five engagements and can’t meet with small businesses in any of the 11 categories like cyber or AI more than twice. Bowen said that means if large company X meets with two different AI companies, then they have to pick three other emerging technology areas like cloud or health IT for their other meetings.

Matchmaking made easier

Small firms bidding on Alliant 3 do not have to participate in this part of the evaluation. GSA says they would receive the 1,000 points automatically.

Bowen said GSA’s decision to take this approach made sense for several reasons.

First, it just made sense to make small business matchmaking part of the evaluation factor just made sense.

“We know that small businesses have really been leaders in emerging technology, which is such a focus for everyone, including the government. For us to have an evaluated factor where other than small business offers on Alliant 3 have a scored element where they can go out and meet with small businesses with emerging technology solutions is a win-win for everyone,” Bowen said. “It’s a win-win for the small businesses with the emerging technology because they have the ability to go meet with these companies where previously may have been difficult to get in the door. It’s a win for the other than small business offers because they get to learn about these technologies. They demonstrate to the government that they have the ability to go out and find small businesses with emerging technology because so much of the emerging technology is being done to almost the garage level and above at this point.”

Bowen said this approach also gives the small businesses some leverage with the large firms in terms of getting meetings and explaining their technologies and value.

In addition to this 1,000 point evaluation factor, Bowen said GSA also will hold vendors accountable for meeting their subcontracting goals as part of the contract.

GSA expects to issue the final solicitation for Alliant 3 toward the end of May or early June.

One big change to the Alliant 3 is the number of awards GSA is expecting to make. Bowen said GSA is targeting about 76 awards, which is up from the 60 awards it made under Alliant 2 back in 2018.

One reason GSA is looking to make a larger number of awards is the number of contractors who ended up leaving Alliant 2. GSA started with 60 awards and has lost 22 over the last six years. Of those 22, 11 were lost to mergers and acquisitions and another 11 to the companies “volunteered” to leave the contract as they were not meeting specific bidding and winning requirements.

There now are 38 vendors under Alliant 2 and GSA expects the larger number of awardees to provide better and more competition.

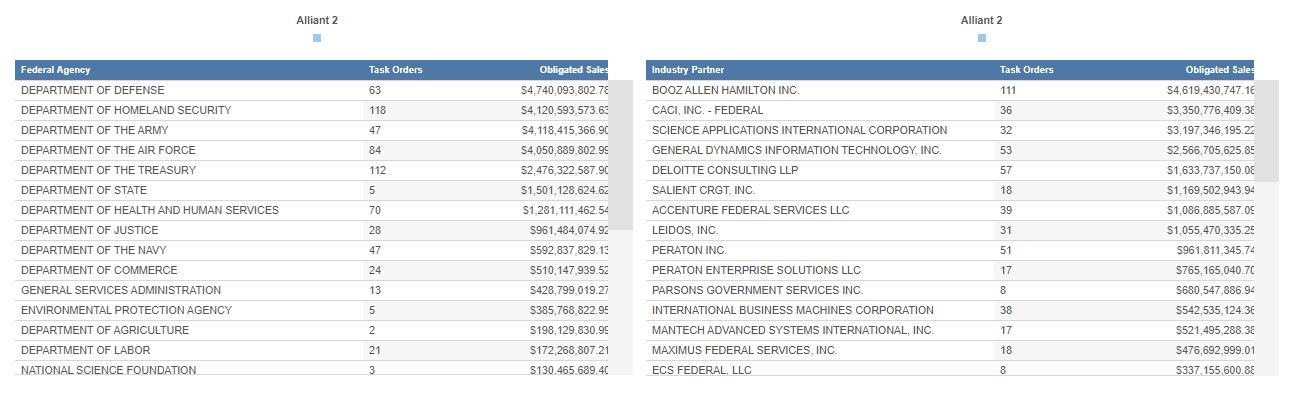

Alliant 2 remains a popular contract among agencies, adding a lot of focus and excitement on Alliant 3.

GSA data shows agencies obligated more than $8.6 billion across 117 task orders in 2022. Since GSA awarded Alliant 2 in 2018, agencies have obligated more than $26 billion.

The popularity of Alliant 2 caused GSA in August 2022 to increase the ceiling of Alliant 2 to $75 billion from $50 billion because it saw the increasing spending trends.

Over the last four or so years, Alliant 2 has been a go-to contract for many of the major and high dollar programs agencies have pursued. The average task order under Alliant 2 is around $120 million.

Industry and GSA expects Alliant 3 will be just as popular with spending continuing to increase.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED