In 2025, FEHB enrollees will see largest health premium increase in over a decade

Beginning in January, federal employees and annuitants in FEHB will pay an average of 13.5% more toward their health care premiums, according to OPM data.

Editor’s Note: This story was updated with additional details on the rates and benefits that will be available in FEHB and PSHB for plan year 2025, as well as comments from the National Treasury Employees Union.

Enrollees in the Federal Employees Health Benefits (FEHB) program are about to see the largest annual increase in their health insurance costs in at least a decade.

Beginning in January, federal employees and annuitants enrolled in FEHB will pay 13.5% more, on average, toward their health care premiums, according to data the Office of Personnel Management released Wednesday.

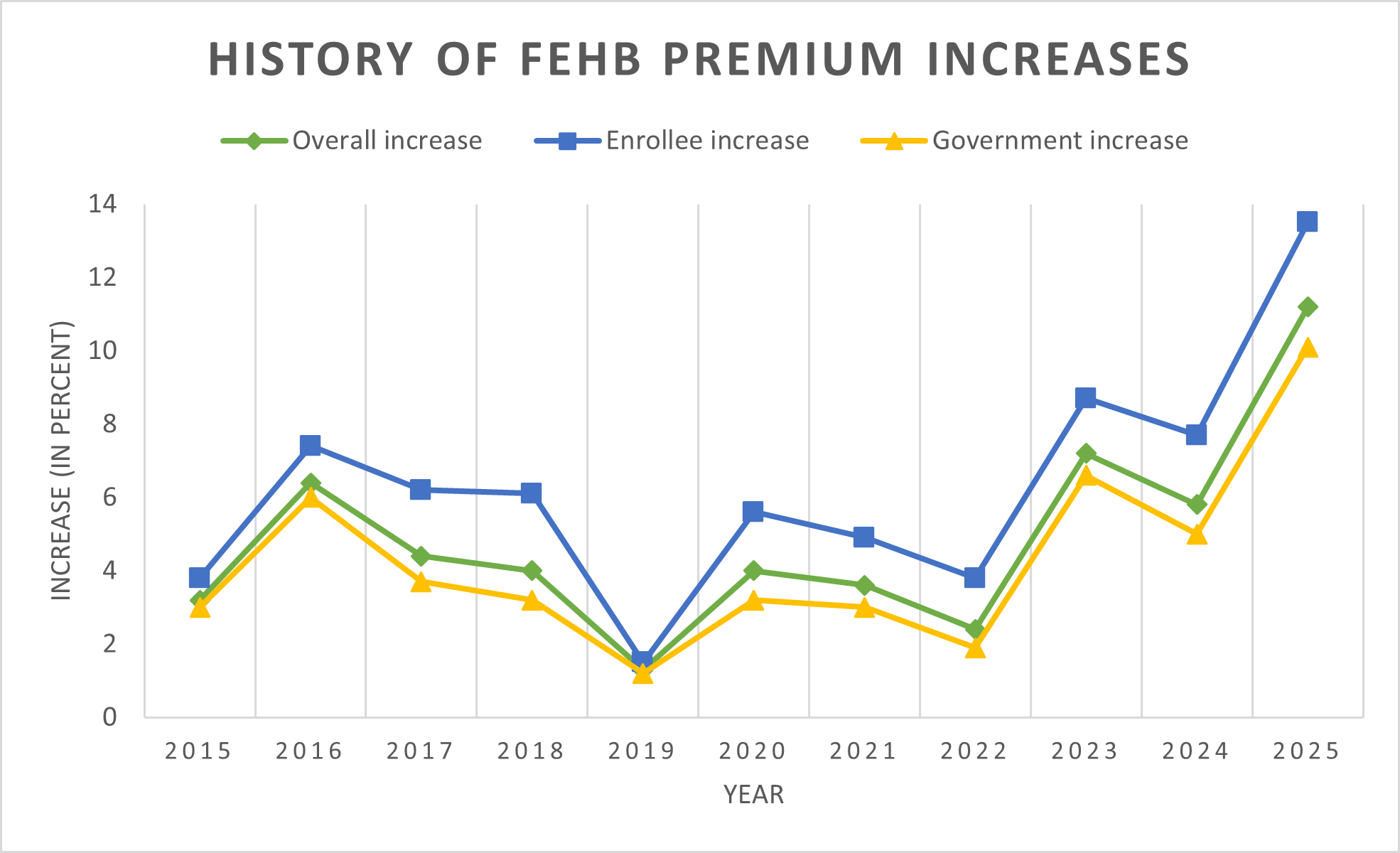

The significant premium increase for FEHB plan year 2025 follows a 7.7% jump for 2024, and an 8.7% increase in 2023. OPM said the increase reflects changes in the market over the last year, and generally aligns with other programs in the commercial market.

“The premium increases are due to the impact of price increases by providers and suppliers, increased utilization of certain prescription drugs and behavioral health spending,” OPM said. “Industry-wide cost pressures affect FEHB and PSHB rates similarly.”

In dollars, FEHB enrollees will begin paying an average of $26.10 more toward their biweekly health premiums in 2025.

Accounting for both the participant’s and the government’s shares of insurance costs, FEHB health premiums for enrollees will increase by 11.2% on average, when weighted with the government’s contribution, which is increasing by 10.1%.

The breakdown of how much an enrollee versus the government contributes to FEHB premium rates is defined under law. The government covers about 75% of an FEHB participant’s premium, but the number is capped at 72% of the weighted average of the previous year’s premiums.

Premium rates for FEHB change every year, but they inevitably increase to some extent. The percentage increases for FEHB premiums are an average, meaning some plan options will have smaller cost increases, while others will have larger ones.

In contrast, premium increases for new Postal Service Health Benefits (PSHB) program participants will be slightly lower than those for FEHB. Postal enrollees will pay 11.1% more toward their health care premiums. Averaged with the government’s share of the cost, which is increasing by 5.1%, the overall premium increase for PSHB is 6.9%.

“The premium increase for the Postal program is lower than the FEHB premium increase due to greater integration in Medicare required under the Postal Service Reform Act, differences in the cost profiles of the plans offered in each program and demographic factors,” OPM said.

PSHB enrollees, on average, will pay $20 more toward their biweekly health care premiums next year.

In comparison to FEHB and PSHB, CalPERS, which purchases health insurance for California state government employees, announced an average premium increase of 10.79% for 2025. After the federal government, CalPERS is the second-largest public insurance purchaser in the U.S.

The National Treasury Employees Union is calling for a higher pay raise of 7.4% next year for federal employees to help offset the growing insurance costs. In August, President Joe Biden officially planned for a 2% federal pay raise in 2025.

NTEU National President Doreen Greenwald said the rising insurance premiums “will stretch employees’ paychecks beyond what they can afford.”

“While employees have options for lower-cost plans, we know those often come at the expense of fewer benefits,” Greenwald said. “Federal workers should not have to sacrifice health coverage because they can’t manage the higher payments.”

Options for Open Season

OPM’s announcement, as usual, comes several weeks ahead of the start of Open Season. That’s the time of year when FEHB participants can take a look and consider making changes to their health care options for plan year 2025. This year, Open Season will run from Nov. 11 to Dec. 9.

Though the open enrollment period occurs every year, this fall’s Open Season will look quite different. Alongside FEHB, OPM is launching the brand-new Postal Service Health Benefits (PSHB) program to provide health insurance to roughly 2 million Postal employees, annuitants and their family members.

Like FEHB enrollees, new participants in the Postal program will be able to make changes to their health care options during Open Season for plan year 2025.

“All current Postal employees, annuitants and their family members enrolled with an FEHB plan will be mapped to an equivalent PSHB plan prior to Open Season,” OPM said. “During Open Season, enrollees may opt to stay with the plan they have been mapped to or select a different plan.”

Across the 42 health carriers for 2025, FEHB participants will see 64 plans and a total of 130 plan options.

PSHB participants will, by contrast, have 69 plan options offered across 30 health carriers. That includes seven fee-for-service carriers and 23 health maintenance organizations (HMOs) available through the PSHB.

Some plan options, however, are specific to certain geographic regions or agencies. Not every FEHB or PSHB participant will have access to every plan option. Participants can use the FEHB plan comparison tool on OPM’s website to compare all of the different plan options.

Details on FEHB, PSHB coverage

OPM also announced several changes to the benefits and options that federal employees, annuitants and their family members will have access to in 2025.

Notably, OPM announced Wednesday morning that FEHB enrollees will see more options for “comprehensive” coverage of in vitro fertilization next year. Both Blue Cross Blue Shield and GEHA will offer a $25,000 benefit to help cover the cost of IVF for enrollees, on top of OPM’s baseline requirements for fertility treatment coverage.

OPM also shared changes to coverage for obesity medications, maternal health treatments and mental health treatments. Carriers will be required to cover at least one anti-obesity GLP-1 drug, as well as at least two oral anti-obesity drug options.

On top of that, “carriers must offer comprehensive behavioral therapy, covering appropriate diet and exercise regimens, for those prescribed anti-obesity medications,” OPM said.

Additionally, OPM said FEHB plans will reimburse behavioral health services offered in primary care settings, in part as a response to challenges stemming from the COVID-19 pandemic, youth mental health and the opioid epidemic.

That will incentivize “greater coordination among behavioral health providers and other providers in the health system, and [put] paying for behavioral health services on par with comparable physical health services,” OPM said.

In support of maternal health, OPM said all 64 FEHB plans will cover mental health treatments for postpartum depression. Many, but not all, plans will additionally cover costs of certified nurse midwives, delivery at birthing centers, nurse home visits and doulas.

All PSHB benefits will align with those in FEHB, with the exception of prescription drug benefits. Health carriers in the PSHB program are required to offer Medicare Employer Group Waiver Plans (EGWPs) to Postal annuitants and their family members. Some carriers will additionally be offering Medicare Advantage EGWPs with prescription drug coverage, OPM said.

Importantly, Medicare-eligible Postal annuitants and their family members have to enroll in Medicare Part B to be able to access PSHB benefits, with only a few limited exceptions. OPM said it expects more than 80% of Medicare-eligible Postal annuitants to enroll in Part B by Sept. 30, when the special enrollment period ends.

2025 vision and dental options

In contrast to the large increases for FEHB and PSHB premiums, the average premium rate increases for the Federal Employees Dental and Vision Insurance Program (FEDVIP) will be relatively small in 2025.

Premiums will rise for FEDVIP dental plans by 2.97% on average, while vision plans will go up by 0.87%, OPM said.

FEHB and PSHB participants will both be able to select from seven dental carriers offering 14 nationwide plan options for 2025. There will also be 10 nationwide vision plans available nationwide across five different carriers next year.

In 2023, OPM expanded eligibility for enrolling in FEDVIP to Postal employees and annuitants, as well as temporary, part-time and seasonal federal employees.

Those interested in setting up or continuing a Flexible Spending Account must, per usual, reenroll in Federal Flexible Spending Account Program (FSAFEDS). The program lets FEHB participants set aside pre-tax dollars to go toward their or their dependents’ health care costs.

FEHB and PSHB enrollees can make changes to their health care selections during Open Season between Nov. 11 and Dec. 9 this year. Plan year 2025 will officially take effect on Jan. 1. OPM offers more information and resources on its website for both FEHB and Postal participants.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED