The Government Accountability Office issued its 2016 report on federal financial management and once again can’t offer an opinion because of incomplete data from...

For the fourth straight year, the federal government increased the amount of money described as improper payments. The Government Accountability Office is reporting that agencies exceeded $144 billion in improper payments in fiscal 2016, up from $137 billion in 2015.

This increase translates to a higher improper payment rate as well, up to 4.67 percent of all outlays from 4.39 percent last year. Despite the increase, the rate still is half a percent lower than when President Barack Obama took office in 2009, GAO said.

“This increase between FY 2015 and FY 2016 can be attributed to percentage and dollar increases in the Medicaid Program, the Direct Loan Program, the Medicare Part C Program, the Pell Grant Program, the VA Community Care Program, and the Earned Income Tax Credit (EITC) Program,” GAO stated in the report released Jan. 12. “For fiscal year 2016, federal entities reported improper payment error rates that exceeded 10 percent for 11 risk-susceptible programs, accounting for more than 70 percent of the governmentwide improper payment estimate.”

And the governmentwide total could increase even more as GAO says it doesn’t include the Defense Finance and Accounting Services Commercial Pay program as well as 18 other risk-susceptible programs, such as the Agriculture Department’s Supplemental Nutrition Assistance Program (SNAP) and the Department of Health and Human Services’ Temporary Assistance for Needy Families (TANF) program.

The federal government’s improper payment totals come as GAO also determined it could not render an opinion on the government’s consolidated financial statements for 2016. GAO says deficiencies in the financial statements from the Department of Defense and the Department of Housing and Urban Development contributed to the non-opinion.

“Given the federal government’s mounting fiscal challenges, it’s essential that it be able to accurately account for its costs, outlays, and assets,” Gene Dodaro, Comptroller General of the United States and head of the GAO, said in a statement. “But GAO’s latest audit report on the consolidated financial statements underscores how much more has to be done to provide policymakers with reliable financial and performance data — information that is crucial for the difficult spending decisions that lie ahead.”

GAO says 21 of 24 CFO Act agencies received clean, unmodified audit opinions, but along with DoD and HUD, the National Science Foundation and the Agriculture Department also didn’t get a clean opinion on all financial statements.

The Obama administration and Congress have been pushing hard on agencies to gain more control over and reduce improper payments for the last eight years.

In 2010, Congress passed the Improper Payments Elimination and Recovery Act. The Office of Management and Budget has made reducing improper payments a governmentwide goal since 2004 under the administration of President George W. Bush, and Obama issued an executive order in 2009 seeking to add more focus to this long-standing challenge.

At a House Oversight and Government Reform Committee hearing in September, members expressed frustration that agencies haven’t made more progress.

Part of that frustration comes from programs that continue to struggle.

GAO says the Medicare Fee for Service (FFS) program accounted for the largest amount of improper payments — $41 billion or 28 percent of the governmentwide total. Medicaid was the second with $36 billion or 25 percent of the governmentwide total while the EITC and Medicare Part C combined account for the third with $33 billion or 23 percent of the governmentwide total.

On the positive side, GAO said the government recovered about $20 billion in overpayments last year.

To be clear, an improper payment doesn’t mean the government overpaid a beneficiary or another customer. An improper payment could mean someone was underpaid too.

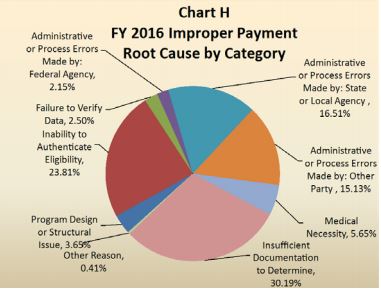

“Approximately $44 billion of the governmentwide improper payments in fiscal 2016 are caused by insufficient documentation. A lack of supporting documentation could be a situation where there is a lack of supporting documentation necessary to verify the accuracy of a payment identified in the improper payment testing sample such as a program not having the documentation to support a beneficiary’s eligibility for a benefit,” GAO stated. “Approximately $34 billion of the governmentwide improper payments in fiscal 2016 were caused by the inability to authenticate eligibility.”

GAO says the inability to authenticate eligibility is a situation where the agency can’t determine if the citizen is eligible to prevent a payment.

The Office of Management and Budget has been pushing for agencies to use more and better data and other approaches to reduce improper payments.

GAO pointed to the Do Not Pay database for agencies to check before sending out any money.

“The Treasury Working System provides agencies a single-point of entry to access data and matching services to help detect, prevent, and recover improper payments during the award or payment lifecycle. Furthermore, Treasury has begun analyzing data across agencies to identify potential duplicative benefit payments in programs with related missions and beneficiaries,” GAO stated. “In addition to Treasury, agency payment integrity tools include the CMS Center for Program Integrity (which has implemented CMS’ Fraud Prevention System); the Department of Defense Business Activity Monitoring tool; and the Department of Labor’s Unemployment Insurance (UI) Integrity Center of Excellence, a federal-state partnership that helps prevent, detect, and reduce improper payments in the UI program.”

GAO said OMB also is using the FedStat process to improve performance and mitigate risks.

But GAO said until agencies can get a better handle on how they are spending their money, the funds are at risk.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED