Benefits

-

"These are very complex cases that require special attention," Mark Searight said.

August 28, 2024 -

Consumers' Checkbook Senior Editor Kevin Moss introduces his new column on FEHB benefits, and kicks things off with some advice on Medicare Part B.

August 26, 2024 -

From WEP/GPO repeal to getting a rational long term care insurance program, the work, pay, benefit and federal retirement issues never end.

August 22, 2024 -

In today's Federal Newscast, new instances of fraud in the government’s Flexible Spending Account program, FSAFEDS, are dwindling.

August 13, 2024 -

Hiring reform, telework, locality pay, official time and paid leave are a just a handful of the federal workforce priorities currently pending in Congress.

August 12, 2024 -

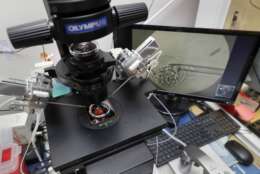

FEHB carriers already cover some costs of IVF-related drugs. But employee testimonials show many feds still have to pay the “lion’s share” out of pocket.

July 26, 2024 -

A recent inspector general report found VA failed to identify tens of thousands of Vietnam veterans who could qualify for retroactive benefits.

July 25, 2024 -

USPS annuitants who opt out of Medicare Part D will lose underlying prescription drug coverage, according to OPM’s regulations.

July 24, 2024 -

FSAFEDS enrollees will also soon have to transition to Login.gov and complete an identity verification to continue accessing their accounts.

July 18, 2024 -

VBA has delivered record-breaking level of benefits to veterans for the past three years, and is on track to break yet another record this year.

July 10, 2024 -

Government employee recruitment often relies on the appeal of the mission. Still people want to be paid and have some financial security.

July 03, 2024 -

Applying for federal retirement is a complex process. Here’s a breakdown of what paperwork you need, when you need it, and what comes next.

June 28, 2024 -

FSAFEDS is lifting a temporary suspension on reimbursement payments. But employees are expressing frustration with the lack of communication ahead of the pause.

June 26, 2024 -

With stricter measures on who can enroll — and stay enrolled — in FEHB, OPM should be able to more effectively address cost issues in the program, GAO said.

June 17, 2024 -

One former official questioned why OPM and the FSAFEDS program didn’t have stronger fraud controls in place before recent reports of fraudulent deductions.

June 14, 2024