Retirement

-

Congress once again is considering higher Voluntary Separation Incentive Payments (VSIPs) for civilian federal employees.

June 07, 2018 -

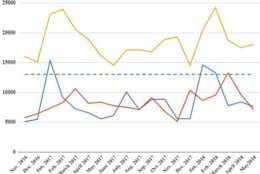

About 9.1 percent fewer retirement claims were received in May than the month before and nearly 26.4 percent fewer retirement claims processed last month than in April, according to the Office of Personnel Management.

June 06, 2018 -

The Trump administration has submitted a legislative package that would, among other things, eliminate cost of living adjustments for current and future retirees. Will Congress pass it? Find out when NARFE Deputy Director for Advocacy John Hatton joins host Mike Causey on this week's Your Turn to discuss the president's proposals. June 6, 2018

June 06, 2018 -

Federal retirees in 1980 could establish a standard of living and keep it even during 14 percent inflation and 11-plus percent the following year. Now, the Trump administration has submitted a legislative package that would, among other things, eliminate cost of living adjustments for current and future workers retiring under the Federal Employees Retirement System.

June 06, 2018 -

Benefits expert Tammy Flanagan makes the case for a centralized retirement counseling service.

June 01, 2018 -

Politicians who want to reduce the cost of the federal retirement and labor-management programs say they are doing it for the most noble reasons.

June 01, 2018 -

Are you worried about the pay-more-get-less design changes Congress and the White House are considering for your Federal Employees Retirement System and Civil Service Retirement System plans?

May 31, 2018 -

The Federal Retirement Thrift Investment Board, the agency that administers the TSP, is planning a series of sweeping changes to withdrawal rules and installment payments for participants by September 2019.

May 30, 2018 -

In today's Federal Newscast, the Congressional Budget Office reviewed how much money the government would save if Congress implements the White House's new proposals for the federal retirement system.

May 30, 2018 -

The amount of money the White House is proposing to cut from federal workers' take-home pay and the future inflation protection benefits for retirees closely mirrors the balance of the F, I and S funds in the Thrift Savings Plan as of Dec 31.

May 25, 2018 -

The House-passed version of the defense authorization act does not include the Trump administration's proposed changes to federal retirement.

May 24, 2018 -

Tracking the stock market and making long-term decisions based on day-to-day changes is not the way to build a retirement nest egg.

May 24, 2018 -

About half of all thrift savings plan account holders move their money to an outside IRA or other investment option when they leave federal service. So who is right, and what is your plan?

May 23, 2018 -

The White House management agenda, which would trim take-home pay and eliminate inflation protection for retirees, could help union leaders recruit from workforce that has shifted.

May 22, 2018 -

Big changes are coming to the Thrift Saving Plan. Kim Weaver, director of External Affairs for the TSP, joins host Mike Causey on this week's Your Turn to talk about the changes, which include making it easier for participants to make withdrawals from their accounts. May 23, 2018

May 21, 2018