TSP tips: Buy high, sell low, right?

Lots of people wait for sales to buy things. But Senior Correspondent Mike Causey says sales panic lots of federal workers while they are building their retirement...

By the time they are mature wage-earners, eligible to invest in the federal Thrift Savings Plan, most people know the cardinal rule of long-haul investing: Buy low and sell high.

If you are investing for retirement, which may be 20, 30, even 40 years off, you quickly learn that markets and funds rise and fall. Figuring out when they have peaked and bottomed out is very, very, very hard to do. During the Great Recession, the market tanked. But instead of seeing that as an opportunity to buy stocks that were on sale, tens of thousands of federal workers and retirees yanked money from the C, S and I stock index funds (when they had lost value) and put their nest egg into the safe, but low-yield Treasury securities G fund .

People who stuck with the U.S. stock index funds during the recession and recovery, and who continued to buy even though the market was down, got a happy surprise. When the markets recovered, their TSP balances soared. For several years, they had been buying low.

By 2016, when the markets were recovering nicely, many people whose accounts languished in the super-safe, but super-dull G fund during the post-recession recovery again forgot the don’t-panic rule.

Financial planner Arthur Stein said typically “many investors panic and sell after markets begin declining or even hit bottom.” That’s the selling low part. Later, when things get better, these same people tend to buy when markets — and share prices — are at or near their peaks,” according to Stein.

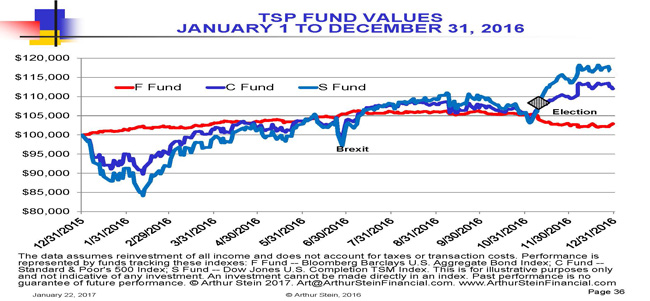

Stein says that 2016 was a textbook case of why trying to time the market (guess when it’s peaked or bottomed out) isn’t a good idea. Stein says there were lots of reasons for TSP investors to panic last year. As in:

- The year opened poorly, with the TSP’s C fund (the S&P 500 index of large U.S. stocks) declining 11 percent from the beginning of the year through mid-February. A good time to buy, as it turned out, rather than sell.

- The U.K.’s June 23 Brexit vote to leave the European Union was supposed to bring a sharp decline in international stocks, and probably U.S. stocks as well.

- Many stock market forecasters said a victory by Donald Trump over Hillary Clinton would crash the U.S. stock markets. It didn’t happen.

- The Federal Reserve raised rates on Dec. 14.

Stein will be my guest on today’s Your Turn radio show. Listen if you can, either at Federal News Radio or in the D.C. area on 1500 AM. If you have questions for him, email them to me before showtime (10 a.m. EST). If you can’t listen live, the show will be archived on our Your Turn page. Meantime, to illustrate the folly of trying to time the markets based on what might-or-might-not-happen, Stein has prepared this graph, which shows the ups and downs of the F fund (bonds), the C fund (large cap stocks) and the S fund (most of the rest of the U.S. stock market). The U.S. stock funds were the big winners with the C fund up 12 percent and the S-fund up 17 percent for the year.

Nearly Useless Factoid

Comedian Jerry Seinfeld attended Massapequa High School on Long Island, New York.

Source: Wikipedia

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED