Your most important financial decision

If you were in a car crash and got hit with a $19,000 medical bill, could you pay for it out-of-pocket, or would your health insurance cover it?

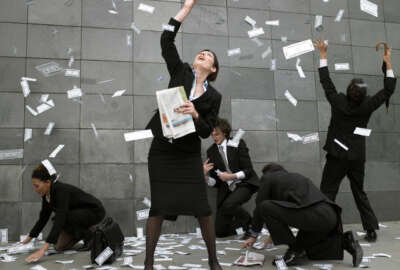

Given the option of shopping for a health plan or watching paint dry, many red-blooded Americans might opt for the latter. While sorting through a dozen or more health plan brochures can be nightmarish, picking the right (or wrong) health plan could be the most important family financial decision you will ever make. Bigger than life insurance. Bigger than buying a house.

Most people think of health insurance as a way to minimize the bills when they visit a doctor or go into a hospital. Premiums are the first thing many people look at. Sometimes the only thing.

Copayments are important too.

So is the PPO network (is your doc in it?) of the health plan you are in, or are looking at. If you don’t change health plans, but your doctor is leaving it in 2018, you have problems. Unless you find a comparable plan where your primary physician is in the network.

What if you need to go to the Mayo Clinic or some other specialized medical facility? What if it is potentially a life-or-death decision? Will your plan cover it, or are you limited to a doc-in-the-box?

While most people are in the same plan (one of the Blue Cross-Blue Shield options), some may be paying too much. What’s the difference — other than premiums — between the standard option and the basic option?

Are you scared of the HMO thing? They’ve changed dramatically over the years. Mostly for the better.

Suppose you don’t think you need heavyweight insurance: Your family is in perfect health, eats right and has good genes. Grandpa Tyler died at 104 from a fall, while climbing out of a bedroom window. Grandma Madison is still canning peaches at 99. So all you need is basic bare-bones coverage at a low premium. Great. No problem. Unless …

The family SUV is hit by a tractor-trailer while on your way to yoga camp or a family marathon. Depending on the plan you chose to cover you this year (2017), your catastrophic coverage (the amount you would have to pay out-of-pocket) ranges from $8,110 to $19,260. Accidents, and major illness, usually come out of nowhere.

Walton Francis, editor of the Consumers’ Checkbook Guide to Health Plans for Federal Employees, says anybody can shop a little and save a lot. Many federal agencies now subscribe to the online version of the Checkbook, which lets you compare plans and premiums. And will tell you if your doctor will be in your network next year. And if your catastrophic limit ( the amount you pay out-of-pocket) is high or low.

Francis will be our guest today at 10 a.m. ET on Your Turn. You can call in during the show if you have questions. Or you can send them to me (before showtime) at mcausey@federalnewsradio.com.

Wondering whether to get Medicare Part B? Or take advantage of a health maintenance organization? What’s the difference between a self-only plan, a self-plus-one plan and a family plan? Are there plans where the self-plus-one premium is the same or HIGHER than a family plan? What’s a health savings account?

We (rather, Walt) will have it all today. If you miss the show or want to listen again later, or refer it to a friend, it will be archived on the Your Turn page.

Nearly Useless Factoid

Chile is the third major per capita consumer of mayonnaise in the world.

Source: Wikipedia

Read more of Mike Causey’s Federal Report

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED