Good news: There are 98,879 federal TSP millionaires! Bad news: Too many people know it!

While some welcome regular reports on the TSP and its stakeholders, many are concerned that Congress may take issue with the idea of millionaire bureaucrats.

The number of federal/postal workers who have become Thrift Savings Plan millionaires has skyrocketed in recent years. Most did it the old-fashioned way: Investing the maximum allowed in their 401k plan, getting the government match and investing mostly in the stock indexed C, S and I funds.

Many made huge gains during the 2008-2009 recession, when stock prices plummeted and investors stuck with them, buying (as it turned out) low. The number of TSP millionaires jumped from 45,219 in June 2020 to 98,879 in June 2021. Most had been investing for at least three decades. Many long-term investors are (stock market willing) on the verge of joining the million dollar club.

The success of so many TSP investors should tell the American public that these are smart people, and their optional investments will make them self-sufficient in retirement.

Or not.

The problem is that what’s good news for some people — in this case, federal and military personnel and their families — can backfire. In fact, while they welcome regular (quarterly) reports on the TSP and its stakeholders, many are concerned that cranky members of Congress may take issue with the idea of millionaire bureaucrats. Even if they made it the hard way.

They worry that the pols (most of whom belong to the TSP) might trim the program, reduce the government match or otherwise change the TSP. For the worse.

Lots of people think the media should downplay the success of feds for fear that politicians (like members of the House and Senate) will decide the benefits are too good — for bureaucrats.

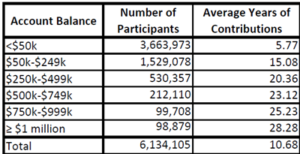

There are regular updates on the TSP every three months. This is the latest, as of June 30, 2021:

Naturally we reported on the numbers. It lets people know how they are doing and probably spurs many to put more in the TSP so they can have a happier retirement, free from money woes. But many probably feel there is a downside — that keeping feds posted also serves to stir up their enemies.

Typical is this recent e-mail from a fed who has genuine concerns that the publicity will damage the program. This is what he said:

Howdy Mike.

Hope this finds you well.

I know you have space to fill and deadlines to make, but I wish you’d throttle back on all the TSP millionaire articles.

The more you put it out there the more of a chance that those clowns on Capitol Hill will try to put TSP in a bullseye.

I mean, can’t you just hear it now?

“How equitable is it that federal employees actually have been able to accumulate such wealth while other workers in the US can’t? What is the ethnic makeup of those millionaires? Shouldn’t their annuities be reduced if they have a million dollars in TSP? Is this fair?”

Do what you gotta do my friend, but I keep waiting for the hammer to fall from those socialists masquerading as legislators.

SIDEBAR: Another private fear I have revolves around those of us who have put all of our “eggs” into the Federal basket. I am a military retiree with an annuity. I receive a VA disability. My wife and I are receiving SS. I work for DHS. And I have a TSP account (inching towards $700K). All of it Federal…..all of it subject to whims and the stroke of a pen. Didn’t used to feel this way, but my how times have changed.

Be well and be blessed always.

So, what do you think?

Nearly Useless Factoid

By Jonathan Tercasio

July 20, 1930, marked the hottest day ever recorded in Washington, D.C. The temperature reached 106 °F. July 7, 2012, came close at 105 °F.

Source: National Weather Service

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED