GSA property shop sees ‘tremendous opportunity’ for better utilized agency office space

With half of GSA’s private leases set to expire in the next five years, the agency and its Public Buildings Services has a chance to shrink the government's r...

This story is part of Federal News Network’s series GSA @ 70: Mission Evolved

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

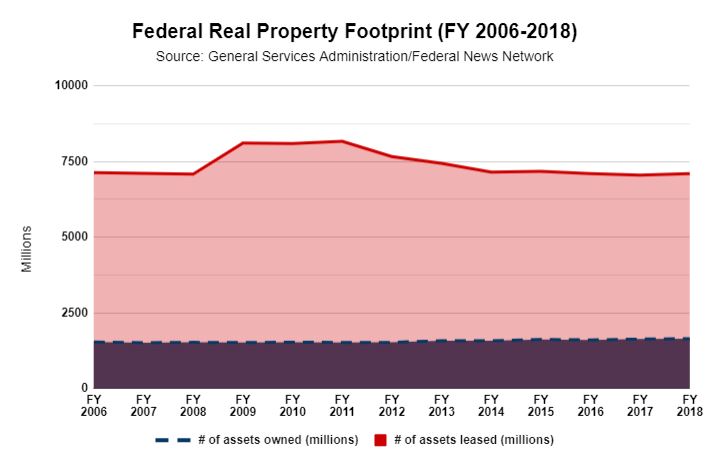

As the landlord for the federal government, the General Services Administration and its Public Buildings Service oversee one of the world’s largest real estate portfolios.

Several administrations, though, have sought to freeze and then shrink that footprint. And with half of GSA’s private leases set to expire in the next five years, the agency has a chance to realize those goals.

As part of Federal News Network’s special report, GSA @ 70: Mission Evolved, PBS Commissioner Dan Mathews, told Federal News Network’s Jory Heckman how the agency can make the most of this opportunity.

Here are some edited highlights of that conversation:

Jory Heckman: With many GSA-held building leases set to expire in the next few years, what opportunities does PBS have for cost savings?

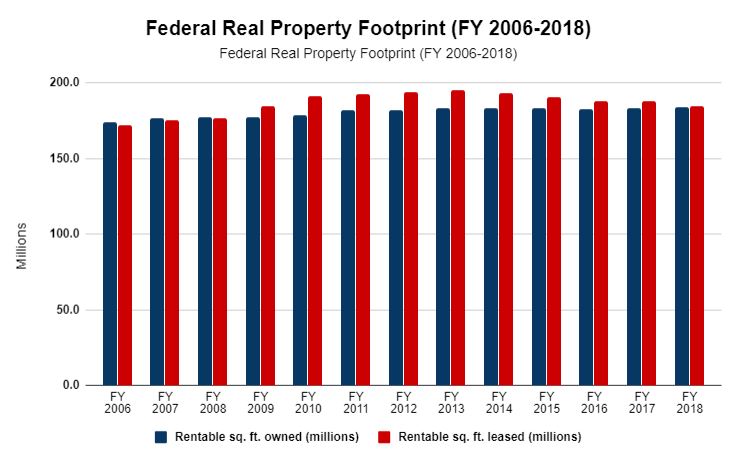

Dan Mathews: It’s a huge opportunity. Half our inventory consists of private-sector leases, the other half of our inventory are government-owned buildings. But out of [those] private-sector leases, we have roughly 180 million square feet of office space.

It’s a tremendous portfolio, it’s one of the largest real estate portfolios in the world. And half of those leases are expiring in the next five years. That creates a tremendous opportunity for turnover and transforming that portfolio into a smaller, better utilized, more cost-effective portfolio, and that’s what we’re focused on.

To do that, when those leases expire, our goal is to replace at least 80% of those expiring leases, particularly the high-value ones, which represent most of the money, with good, long-term solutions that include consolidations — so a smaller footprint than we would be replacing. And when we go out to the market with long-term requirements, that gets us far better pricing and concessions from the private sector.

I’ll give you one little factoid: This year alone, this fiscal year, we have executed a number of new leases, and those leases have come in 11% below market. Historically, we’ve been running about 3% to 4% below market. So what changed? How is it that we’re getting larger concessions, better pricing on our leases?

It’s two things: We’re using our brokers and we’re focusing on long-term leases. And when we put a longer-term lease out there, there’s a lot of competition that’s very valuable for a landlord and for institutional investors. And so there’s competition for these deals. And we reap the benefits.

JH: A big trend I’m seeing with PBS now is data-driven decision-making for a lot of these things — knowing when leases are about to expire, identifying the value and knowing how long to make leases for and things like that. Could you go into a little bit of detail on how data-driven decision-making empowers a lot of the decisions that are made here at PBS?

DM: As technology improves and we have better systems —we’re modernizing them on a regular basis — we have better quality data. We still have some gaps, some important gaps across our inventory that make it difficult at times to make really good real estate decisions.

Our goal at GSA is to make sure that we’re able to provide real estate that agencies need to fulfill their mission, that we do it at the best possible price for the taxpayer.

So again, like with the leasing portfolio, that means transforming that portfolio into a smaller, better utilized, better quality, more cost-effective portfolio for meeting the agencies’ missions.

One of the important data points that we need to make those types of decisions is how well our buildings are actually being used on a daily basis. The private sector is way ahead of us when it comes to that.

But in many of our properties, federal employees have an HSPD-12 card — an ID card — and they walk to the front door, they swipe that card, and then when they leave, they swipe again.

So we have, in those locations, really good daily occupancy data. We know how many people are using that building. We know what the capacity is in that building and if there is a big delta between the two, we can identify excess capacity in our real estate, and that allows us to make smart decisions.

Where do we put our capital? Maybe to re-stack a federal building so that we can take an expiring, lease and move the people from the lease into a building that the taxpayers have already bought and paid for and that we’re paying every day to operate and maintain it.

JH: As far as some of the specific use cases of that, I think that was part of what went down with GSA’s National Capital Regional building near L’Enfant Plaza. How did that data factor into the ultimate decision of bringing more employees to headquarters at 1800 F St.?

DM: It was critical. And I would say, our top two budget requests in fiscal year 2020, pending in Congress right now, our project proposals were possible because somebody had daily occupancy data.

We also have a pretty significant telework program at GSA. Our employees have laptops, mobile phones. We’re pretty much paper-free in terms of getting our work done, so we’re very mobile. And so, if you walk around the building, sometimes it’s pretty clear it’s not being fully utilized. There are a lot of empty seats.

Because we had that daily swipe data, we knew on our busiest day we had 1,000 empty seats in our building. That allowed us to make a strategic portfolio decision about our regional office building at 7th and D St. in Southwest D.C.

It’s a large federally-owned building. We have 1,300 people assigned there, so right now, the taxpayers are paying for 1800 F street and the regional office building.

We’re paying to operate those every day. We know that in a regional office building, even though we have 1,300 people assigned there, there aren’t 1,300 people there on any given day.

And so we were able, with the data, to know that we can move them into our headquarters building and free up many floors at the regional office building, which then allowed us to reposition that building.

More from "GSA@70: Mission Evolved"

GSA@70: 32-year GSA telecom veteran marvels at the progress through the years

There’s a lot of demand for federal employees to be in a location like that. It’s easy to get to, and knowing that we could move so many people into our building, that allowed us to propose a significant capital allocation to renovate that building. And then that’s gonna allow us to move another federal agency in and get out of probably 250,000 square feet or more of privately leased space.

JH: And as far as future tenant agencies for that space, are there any talks of who might be moving into that space? Who would be a good candidate?

DM: A lot of agencies would be interested in being in that location. We’re working out the details, but one of our other attendants in that building now is the Department of Homeland Security, and they have an interest.

JH: There’s been a lot of attempts to produce the federal real estate footprint. Under the 2016 Federal Assets Sale and Transfer Act (FASTA), GSA has sold parcels of land a lot faster. I know this FASTA board is still in its early stages, but what impact do you see this partnership having on trying to reduce and freeze the footprint? How do you see that partnership playing out in the years ahead?

DM: I would say GSA is committed to the success of this statute and the board. And so we’re supporting the board in any way that we can to help it be successful.

Congress viewed there was a significant problem. The previous law governing federal property disposals was very cumbersome, to say the least. And the outcome of those laws and policies was that it was very difficult to sell or dispose of federal property.

Over time, you end up with real property you really don’t need, but you still have it. It’s on the books, and it’s costing a lot of money to hold onto, to operate and maintain.

And so part of Congress’s goal in reducing our overall footprint was on the owned side, to make it easier to dispose of federal property when it doesn’t meet federal needs.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED