Majority of TSP participants staying the course through coronavirus market volatility

The Thrift Savings Plan has been functioning normally during the pandemic, in large part due to the Federal Retirement Thrift Investment Board's efforts to move...

Participants in the Thrift Savings Plan are, by and large, powering through the unprecedented stock market volatility caused by the coronavirus pandemic.

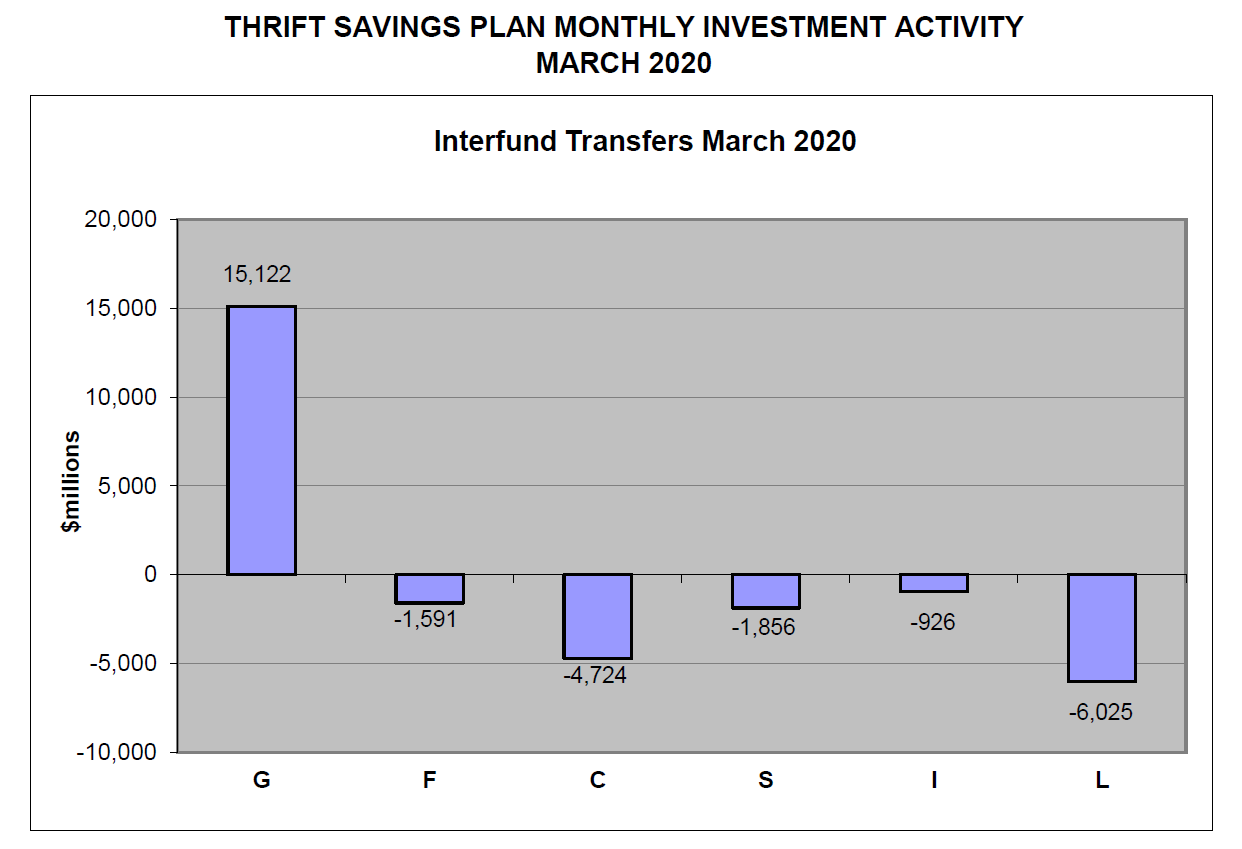

Some TSP participants though clearly looked for safety in the G fund, as the month of March was an all time high for inter-fund transfers, said Sean McCaffrey, the chief investment officer for the Federal Retirement Thrift Investment Board.

About 7% of TSP participants submitted an inter-fund transfer (IFT) between Feb. 24 and March 31, up slightly from the 5% who had conducted an IFT during a shorter period in early March.

The vast majority of participants, about 93%, were not “stirred to action” by the market volatility.

“Most TSP investors stayed the course,” McCaffrey said Monday during the board’s monthly meeting. “Thus far in April the volume of IFT activity has fallen significantly from the all-time IFT highs of March and late February.”

Participants moved some $15 billion into the G fund in March from the other funds, though McCaffrey said transfers were slowly beginning to move in the other direction.

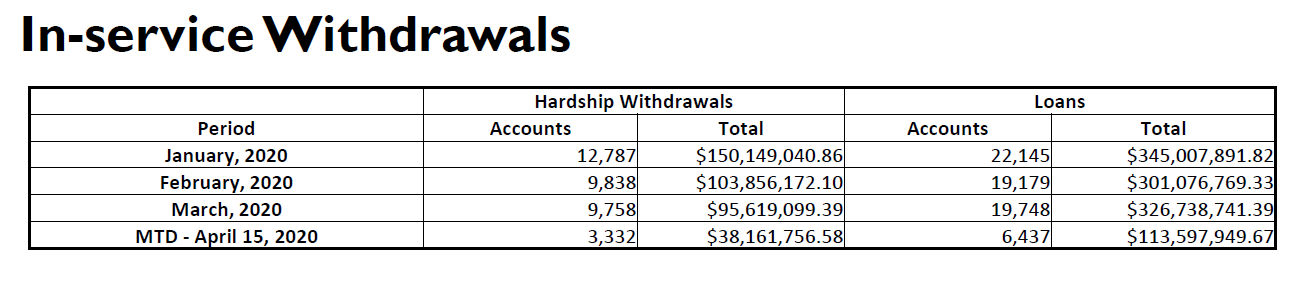

The TSP is also seeing a definitive decrease in the number of participants taking hardship withdrawals and loans in recent weeks. Participants took on significantly more hardship loans than usual in January, and the numbers have been falling since.

If the first half of the month is any indication, participants are on track to take 6,664 hardship withdrawals in April.

Loans for the first half of April are down well below the previous month’s totals, with 6,437 participants taking loans in the first two weeks of the month compared to the 19,748 participants who took a loan in March.

The apparent decreases in loans and hardship withdrawals come after the longest period ever of continuous growth in the U.S. stock market came to an abrupt end in March.

“A bear market, as measured by at least a 20% decrease in the S&P 500 from peak to trough, occurred in the shortest time ever, just over a month, sending the index down almost 34%,” McCaffrey said. “Until now bear market peak to troughs were known to unwind over a period of a year to a year-and-a-half.

The picture is improving slightly for TSP funds in April, he added.

TSP moved contractors to remote work

TSP operations, meanwhile, have continued during the pandemic, in large part due to the agency’s recent shift to telework at its contractor contact centers.

The FRTIB moved 80% of its contractor workforce, some 600 employees, to remote work in three weeks, the agency said Monday.

Vijay Desai, the agency’s chief technology officer, described the move as “nothing short of monumental” given the FRTIB’s federal workforce has been working from home since March 23.

The FRTIB expanded its bandwidth and made a number of other technical changes so TSP contractors, who answer the participant phone calls and online questions, in addition to processing agency and participant contributions, withdrawals and loans, can continue their usual work.

Service levels have remained steady during the telework shift, Sophie Dmuchowski, deputy for TSP policy operations, said. A skeleton staff of TSP contractors continue to work on site at the agency’s contact centers, though who comes in and stays home is voluntary, the agency said.

The FRTIB will take a similar approach whenever it chooses to reopen its office in Washington, which remains closed through at least May 15.

A coronavirus response team at the FRTIB is exploring how it might gradually allow employees to return to the office in the next few months. Those plans will be phased and will allow employees to balance their home and work responsibilities, said Suzanne Tosini, the board’s chief operating officer and deputy executive director.

“One of our board members termed it, ‘inviting staff to return versus requiring them to be on site,’ which perfectly encapsulates how we are thinking about the next few months,” she said.

RMDs suspended, other CARES Act relief under review

The TSP earlier this month suspended required minimum distributions for 2020, per a provision in the Coronavirus Aid, Relief and Economy Security (CARES) Act.

Under current rules, retirees at age 72 or older must withdraw a minimum amount from their accounts each year. Minimums are determined using a specific formula, which is based on a retiree’s account balance at the end of 2019.

The TSP has stopped sending automatic RMD payments, and with these rules waived, federal retirees should keep a greater portion of their savings.

Other provisions in the CARES Act may provide additional relief to federal retirees. The law, for example, allowed eligible individuals to withdraw up to $100,000 from their retirement accounts without incurring the typical 10% tax penalty.

To qualify, individuals must be diagnosed with coronavirus, have a spouse or dependent who has the virus or must experience adverse consequences due to the coronavirus. “Adverse consequences” include losing work hours, being laid off, furloughed or quarantined, or being unable to work due to lack of child care or school options.

The FRTIB is still reviewing how it might implement this provision, the agency said.

The TSP had previously said this provision may be administratively difficult for it to implement given the wide variety of options individuals may have to qualify for the hardship flexibility.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED

Related Stories