The CFO Council released a new workforce strategy to help reimagine the federal financial management workforce.

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

The government doesn’t need more financial management employees who are just accountants.

That’s not taking a swipe at all those number crunchers. It’s just that the modern financial management employee must bring a set of skills that are much different today than 30 years ago when Congress passed the CFO Act.

“I can remember when I was starting out my career, 30 years ago there’s a big push to get accountants in the government and get CFOs set up to get financial statement audits,” said Mike Wetklow, deputy CFO at the National Science Foundation, in an interview with Federal News Network. “I’m a proud accountant. But accounting alone is not going to help you with your career. You really need a mix of skills. You need to be ready to diversify yourself [to] learn different things. We’re just so much more than accounting and reporting. There’s a lot of systems work, there’s a lot of technology performance, risk management and supporting our leaders with decision making.”

For these reasons and so many more, the CFO Council released a new workforce strategy to help reimagine the federal financial management workforce.

The new plan lays out seven objectives to ensure financial managers are successful today and in the future.

Steve Kunze, the deputy CFO at the Commerce Department, who led the CFO Council working group along with Wetklow and others, said many agencies spent the last 30 years achieving the foundational aspects of financial management like clean audit opinions and improving compliance with internal controls and financial statements.

“We’re at that next stage where now that we have credible numbers, so what are we going to do with them? How can we be more effective as an organization and as individuals to be that business partner, the other seat at the table that takes the financial information and provides viable data driven options?” Kunze said. “It’s all about the fact that we have a massive amount of data and we have many new technological tools at our disposal. We did not have those 30 years ago. Now that we have this wealth of data, that is going to allow us to be able to inform the mission side of our organizations. It’s incumbent upon us to develop the workforce to be able to access that data, and be able to present it in meaningful ways that the mission side of our agencies can all utilize to make, prompt business decisions and know that they’re making it with the most accurate and latest financial information available to them.”

The focus on data throughout the strategy, is not just as a strategic priority — it is within nearly every other focus area.

Under the goal to support the current workforce, the council said it will focus on data proficiency, analysis and visualization as a skillset for today and in the future.

Under the goal of culture change, the council said it wants to shift from a culture that is focused on compliance to one that is providing strategic value and intent through data.

And under the harnessing technology goal, the council said legacy systems make it harder to find and share data, and the workforce must be trained to adapt to new technologies.

Kunze said the working group came up with these seven strategic goals with help from the Office of Personnel Management, which provided facilitated advice to create a strategic foresight methodology.

“This is a very structured approach. What we did is we looked at what were the major drivers of change in our financial management workforce,” he said. “We looked at different scenarios that could potentially play out like what would the future of financial management look like with data and technology driving that to varying degrees. The seven objectives or strategic goals are all focused on leveraging data, leveraging the skill sets of our current workforce and making sure that we are attracting that workforce of the future.”

Kunze added compliance will remain important, but it will not drive the financial manager’s day like it may do currently.

The strategy also is clear that the focus isn’t just on new employees, but ensuring the current financial management workers are reskilled or upskilled to provide that “higher value” work.

The financial management community has been out in front of other federal back-office areas in using newer technology like robotics process automation and intelligent automation. The RPA community of practice found 49% of all uses cases came from the financial management community. Acquisition, technology and administrative were the next biggest users but all came in under 20%.

NSF’s Wetklow said the need to add data science as a skillset for financial managers is clear based on his personal experience.

“You use the robotic process technology to help with the manual workloads, but then use things like R or Python to turn data into information and decision making,” he said. “You’ve got these different gateways you go through, and now we’re starting to see gateways to machine learning, artificial intelligence and it just keeps on expanding.”

Ben Ficks, deputy CFO at the Nuclear Regulatory Commission and another co-author of the report, said recent council efforts like the learning portal will help the workforce continue to develop important skills, particularly those that these workers will need over the next three-to-five years.

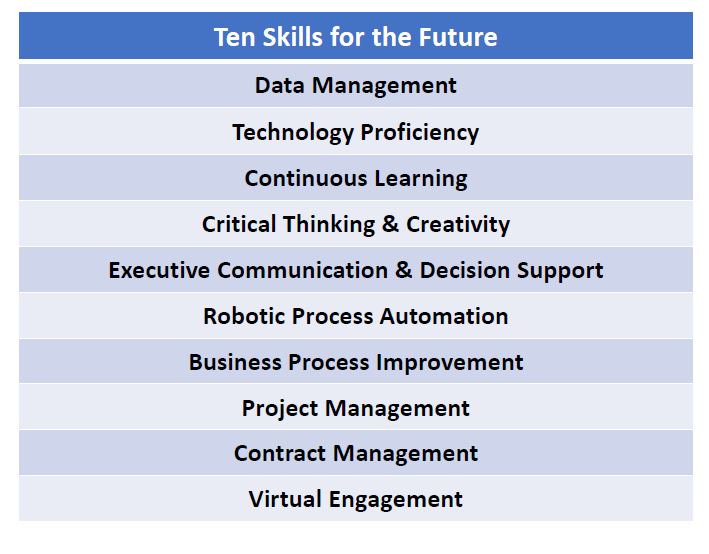

“We’re really excited about our vision of establishing a learning portal that we believe will add a tremendous amount of value to our 140,000 financial staff across our 24 CFO act agencies. The vision is to support them in accessing innovative external training and needed skill areas,” Ficks said. “We’ve accomplished some things already last year. We did some market research that GSA facilitated to better understand the marketplace and better define our needs. We also identified the 10 priority skill needs for the federal financial workforce. So there’s a clear picture of what we’re looking for in terms of expectations going forward and the rest of the year and beyond.”

The council will continue its work with the General Services Administration to establish version 1.0 of the learning portal, which will provide vendor-based training to align with the federal standard financial competency model, which OPM helped develop.

“Basically employees can come in [and] self assess their training needs against that model, and then they could access the training that they want to take with vetted providers that can best meet their needs with new skill sets and other skill sets that they need, like data management,” Ficks said. “We’re excited about that because we think it satisfies the vision of economies of scale, economies of learning across our community.”

Wetklow added the council also is working with colleges and universities to help students understand the opportunities available in government.

The CFO Council will continue to socialize and share the strategic plan so it doesn’t end up as shelfware.

Wetklow said the CFO Council community has been involved in the development of the strategy since the beginning and they plan to update it often.

Kunze added, “Our intent is to basically solicit continued input and assistance from the CFO Council, to have groups look at each of the goals that we came up with in this strategic workforce plan and identify tangible real improvement activities that we can put into play, and work toward them and build off of — all the good work that’s already been done.”

He said getting the CFO’s staffs involved is key to taking the strategy from electronic to action that will help modernize the workforce.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED