TSP’s modernization project set to launch June 1 after transition period

After a brief pause on investment changes, Thrift Savings Plan participants will get a host of new features starting in June.

After a year and a half working on a system modernization project, the agency that manages the Thrift Savings plan is just about ready for the program’s new features to go live.

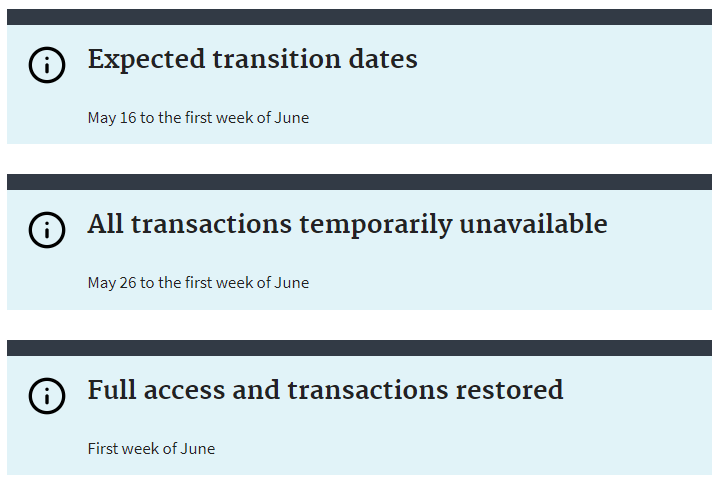

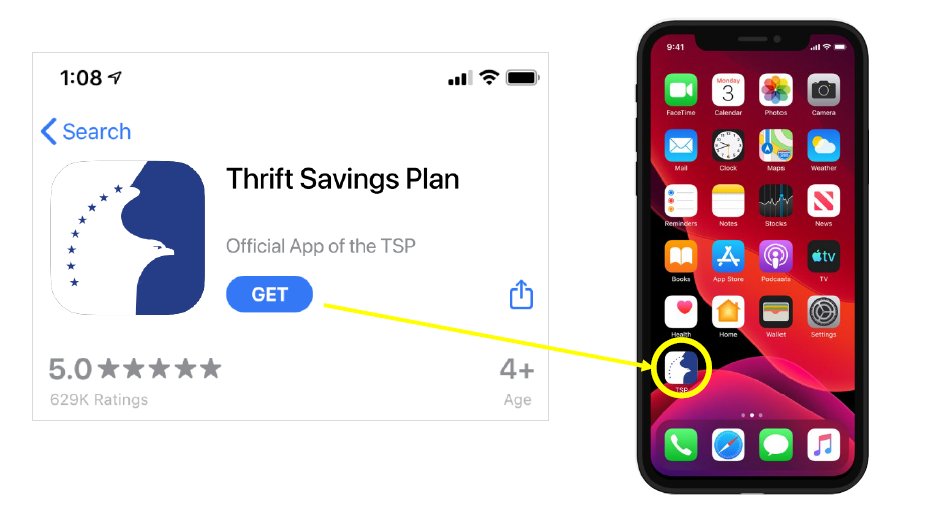

Before participants can access new features on the TSP’s first-ever mobile app, the Federal Retirement Thrift Investment Board is gearing up for the second phase of a transition period starting May 26.

Over the next week, participants will not be able to make any changes to their current investments. That’s after the FRTIB took some initial functions offline starting May 16.

During the downtime, all TSP savings will remain invested and payroll contributions will continue.

After the transition period, Thrift Savings Plan participants will see a more secure, streamlined version of TSP, called Converge, starting on June 1.

When services go back online, participants should expect longer than normal wait times, Director of Participant Services Tee Ramos said at the board’s May 24 meeting.

“Given the excitement around the myriad of new services we are offering and the necessity to reestablish online access, we expect that there will be some delays during the first week,” Ramos said. “We’re doing everything we can in preparation to support participants, but expect much higher than normal volume the first few days beyond go-live and appreciate your patience.”

The update will give users modernized service options, including flexibility in how to access “My Account,” more ways to contact TSP representatives for help and smoother and more secure online transactions, the board wrote in an April 19 announcement.

Most participants do not need to make any changes before the pause, but if they choose to, they can complete transactions, download documents from “My Account” and check investments before the schedule downtime, the board said. All of those features will be available again in the first week of June.

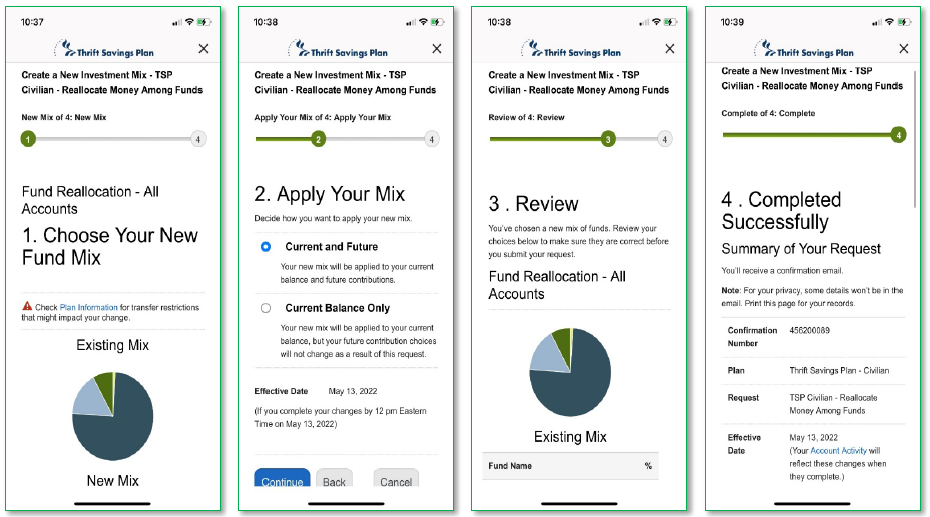

Once Converge launches, participants will see several new features to use in the TSP mobile app, including a live chat window with a TSP representative during business hours, access to digital forms and e-signatures, as well as a system for uploading checks for rollovers and other documents.

To access the mobile app, participants will need to set up their “My Account” once they log in for the first time, either using a computer or a website on a personal device. Participants will also use multi-factor authentication to log in, as part of enhanced security measures, said Tanner Nohe, program manager for the Office of Participant Services.

“Participants will have pretty much all the same functionality on the mobile app as they would if they logged in from their computers,” Nohe said at the board meeting.

Also starting June 1, the FRTIB will transition to a new record keeper. Part of the board’s transition period involves moving all participants’ data over to the new system, Kim Weaver, the board’s director of external affairs, said.

Adding thousands of TSP options

Also starting next month, eligible TSP participants can access a range of up to 5,000 mutual funds through a mutual fund window.

Participants can access the mutual funds on a separate website from “My Account” and use filters to see a variety of funds available for investments. The board also said there are additional fees associated with the mutual fund options.

Federal organizations, including the National Active and Retired Federal Employees (NARFE), support the addition of the mutual fund window. NARFE National President Ken Thomas said it would help TSP remain competitive with the private sector, as well as encourage more federal employees to enroll in TSP.

“Greater options and increased control over retirement dollars are attractive aspects for participants and strengthens the TSP over the long run by encouraging account holders to keep their funds in TSP, thereby lowering administrative costs,” Thomas wrote in a March 28 letter to FRTIB.

But on Capitol Hill, some lawmakers are concerned about the implications of expanding investment options for TSP. Six Republican senators are calling on FRTIB to either cancel or postpone the mutual fund window until the board can ensure no funds are invested in “dangerous, noncompliant or opaque Chinese securities,” the senators wrote in a May 24 letter to the board.

“It is unlikely that your board would be able to ensure that the approximately 5,000 mutual funds are all free of Chinese firms that pose a direct threat to American national security,” the senators wrote. “In fact, the FRTIB has explicitly acknowledged as much, when it noted last year that ‘monitoring approximately 5,000 mutual funds for any investments in Chinese entities would prove too costly for the plan.’”

Weaver told Federal News Network that FRTIB is still reviewing the letter, but noted that the mutual fund window is entirely voluntary — no TSP participant has to invest in any mutual fund.

Concerns about market volatility

Separately from the Converge update, the board said current high market volatility is causing some TSP participants concern about their investment plans.

In response, the board said it does not recommend changing investments because of the uncertainty.

“In periods of high volatility, we’re especially concerned that participants might be moved to deviate from their long term strategies. We always think that’s a bad reaction to have in a period of high volatility,” FRTIB Chief Investment Officer Sean McCaffrey said.

Jim Courtney, FRTIB’s director of the Office of Communications and Education, said the consistent message is have a plan and stick to it – don’t try to time the market.

“I think the numbers bear out that the message is resonating,” Courtney said. “Certainly these first five months have been very volatile and most people are not doing anything.”

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED