Exclusive

Exclusive  Exclusive

Exclusive Ronda Kent, of the Treasury’s Bureau of Fiscal Service, said agencies and vendors alike are benefiting from the centralized management of federal invoices.

Subscribe to Federal Drive’s daily audio interviews on iTunes or PodcastOne.

The Trump administration wants more shared services. The Obama and Bush administration were big fans of shared services. But the track record of consolidating and centralizing common functions, for the most part, has been less than stellar.

Beyond payroll processing, there have been few success stories. But the Treasury Department may add one more to that short list.

The Invoice Processing Platform (IPP) is demonstrating both the benefits and savings envisioned for shared services.

Ronda Kent, the assistant commissioner for payment management at the Treasury’s Bureau of Fiscal Service, said agencies and vendors alike are benefitting from the centralized management of federal invoices.

The best example comes from the Agriculture Department, which implemented IPP in 2015.

Kent said USDA used to get vendors calling them all the time trying to find out about the status of their invoice and the payment. But now using IPP that has changed.

“After implementation of IPP, one of the things USDA consistently marvels about is the dramatic decrease in their call volumes. They reported to us their call volumes immediately fell by 90 percent-to-95 percent,” Kent said. “Now vendors can go onto the IPP portal and immediately see what’s the status of the invoice. They know where the payment is and they know what the payment is for. If the payment was intercepted to pay a delinquent debt, they would see that information there. And it wouldn’t have to call USDA, who would say ‘I don’t know why that payment was intercepted,’ and then have to go chase the information through the government agencies to find out what happened.”

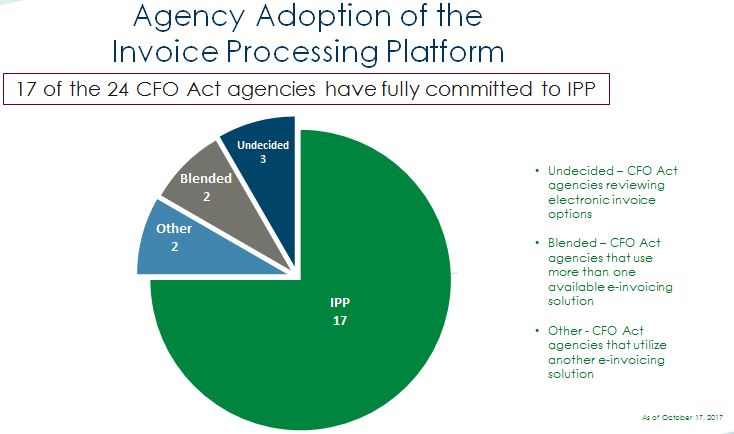

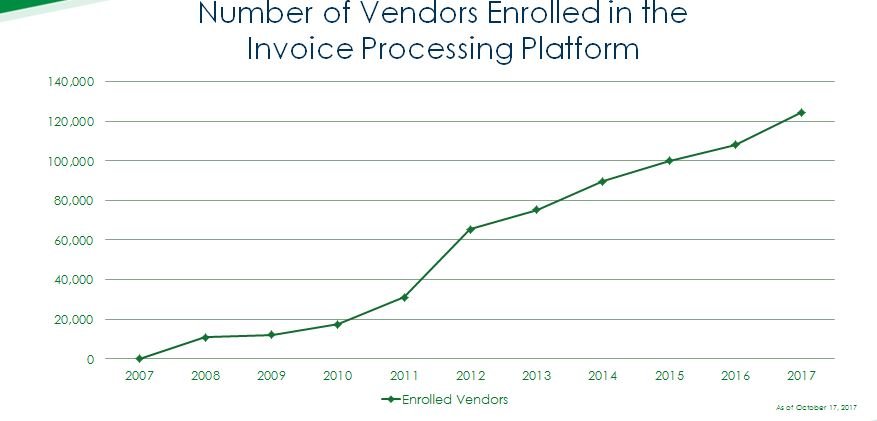

USDA is one of 17 CFO Act agencies that are committed to using IPP. In all, the Fiscal Service has 85 total agencies and 122,000 vendors using the platform.

“There are about three CFO Act agencies who are still undecided as to what invoicing system they would use and we are working with them to see if IPP is the right solution for them,” Kent said. “In the last 15 months, we’ve had an additional 11 agencies that have committed to use IPP, and we continue to hear from other non-CFO Act agencies especially as the deadline for 2018 approaches.”

That 2018 deadline that Kent is talking about comes from the Office of Management and Budget, which in 2015 mandated agencies move to an electronic invoice processing system by the end of this year.

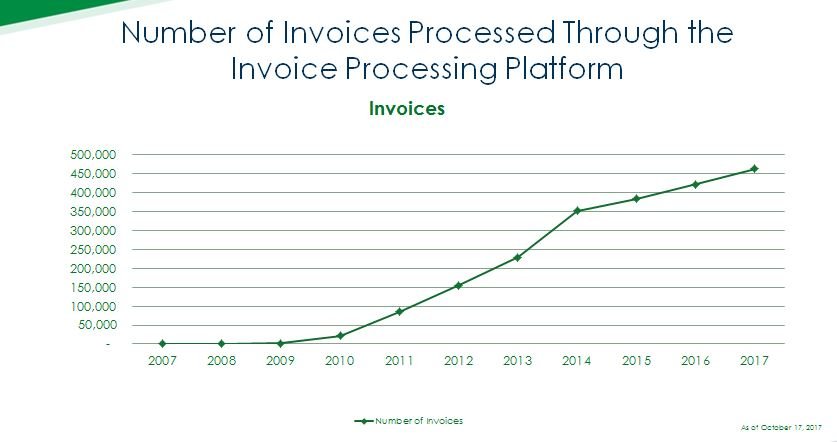

Treasury launched the IPP in 2008 and has been expanding and improving the system each year—over 200 new capabilities over the last 10 years — as it has added more agency customers.

Kent said while a handful of agencies will continue to use their own systems, the rest of them will move to IPP over the next year.

“From IPP’s perspective, we are ready. We’ve been readying ourselves since before the memo came out, and even beforehand. Our goal always was to get as many of the agencies on board who needed us as quickly as possible,” she said. “We’re working a number of implementations now. We’re reaching out to agencies who have not yet implemented. An implementation can range from anywhere from six months to longer depending on the complications for the agency. We have it all paced out. We have disciplined project management. We work with the agencies to integrate our schedules with their schedules, and for the most part the implementations can go pretty smoothly.”

Since December 2016, the Department of Labor, the General Services Administration, the National Science Foundation and the U.S. Agency for International Development joined the platform.

“I’ve been in the government for many years, so I know transitions are never easy. Sometimes the systems transition is the easiest part, but figuring out how to change your business processes and how you do business is much harder,” Kent said. “We can do multiple implementations at once. The agencies are at different phases of their implementation so maybe one agency has to do some work on their end so we can do work for another agency on our end. Right now, the ways it’s all phased out, we definitely have plans, steps in the process of what has to happen when. Some of it is a technical implementation and some of it is we work with the agency to figure out the work on their end. We have a disciplined approach that helps agencies meet the deadlines and the targets.”

Kent said the fiscal service mostly works with the CFO shop, but does have discussions with the technology and acquisition offices too.

“Given the limited number of enterprise resource planning systems (ERPS) that are out there, we have experience with all of them so we can help guide an agency,” she said. “We do have connections with three of the four shared service providers. One of the things agencies find, if they are with a shared service provider, the provider will get them connected with the IPP as part of the service.”

The federal providers also save money using IPP. Kent said Treasury’s shared services provider, the Administrative Resource Center, said by using IPP, it has saved 50 percent of the cost of processing a vendor invoice. ARC also reduced the number of manual steps to process an invoice by 50 percent, and decreased its rejection metric to 7 percent from 25 percent because of what the platform provides upfront with automated checks.

Kent said the bureau expects to continue to develop IPP over the next year, including improving the integration of GSA’s System for Award Management (SAM) to pre-populate information about new contractors joining the platform.

“One of the bigger nuts to crack is working with the government’s larger vendors. Your utility companies, your phone companies, delivery companies and things like that have a large number of invoices that they have to send out to multiple agencies in the government so we are looking to how we can have more efficient system-to-system connections, what we are calling e-file,” she said. “The vendor would connect their system to our system, send the invoices in and they would be processed through IPP that way.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Exclusive

Exclusive