TSP’s index funds are hot! So, what’s an index fund?

A growing number of self-made TSP millionaires invested in index funds from day one. But what are they? Senior Correspondent Mike Causey has the answer.

Thrift Savings Plan investors who have exclusively stuck with the C and S funds through thick and thin (investing in good times and bad) have made a bundle. A growing number are self-made millionaires, investing in the index funds from day one even during the Great Recession, when, as it turns out, shares were on sale big time.

The C fund invests in the 500 largest companies in the U.S. stock market, tracking the S&P 500. The S fund follows the rest of the U.S. market. Earlier, we heard from an investor who said the numbers in the S fund (small cap stocks) didn’t add up. We went to the experts and it turns out that the questioner, and probably lots of others who track the fund, were on the wrong trail. For more on that, click here.

Today, the issue is the largest of the index funds, the C fund. You may have some or all of your money in it (and if not, maybe you should), but do you really understand what it is? What an index fund is? Today on our Your Turn radio show, Washington-area financial planner Arthur Stein is going to talk about the TSP, how it works and how you can make your investments work for you. And the subject is:

The C-fund is an index fund. So, what’s an index fund?

By Arthur Stein

Most TSP investors know that the C fund is an “S&P 500 Index fund.” But what is an “index fund” and how does that differ from an “index?”

Indexes and an index fund are different. Cousins, maybe, but not the same.

Investment indexes represent a group of stocks or bonds and a percentage allocation. Indexes track a certain segment of the stock or bond markets or perhaps all the stocks or bonds that exist. You cannot invest in an index. You can only invest in an index fund.

Index companies decide which stocks or bonds go into an index. Fund companies then pay a fee to the index companies to use an index.

The S&P 500 Index represents 500 of the largest companies in the U.S. stock market, chosen by a committee. Every year, a few stocks are dropped from the index and others are added. The index represents such a large percentage of the value of the U.S. stock market (approximately 70 percent) that it is often used as a proxy for the entire U.S. market.

The S fund in the TSP represents the Dow Jones U.S. Completion Index. That index includes almost all stocks of U.S. companies minus the 500 in the S&P 500 Index (C Fund). There is no overlap between the C and S funds.

Criteria for inclusion in the S&P 500 Index include being domiciled in the U.S., worth more than $6 billion, sufficiently liquid, reasonable share price, public float of at least 50 percent (don’t ask), sector balance and historical earnings.

Reported index returns may be different than the reported index fund returns. It depends upon whether price return or total return is quoted.

- Price return: Change in value of the index without including dividends paid by the companies. Index returns, especially when reported on a daily, weekly or monthly basis, do not usually include the increase in value from reinvested dividends, capital gains and interest.

- Total return: Includes the change in value of the index plus the benefit of reinvesting dividends, capital gains and interest.

For instance, during the first six months of 2017:

- The S&P 500 Index increased 8.2 percent, from 2239 to 2423. That is the price return.

- The C fund share price increased 9.4 percent from 30.9 to 33.8. Other S&P 500 Index funds increased the same amount. That is total return.

The table below illustrates that the percentage changes in the S&P 500 Index were 16-to–28 percent lower when dividends were not included.

Average Annual Returns as of Dec. 31, 2016 Name 1 Year 5 Years 10 Years S&P 500 Index fund and C Fund returns (dividends included) 12% 15% 7% S&P 500 Index (dividends not included)

10% 12% 5% Decrease in reported returns when excluding reinvested dividends. -16% -18% -28% Source: Morningstar Office and TSP.gov. Calculations by Arthur Stein.

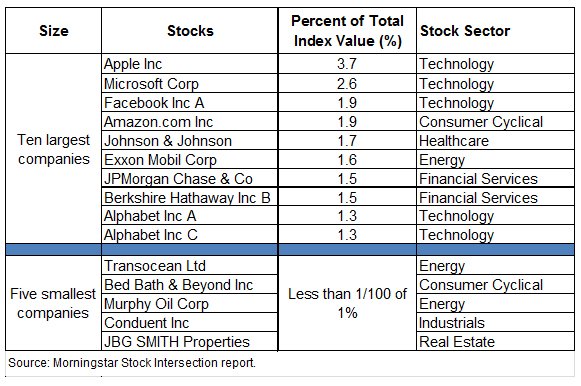

The percentage invested in each of the 500 stocks is based upon the total value of their shares as a percentage of the total value of the Index. The table below lists the largest and smallest companies and the percentages:

Fortunately, you don’t need to understand all these details to be an informed investor. What you should understand is that:

-

The C fund invests in the stocks of large U.S. companies, which represent about 70 percent of the total value of the U.S. stock market.

-

The C and S funds together represent the entire U.S. stock market.

-

Historically, over long periods of time, the U.S. stock funds (C and S) outperformed the bond funds (G and F).

-

The stock funds are much more volatile than the bond funds.

-

When you read or hear about returns for the S&P 500 Index, those returns may or may not reflect increases in value from reinvested dividends. When returns do include dividends, you can expect similar returns for the C fund.

-

Past performance is no guarantee of future performance.

Nearly Useless Factoid

Thomas Edison was the first to contract and reside in a precast concrete home.

Source: Concrete Helper

Read more of Mike Causey’s Federal Report.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED