Want new participants to contribute more to the TSP? Do it for them.

The Thrift Savings Plan will start quietly nudging new participants to contribute more of their income toward their retirements -- by doing it for them.

The Thrift Savings Plan will soon start quietly nudging new participants to commit more toward their retirements, by automatically enrolling them at a 5% contribution rate.

The new automatic enrollment plan launches in a few weeks on Oct. 1, Ravi Deo, executive director for the Federal Retirement Thrift Investment Board, told members last Monday.

This means that for new or rehired federal employees, those participants will automatically begin to contribute 5% of their basic pay toward their TSP, unless they elect otherwise. Participants in the blended retirement services program who are automatically re-enrolled in the TSP on or after Jan. 1, 2021 will also see higher contribution rates.

Participants can change their contribution rates at any time.

Currently, the TSP enrolls new participants at 3%.

The goal, of course, is to nudge new TSP participants toward saving as much as they can for their retirements. Participants must contribute 5% of their basic pay in order to receive their agency’s full matching contribution.

Benefits experts will often tell you: Failing to contribute at least 5% is like leaving free money from your agency on the table.

For some of our more seasoned TSP participants, you might think: so what? This upcoming change doesn’t impact you directly — only your new colleagues.

But what may interest you is the research and feedback the TSP collected to inform the new policy. And that’s where you come in.

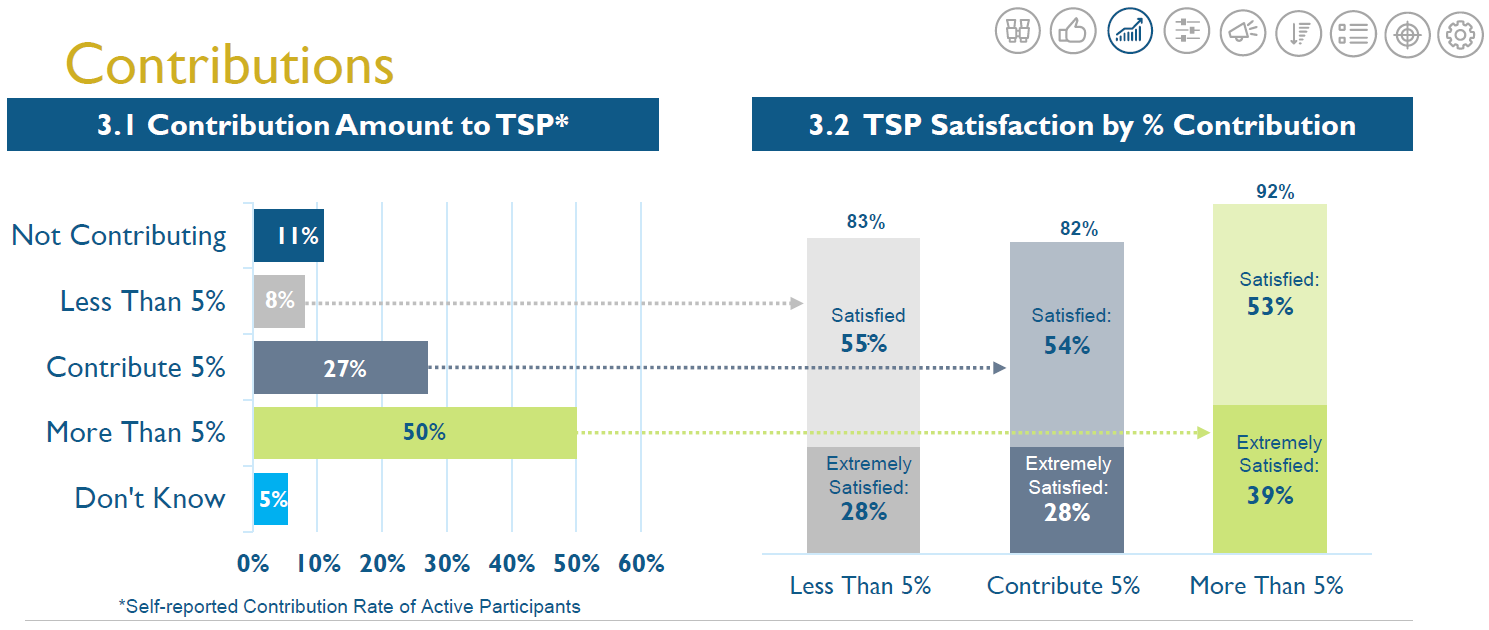

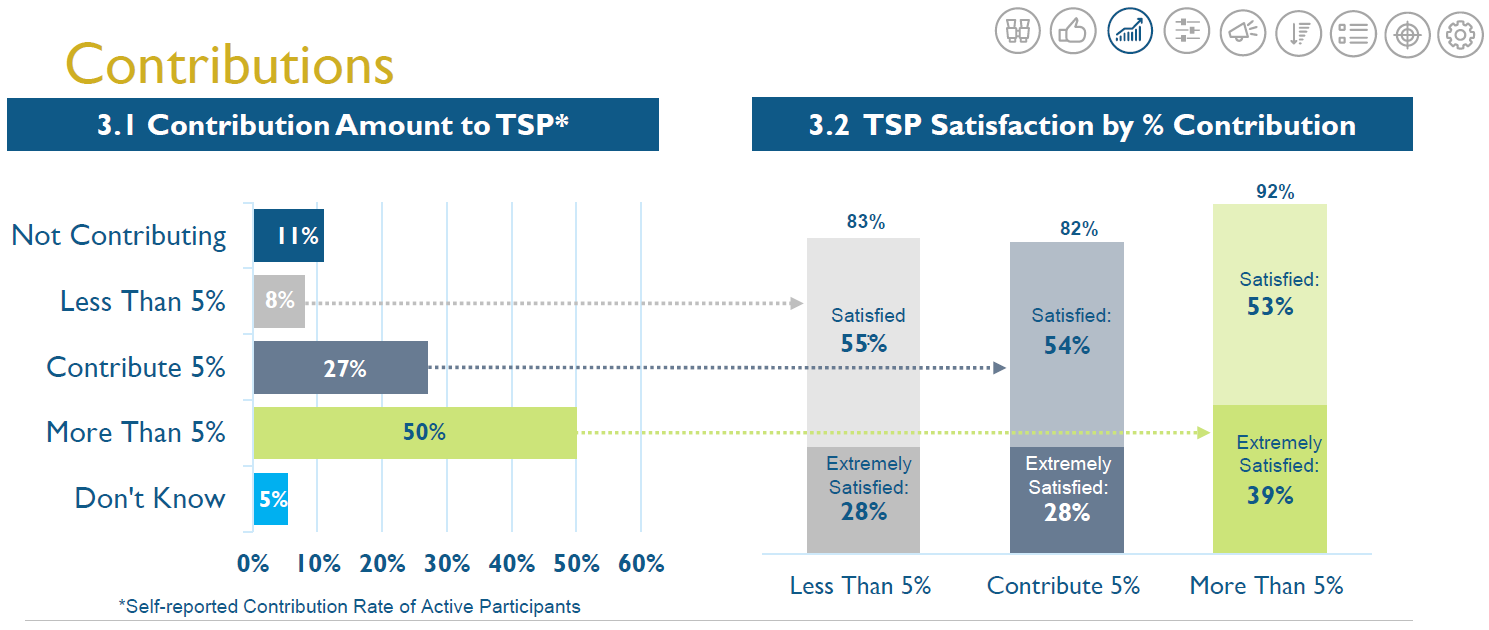

According to the TSP’s recent survey of current participants, the more you contribute, the more satisfied you are with the plan.

About 27% of participants contribute 5% of their income to the TSP, and 50% are contributing more than 5%, according to the survey.

Roughly 8% of participants surveyed said they contributed less than 5%, while 8% said they didn’t know how much they were contributing.

About 11% aren’t contributing at all.

While most participants say they’re satisfied with the TSP, those who contribute more tend to indicate they’re “extremely satisfied” with the plan.

Maybe oddly enough, participants with higher incomes are more likely to cite affordability as the main reason why they aren’t contributing at least 5%.

Of the participants whose households earn $60,000 or less a year, 30% said they couldn’t afford to contribute 5% or more to their TSP, while 41% said they simply never changed their contribution from the original automatic enrollment rate.

But for participants who are part of households earning between $60,000-and-100,000 a year, 55% of them said they couldn’t afford to contribute that much, with 24% adding they simply never changed from the original enrollment amount.

There could be all kinds of reasons for the data to play out in the way it does. Perhaps those who fall under the $60,000 threshold are young and single and have few other financial obligations like children or dependents to care for.

But then consider this final point. For participants whose households earn more than $100,000 a year, 54% — just 1% less than the folks in the middle salary bracket — say they too can’t afford to contribute 5% or more to their TSP.

For the TSP, this data shows inertia is often the main reason for lower-income participants to be conservative with their own contributions — and it validates those plans to begin enrolling new entrants to the plan at 5%.

But what about the other groups?

That’s a more difficult assessment. Perhaps the participants who would have initially assumed they couldn’t afford the 5% contribution may realize — once someone else does it for them — they can. And if they can’t, there’s always the option to change the contribution rate.

When you look back on your early days in the TSP, do wish you had done something differently? Do you wish you had started contributing more — and earlier? Would you have rolled with the 5% automatic contribution as a new participant, or would you have made a change?

And do your TSP contributions matter more today given the current landscape with the pandemic, the economy and the potentially precarious position of the Social Security program?

Financial planners often advise federal employees to focus on what they can control. And when it comes to the pandemic, the economy and Social Security, there’s not much you — as an individual — can control about all that.

Nearly Useless Factoid

By Alazar Moges

On the Liberty Bell, Pennsylvania is misspelled “Pensylvania.” This spelling was one of several acceptable spellings of the name at that time.

Source: National Science Foundation

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED

Related Stories