Next best spot for your TSP?

When people leave government, either for another job or retirement, about a third take their TSP accounts with them.

When people leave government, either for another job or retirement, about a third take their TSP accounts with them.

Some want more investment options. More funds to chose from. Or greater flexibility in withdrawing money from it. But the TSP is a two-way street. Many new feds — from judges to astronauts and postal clerks — bring outside money into the TSP from their outside retirement accounts. The amount of the incoming traffic to the TSP from outside accounts is an impressive figure. Most consolidate their accounts in the TSP because of the options it offers, its very, very low administrative fees and oversight. So what’s best for you when you leave the TSP? Stay put or move on?

TSP investor Abraham Grungold thinks many if not most people should act very cautiously when they take their TSP account with them when they leave government. He’s a full-time fed, part-time financial coach and self-made TSP millionaire. He believes in financial diversity and sent the following:

Do not become the next SEC complainant?

Federal employees are always contemplating the decision of moving their Thrift Savings Plan to an IRA. They are looking for more investment options. They are looking for greater diversity in how they can make withdrawals and they want choices to make charitable distributions. Before you move one dollar from your TSP, ask yourself this question: How many scams have you heard about involving the TSP?

The answer is none.

The Oct. 28 Federal Report, TSP investing: A two-way street, said that many feds are moving their assets from the TSP and combining their retirement assets to one location or custodian. There is an old wise phrase about this very thing. Do not put all your eggs in one basket, because dropping that basket, you have broken all your eggs. I do not believe that Elon Musk, Mark Zuckerberg and Warren Buffet have all their billions of dollars with one bank and with one investment advisor. I have my TSP, my IRA and my wife’s IRA all with separate custodians. The custodians are the entities that hold your assets. The custodian is not your investment advisor or your investment manager. They may be employees of the custodian or they may be contracted to provide these services. My suggestion is to never combine all your retirement assets and the reasons why are as follows.

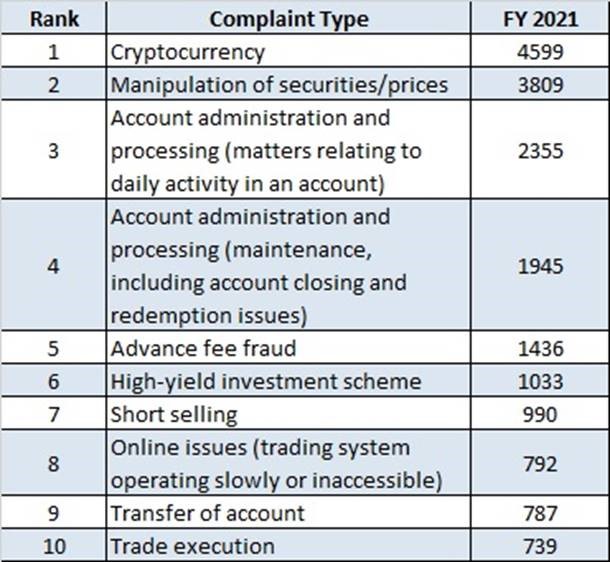

During FY 2021, there were 31,373 files relating to complaints and questions from investors. I do not know of one SEC complaint involving the TSP. Move your retirement outside of the TSP and you may be facing or exposing yourself to potential problems listed below. Here are the top ten categories of complaints filed with the SEC:

Before you make a financial move, perhaps you need to find someone to give you some financial help or to at least validate what your decisions and options may be. You are making decisions regarding your retirement, which means your entire life savings. Moving cautiously can save you a considerable amount of time, money and aggravation. Do not become the next victim.

I have clients who I help with their TSP. In addition, some ask me to assist them with their IRA and brokerage accounts. If you seriously want to move your TSP to an IRA, find reputable custodians and spread large portions of your portfolio among several custodians. If you are a TSP millionaire, move half to one custodian and half to a different custodian. Compare rates of returns, custodial fees and quality of services among each of them.

Financial success can easily be achieved; it only takes a little effort.

Any questions or comments please contact me at Abraham Grungold – AG Financial Services or my Facebook page at FERS Federal Employees.

Nearly Useless Factoid

By Alazar Moges

At 45 letters, pneumonoultramicroscopicsilicovolcanoconiosis, a lung disease, is the longest word in the English language.

Source: Lexico

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED