Feds are likely to get the word, this week, that membership in the TSP millionaires club has plunged.

Somewhere, some place, there has got to be a sports book or group that tracks the world’s biggest 401k, the federal Thrift Savings Plan. Especially the rise and fall of how many members — current and retired feds and military personnel — have built TSP accounts worth at least $1 million. In some cases a lot more! And they did it the old-fashioned way. While the club has expanded and shrunk over the last 30 years due to the stock market and economic trends, mostly it’s getting bigger. Up until now. Feds are likely to get the word, this week, that membership in the club has plunged. And it’s a big drop. But not unexpected after a spectacular record-long run of the stock market. Considering the state of the world today — a changing pandemic, real war in Europe, inflation at a 40 year high and fuel prices skyrocketing — the pending dip is no surprise.

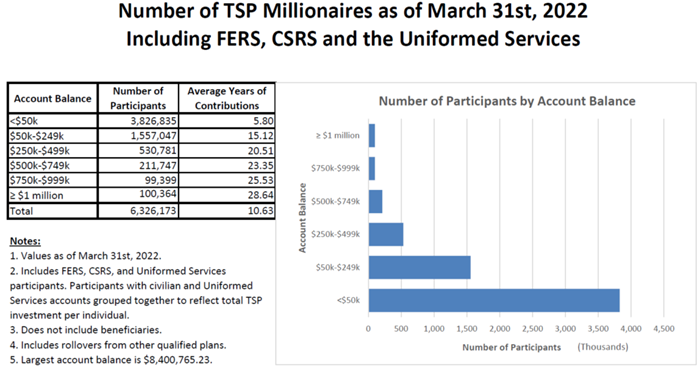

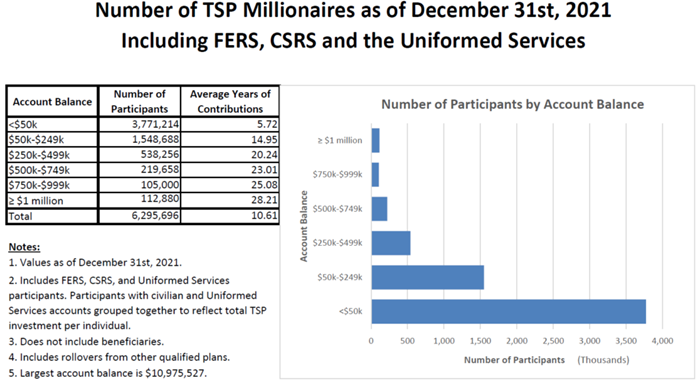

Peak membership in the seven-figure TSP Millionaires Club was December last year. At that time there were 112,880 people with accounts ranging from $1 million to $8.4 million. The Club shrank to 100,364 as of March this year. A downturn to be sure. But not bad for government workers and military personnel who are now among the nation’s salary elite.

The $8.4 Million Dollar Man/Woman is probably a member of Congress, political appointee, somebody on the Supreme Court or a member of the House or Senate, where millionaires abound. But the magic of the TSP is that thanks to the miracle of compounding, and the 5% match investors get, the vast majority of the club’s members are rank and file feds: postal inspectors, IT experts, NASA scientists, researchers at the National Institutes of Health, VA lawyers and doctors. People who invested for the long haul (an average of 29 years) and who stuck with the TSP’s three stock index funds (C, S and I) which cover the U.S. stock market along with an international fund. They stuck with them and continued to buy more during good times, but their smart move was to keep buying shares on sale because of various bear markets (a 20% dip). And especially those who kept buying C and S shares biweekly during the 2008-2009 Great Recession when stocks, we know now, were on sale.

The runup following the comeback (starting in March 2009) of the stock market kept adding more and more members to the Millionaires Club.

But while tracking the population boom of self-made millionaires, the real story is the numbers covering the rest of the TSP membership. The 6-million plus federal and military investors who are NOT in the club. But who — most of the time — have moved up a lot more often and for much longer periods of economic improvements which eclipsed, in the long run, current losses in the market.

On last week’s Your Turn radio show, financial planner Arthur Stein talked about the overall performance of the TSP since inception and how the stock markets suffered their worst January through June performance since the 1970s. He also talked about what feds, young and old, should be doing with their TSP accounts during these down times. Below are two charts that show the status of TSP accounts on Dec. 31, 2021 versus the numbers as of March 31. We’ll have the new numbers tomorrow. Meantime:

And these are the numbers at the end of last year:

Panama hats originated in Ecuador. They got their name because hat-makers in the 1850s found a more successful market for them in Panama, a major international trade center. Travelers would tell people they purchased the hat in Panama, and the name stuck.

Source: Wikipedia

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED