Income plays a role in participants’ likeliness to change TSP contributions, FRTIB finds

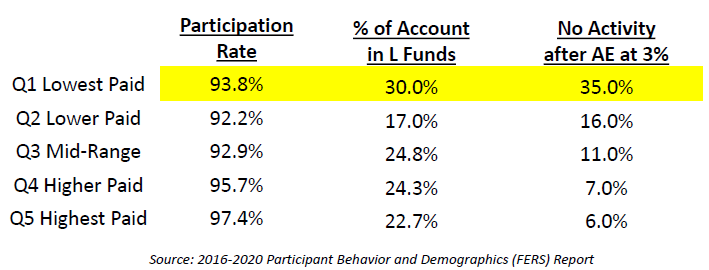

35% of TSP participants in the lowest income bracket did not make changes to their TSP accounts after being automatically enrolled, a significantly higher perce...

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

The Federal Retirement Thrift Investment Board highlighted its efforts to remove barriers to better understanding Thrift Savings Plan services for some underserved groups.

The board aimed to find out how participants’ salaries affected their understanding of TSP, as well as their likelihood to make changes to their TSP contributions, in a recent study.

Data from the board showed that 35% of participants in the lowest income quintile did not make any changes to their TSP accounts after being automatically enrolled at a 3% contribution rate, a significant amount more than participants in the other four income brackets, the board reported during a Sept. 27 meeting.

The goal of the study, then, was to encourage federal employees in the lowest 20% of the income bracket to invest enough income to earn a full matching rate from agencies and services — that requires participants to contribute 5% of their income to TSP.

Agencies and services match the first 3% of pay that TSP participants contribute dollar for dollar. The next 2% is matched at 50 cents on the dollar. And agencies and services do not match contributions that participants make above 5% of their pay.

New TSP participants are now automatically enrolled at 5%, the rate required to receive a full match, but the board aimed to see if different messaging might affect those who entered before that adjustment, and who were still invested at the 3% automatic enrollment rate.

To start the process, the board conducted focus groups to find out how some members of the lowest quintile viewed retirement savings, and what gaps might exist to understanding the matching contribution requirements. Social scientist Elizabeth Perry at FRTIB’s Office of Communications and Education said most focus group participants seemed to understand the match “pretty well.”

“Some participants said that they learned from their families how important it was to save in general, to put something away whenever you could,” Perry said at the meeting. “Others said that they learned specific advice about saving, such as try to max out, but always get the full match. And they said that their families have been saving all of their lives, which influenced them to do the same. Still, others said that their parents worked very hard and may not have had a lot saved … These participants were motivated by wanting to support those who depended on them, even though they were relatively young.”

In a messaging campaign, the board sent test emails to about 3,000 TSP participants in the lowest income bracket, grouping them into different types of messaging, to determine if it would have an impact on their likelihood to contribute more on top of their automatic enrollment.

In the study, the board found that about 15% to 17% of participants increased their contributions in response to the messages, with the average increase being $70 more — a positive result, the board said.

“If that is maintained until age 65, based on median ages, you’re looking at roughly $73,000 more in their accounts, which is almost double their current salary, or potentially another year or more in retirement,” Perry said.

Another trend for TSP participants over 50 years old showed some incorrect use of TSP’s catch-up contribution program. Participants used to have to make two separate elections — one for regular contributions and one for catch-up contributions — requiring participants to figure out for themselves how best make both of those contributions without hitting the limits. The system caused confusion for some participants, Perry said.

“We learned tens of thousands [of participants] were having trouble with this and were missing out on matching, so we decided to simplify it,” she said. “Instead of participants having to make an election, their savings would automatically spill over to catch-up, if they were 50 or older, once they reached their limits. Contributions spilling over to catch-up would be eligible for matching. This led to simplified tracking for both us and the payroll processors.”

The correction resulted in roughly $80 million more in catch-up contributions for 2021, with a 16% increase in participants who contributed — both record-breaking numbers for TSP’s catch-up contributions program.

Participant satisfaction survey results

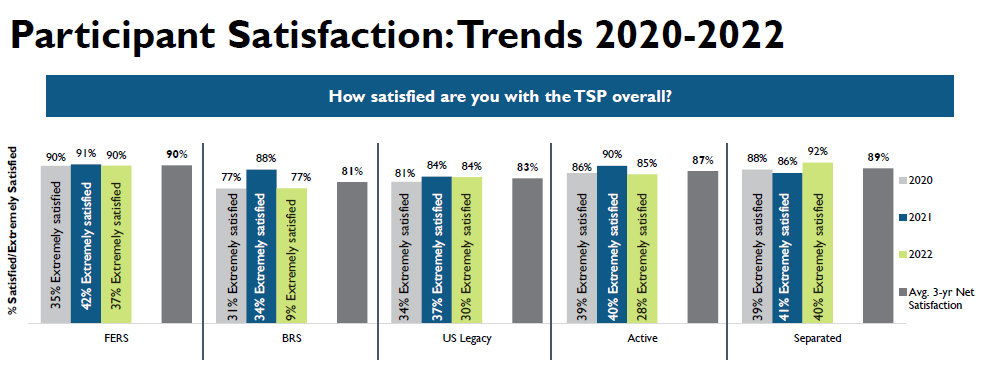

The results of the board’s annual TSP participant satisfaction survey showed a slight dip in the overall satisfaction rate for 2022, down to 87%, from 89% last year. But the percentage was on par with the 2020 survey, which also reported 87% satisfaction.

The board noted, though, that it distributed the survey largely prior to the TSP transition in June, meaning most potential impacts of the major update on participants’ satisfaction would not appear until next year’s survey.

Two notable aspects for which participants’ satisfaction declined in early 2022 were the ability to take out a loan, and the ability to transfer money to other retirement plans.

“We were a bit perplexed by this, since we hadn’t changed any of the processes for these transactions prior to the new record keeper,” FRTIB’s Strategic Performance Branch Chief Dennis McNulty said at the board meeting. “We think that the decline in these areas might be partially explained by participants who responded later in the stages of the fielding period. During this time, we began cutoffs for these transactions in preparation for the transition to our new record keeper. However, we were not sure that this would account for the full decline in these areas.”

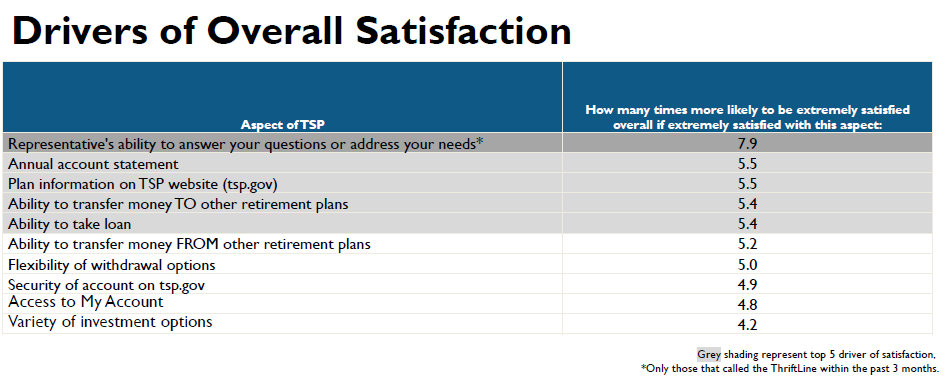

ThriftLine representatives were by far the largest driver of participant satisfaction. And, the board said that most participants use My Account as a way to get information about their accounts, meaning its functionality is also a large driver of TSP satisfaction overall.

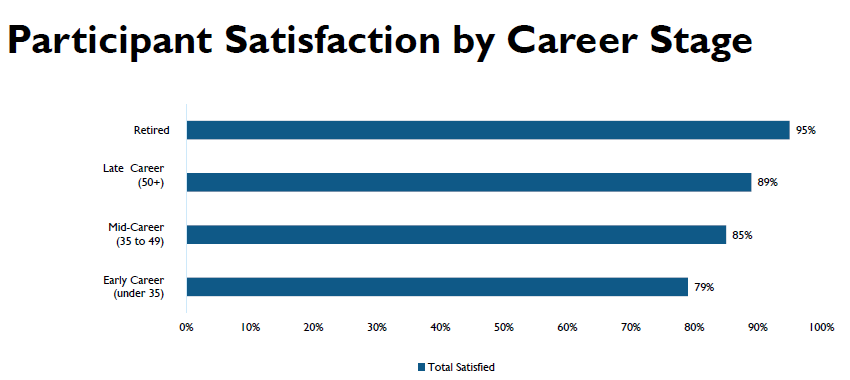

Career length was another factor that affected participants’ satisfaction with TSP. Participants with older accounts were significantly more satisfied with the program, when compared with participants earlier in their careers.

Military members in the relatively new blended retirement system (BRS) also posted much lower satisfaction than other TSP participants, particularly noting their dissatisfaction with the flexibility of withdrawals from their accounts. Those respondents also had the least familiarity with TSP fees, the board said.

And this trend for BRS participants isn’t new. Overall, 77% of those participants said they were satisfied with TSP. That’s compared with 88% of BRS participants saying they’re satisfied with TSP in 2021, and a 77% satisfaction rate for military members in 2020. The group also had the lowest response rate for the satisfaction survey.

“[BRS participants] log on once, and then they really have no purpose to log on again. And so they just make contributions and don’t have many interactions with this,” McNulty said.

Many TSP participants also expressed their desire for better instructions and information on TSP, more investment options and investment advice for retirement planning.

“With the transition to the new record keeper, some of these features are now being provided,” McNulty said. “Specifically, we now have a retirement income modeling tool, which uses the participants’ balance and allows each participant to enter other sources of income in order to provide a gap analysis of their income needs.”

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED

Related Stories