Are TSP investors — especially retirees — playing it too safe with G fund investments?

Because the Thrift Savings Plan's G fund never goes down, in other words it is “safe." But that also depends upon what you mean by “safe.” When is playing...

Remember back in 1998 when President Bill Clinton, in testimony, said, “It depends upon what the meaning of the word ‘is’ is.”

He got a lot of flack for that but as a lawyer fighting for his political life, he had a point.

And some people say the same thing about the super-safe, never-has-a-bad-day G fund of the Thrift Savings Plan. It’s invested in special Treasury funds. So in bad times and good, too, many investors put some, most or all of their retirement nest egg in the G fund. Because it never goes down, in other words it is “safe.” But that also depends upon what you mean by “safe.” When is playing it “safe” actually risky?

Many of financial planner Arthur Stein’s clients are feds. Some are retired, some are still working. A couple of them, at least, have built up million-dollar-plus TSP accounts. And he cautions them to be careful playing it too safe where their G fund allocation is concerned. He will be my guest today on our Your Turn radio show at 10 a.m. EDT. Listen online or at 1500 AM in the Washington, D.C., area. One of the subjects is the allocation feds, especially retired feds, have in the G fund. Here’s a special column he wrote to go with today’s show — check it out:

G and F: Which bond fund for you?

The two bond funds available in the TSP are the G fund and the F fund. The G fund invests solely in short-term U.S. government securities. The principal is guaranteed by the government and never fluctuates in value. The F fund invests in government, corporate and mortgage-backed bonds and does fluctuate in value as interest rates increase and decrease.

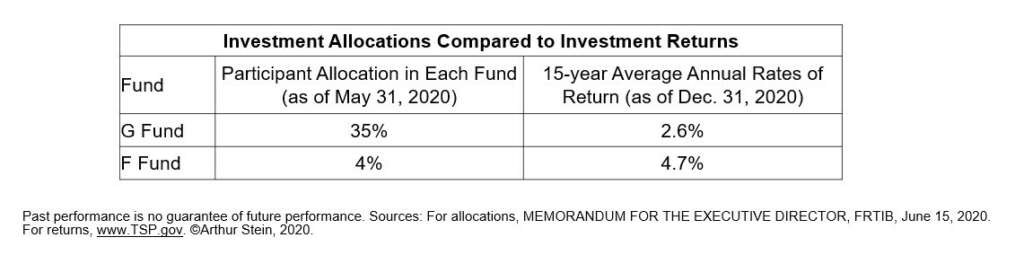

The F fund was usually the top performer. As of Dec. 31, 2020, the fund:

- Outperformed the G fund over the last one, three, five, 10 and 15 years;

- Outperformed or equaled the G fund 19 out of 27 calendar years; and

- The return was negative for only three of the last 27 calendar years.

So where do TSP participants put most of their money? The G fund, not the F fund! Federal employees and retirees invest eight times as much in the G fund as the F fund, despite the F fund’s historical record of outperforming G most years.

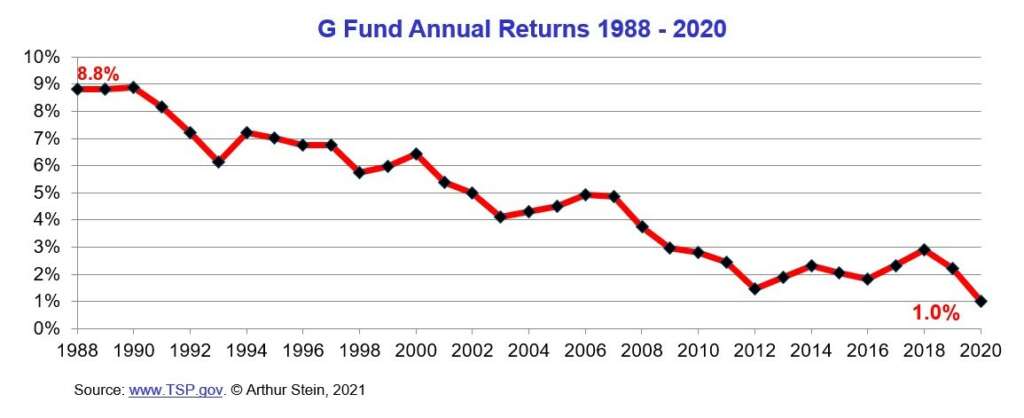

G fund annual returns have gradually declined since it was introduced in April 1987. In 2020, the return was 1% — 89% lower than in 1988. That reflected a general decline in interest rates. The cost of living (inflation) more than doubled over the same time period.

Since G fund returns were declining as the cost of living increased, TSP investors need to ask themselves how “safe” is the G fund?

Nearly Useless Factoid

By Alazar Moges

Source: United Nations Educational, Scientific and Cultural Organization

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED