DoJ’s two big False Claims Act settlements a sign of things to come?

A recent survey from the Professional Services Council highlights optimism in the federal acquisition workforce, particularly around communications with industr...

A huge fine for a big name government contractor.

A flood of interest for the next great governmentwide acquisition contract.

And despite all the challenges with the federal procurement market, there is a lot of optimism about where agencies and contractors are heading.

Welcome to another edition of As the [Procurement] World Turns.

The Biden administration use of the False Claims Act to prosecute contractors was tepid to say the least. The Justice Department brought in $2.2 billion in fiscal 2022 around settlements and judgements. That is down from $5.6 billion in 2021, $2.2 billion in 2020 and more than $3 billion in 2019.

The majority of those 2022 cases were in the healthcare sector, accounting for $1.7 billion in all. Federal acquisition judgements and settlements barely registered in DoJ’s annual release about their successes.

That all seems to be changing in 2023, however.

In the last few weeks, two cases may just be a sign of things to come.

Booz Allen Hamilton settled acquisition fraud allegations to the tune of paying $377.4 million. This is one of the largest settlements related to federal procurement in the last 20 years. It’s among the largest ever win for a Qui Tam or whistleblower case as well. The former Booz Allen Hamilton employee is expected to receive more than $69 million for bringing the case to light.

You can read the entire Justice press release, but the crux of the allegations against Booz Allen stem from the company allegedly improperly charging costs to its government contracts and subcontracts, and getting reimbursed for those charges that instead should have been billed to its commercial and international contracts from 2011 to 2021.

As one person said to me, if Booz Allen agreed to settle for $377.4 million, imagine how much money was actually improperly charged back to the government over that decade? Makes you wonder a bit…

In a press release, Booz Allen stated, it “has always believed it acted lawfully and responsibly. It decided to settle this civil inquiry for pragmatic business reasons to avoid the delay, uncertainty, and expense of protracted litigation. The company did not want to engage in what likely would have been a years-long court fight with its largest client, the U.S. government, on an immensely complex matter. This settlement ends the DOJ’s civil investigation more than six years after it began. DOJ closed its parallel criminal investigation more than two years ago, taking no action.”

The other False Claims Act from earlier this month was much smaller in terms of a settlement, but nonetheless still interesting.

Justice won a $7 million settlement from Foresee Results, Inc. and Verint Americas, Inc. (collectively, Foresee) to resolve allegations that the company violated the False Claims Act by falsely representing that they used the methodology of the American Customer Satisfaction Index (ACSI) to measure customer satisfaction.

This case stems from a 2011 contract from the Federal Consulting Group (FCG), which is part of the Department of the Interior, for website assessment and improvement services, through which Foresee agreed to measure the public’s satisfaction with certain government websites and make recommendations regarding how to improve satisfaction.

“The settlement announced resolves the government’s allegations that Foresee did not use the ACSI methodology, but instead used a different methodology to measure the public’s satisfaction with certain government websites,” Justice stated in its release.

Eric Crusius, a partner with Holland and Knight and a procurement attorney, said what the federal acquisition community maybe seeing now is DoJ ramping up to implement the Biden administration’s priorities with oversight and accountability.

“With this administration, anecdotally, it appears DoJ has been more active recently in the False Claims Act arena; particularly when looking at the Civil Cyber Fraud initiative that was announced in late 2021 and the Procurement Collusion Strike Force. I expect we will continue to see increased activity in these areas, in particular,” he said.

Flood of OASIS+ questions

Speaking of ramping up, industry’s excitement, or better yet attraction, to the General Services Administration’s OASIS+ multiple award program may not have hit the apex yet, but is rushing up the hill.

Contractors submitted more than 4,500 questions about the six solicitations GSA released in June for this professional services governmentwide contract.

GSA says it plans to release its responses in batches in the coming weeks, and will notify industry via SAM.gov and this OASIS+ Interact Community forum.

Bids on OASIS+ are due by Sept. 13, but anyone who has watched these mega-contracts over the last two decades knows, deadlines tend to slip to the right several times, particularly with the amount of interest OASIS+ is garnering.

Now on top of the OASIS+ bid, GSA said today it plans to issue an amendment to Polaris GWAC Small Business Pool offerors in August 2023.

“The amendment will incorporate submission of a price proposal, as well as adjustment to the evaluation requirements specific to protégé firms. Solicitation amendments for the WOSB, HUBZone, and SDVOSB Pools are planned for September 2023.”

Both of these will keep companies, bid and capture experts and GSA contracting officials busy into the new year.

Survey says: Acquisition workers optimistic

Within all of these challenges and opportunities, contracting officers and other acquisition leaders are generally optimistic about where the market is heading.

A recent survey by the Professional Services Council of officials from 13 agencies found, generally speaking, acquisition processes have been functioning well, and there is continued confidence in federal acquisition efforts.

”PSC’s 2023 Acquisition Policy Survey indicates government acquisitions are in a stable condition, though ambiguity at programmatic and policy levels creates an opportunity for federal leadership action at many different decision points,” PSC wrote in the survey summary. “Decision points exist on how best to apply the composing parts of impact areas for mission execution and to determine if some of these composing parts even work at all.”

Survey respondents highlighted several positive outcomes, including the benefits of multi-agency contracts like the GSA schedules or NASA SEWP.

“Sixty-one percent of respondents believed multi-agency contract vehicles — ranked most beneficial to acquisition outcomes and key to the Category Management framework — grow the available vendor base,” the survey stated. “Worth noting: 39% believed that those contracts shrink the base, enough to indicate that while these vehicles are beneficial to acquisition outcomes, those beneficial outcomes may not necessarily result from vendor base growth.”

Many respondents say longer-term contracts help improve communication of expectations with contractors and create more stable partnerships. These vehicles also reduce the stress or impact on understaffed procurement shops.

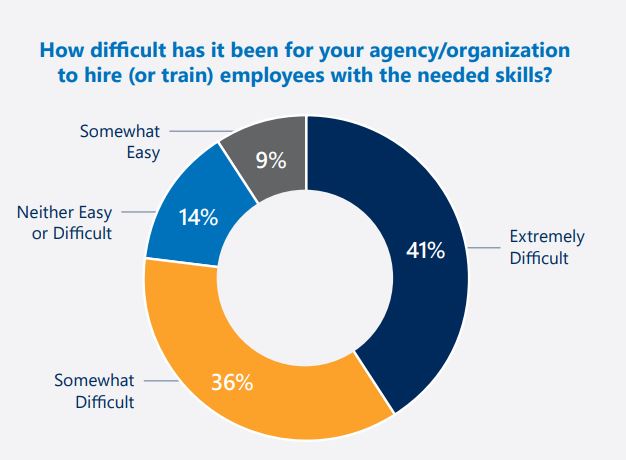

Workforce remains a major challenge with the workforce facing an attrition rate of 25% over two years, the median age of 46 and 23% of staff already retirement eligible.

“Our survey and interviews demonstrated surprising results — that while the government still has difficulty attracting a new generation of workers, employees leave mostly to other agencies and components, instead of to retirement, resignation or private industry,” PSC stated. “Respondents said government hires need to be promoted quickly. Promotion takes training, and acquisition training takes time. Sometimes, ‘we turn to contractors for trained professionalism — especially for knowledge of legacy systems. This is reaching a crisis level.’ Respondents said their employees need more skills to reach the right experience, right fit. Respondents most often stated they are weakest on training in program management.”

Optimism in how agencies communicate and collaborate with contractors is another sign of optimism.

PSC says 67% of respondents believe communication with industry has improved over the last 2-3 years and 70% say it will continue to get better over the next few years.

Respondents said issuing requests for information, holding one-on-one meetings and reverse industry days are among the most effective ways to communicate with industry.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED