Emily Murphy, the GSA administrator, said over the past year the agency has collected and used more information about acquisition and real estate to save money and...

The administrator of General Services Administration is more than just a little excited about her acquisition dashboard showing the status of contract competitions and giving her other important decision-making information.

Murphy said the dashboard is helping GSA measure its acquisition success and how it has led to a record-setting year for the Federal Acquisition Service.

“The data decision portal for acquisition is helping us meet one of things that I said when I was confirmed that I wanted to drive was increased competition. So we’ve been able to slice and dice it. We look at not just what percentage of our work is competed, but also what percentage was competed as a one bid. And also what percentage is competed because it was a mandatory sole source. We really are going toward that sweet spot,” Murphy said in an interview with Federal News Network at the 2019 ACT-IAC ImagineNation ELC conference. “We can ask, what contracts should be fully competed and vigorously competed? And in the cases where we’re only getting one bid, what did we learn from that? So how do we improve that going forward? I love my acquisition dashboards. I’ll admit it.”

Murphy isn’t stopping with the acquisition dashboard. She said data analytics is driving decisions across the agency’s mission space. The Public Building Service, for example, used data to consolidate the National Capital Region office into the headquarters office because even on the busiest days when employees are in the office, GSA still has room for 1,000 employees.

Murphy said she expects employees who work in the NCR to move into the headquarters office in the next month or so.

GSA also is using data analytics to improve how it manages the federal automobile fleet and how it can provide fleet management services to other agencies as part of the administration’s push for more shared services.

“There about 600,000 vehicles in the federal fleet. But 207,000 of those are managed by GSA. And for the fleet, we managed to save about 23 cents per mile for each of our customer agencies. We were challenged to take a look at another 200,000 vehicles. We want to do that in a thoughtful way. So we partnered originally with six agencies, and studied 70,000 vehicles. And the results of those studies showed that if those vehicles were managed by GSA, it will conservatively save agencies $120 million a year. There’s a possibility that the savings could actually be far more than that,” she said. “We’re now studying the next round of agencies. But now that we have data, the conversation that we have with the agencies becomes one of what’s the process for transitioning fleet? And, how do we work with OMB, how do we work with the acquisition services fund, and how do we make sure we do this in a responsible way so that GSA can take over management of the fleet? And in some cases, it also is giving us the opportunity to reduce the size of the fleet, which is another area that’s definitely a win for taxpayers.”

Murphy said it’s a matter of expanding the fleet management services GSA already provides and helping to show agencies that by giving up this capability would mean a more standard, stable and predictable service.

The biggest area where GSA is using data to make better decisions is in the Federal Acquisition Service.

Murphy said the qualitative and quantitative data shows GSA is heading in the right direction.

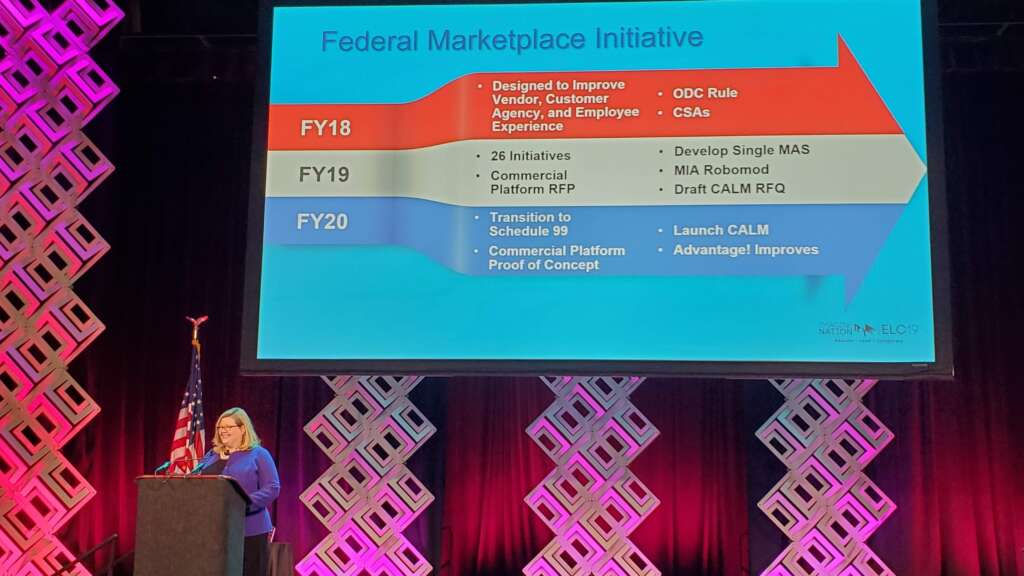

“What I’ve been looking at are the customer satisfaction scores have gone up, our vendor satisfaction scores have gone up and our employee satisfaction scores have gone up when we launched the Federal Marketplace initiative,” she said. “Those are the three areas where we’re looking to really target how do we make things easier for vendors who are trying to sell using GSA vehicles.”

On the quantitative side, Murphy said GSA’s acquisition vehicles, including the schedules and government-wide acquisition contracts, saw a record year of $68 billion in sales. This was a 23% increase over 2017. And because revenues increased, Murphy said GSA expects to spend as much as $150 million from the Acquisition Services Fund on FAS system modernization this year.

“I think that the fact that the dollars are going up and that our vehicles are being so well used is a good sign that our customers and our vendors are happy with the work we’re doing,” she said. “I think that there’s still a lot of room for improvement. One of the things that I track is addressable spend so how much could GSA do for them? How much is GSA currently doing for them? What’s the barrier to entry? And, it’s a conversation I try to have with my peers on a regular basis because they are our customers. I want them to be happy.”

She said the modernization efforts, such as schedule consolidation and the effort to make it easier to do business with FAS is driving the customer satisfaction improvements.

“The one-bid numbers are going down. Our competition numbers for those that are eligible for competition are strong. If you look across, I think one of the advantages also of having a unified schedule is that it means that more vendors will be able to bid and we’ll actually have more transparency,” she said. “Previously, you only got a notification through e-Buy, for example, if you’re on that schedule. Now, all schedule holders will have access to that.”

Despite the record sales and the fact that customers are as happy as ever, GSA has no immediate plans to lower the fees charged to use the schedule or its GWACs.

But Murphy said the agency continues to study the fee structure and see how they can rationalize the fees.

“I’ve asked for a proposal on what that will look like. I don’t think we are ready to move forward at this point in time, but it’s always on my mind,” she said. “When I say sales going through schedules are up and FAS is in a healthy financial position, I mean that FAS did more than break even. It’s been many years since FAS even broke even. They weren’t scheduled to break even until next year.”

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Exclusive

Exclusive