Adding more FEHB options may not lower health care costs, GAO says

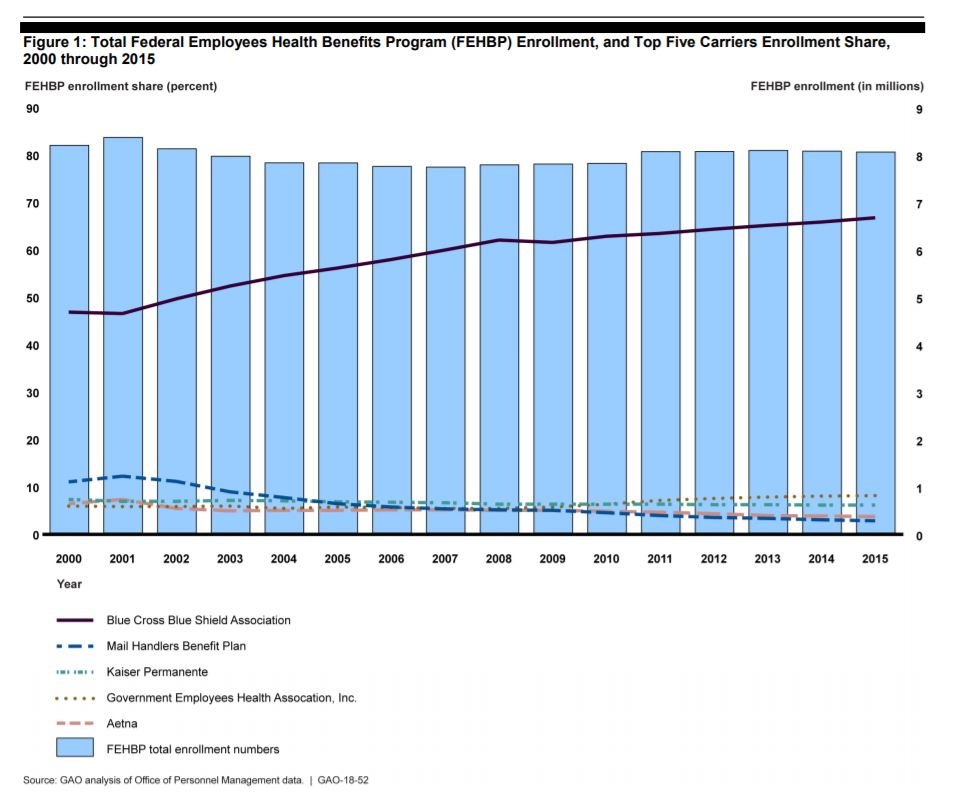

Nearly two-thirds of participants in the Federal Employees Health Benefits Program were enrolled in one of the two Blue Cross Blue Shield Association...

Subscribe to Federal Drive’s daily audio interviews on iTunes or PodcastOne.

Few participants in the Federal Employees Health Benefits Program (FEHBP) change health plans during any given year, and it may be their inaction that is — partly — preventing the program from evolving and growing in the future.

The Office of Personnel Management has long asked for the authority to add more plans to the FEHBP, arguing that more options would create more competition and lower prices for participants.

But the Government Accountability Office says it’s still unclear whether giving OPM greater authority to contract with more insurance carriers would change the federal health insurance program for the better.

Yet even if OPM did contract with more carriers, it’s unclear if FEHB participants would take advantage of more options. Currently, most federal employees and annuitants remain enrolled in plans with a handful of insurance carriers even though a majority of participants have more FEHBP options now than before.

According to OPM, 5-to-7 percent of FEHB participants change health plans during any given year.

And in 99 percent of counties across the country, enrollees had more plan options in 2015 than 2007. For example, the median number of FEHB plans in any given county in the U.S. increased from 19 in 2007 to 25 in 2015, GAO said.

Generally, all enrollees have access to a handful of nationwide fee-for-service plans, but participants in some areas of the country have access to more health maintenance organization (HMO) options than enrollees in other parts of the U.S.

Yet by far, the top three FEHBP carriers have a significant share of the federal employee health market, and that share has been growing.

“Almost 90 percent of counties experienced an increase in the market share held by the largest carrier,” GAO said. “Over this period, the percentage of counties in which the largest carrier held at least half of the market also increased — from 70 percent in 2000 to 93 percent in 2015.”

Two-thirds of FEHB participants were enrolled in one of the two Blue Cross Blue Shield Association fee-for-service plans as of 2015, GAO said.

A majority of the 10 stakeholders GAO interviewed, which included federal employee and retiree organizations and FEHBP carriers and subject matter experts, said OPM should have a greater contracting authority.

But a majority of those seven say expanding FEHBP plan types would have both positive and negative impacts.

“Several of these stakeholders said that adding more plans to FEHBP would exacerbate an existing problem of choice overload for enrollees,” GAO said. “One of the stakeholders said that FEHBP enrollees are already confused by the number of available plan offerings, and that the current information provided to enrollees does not allow for easy comparison of their choices. They noted that additional expansion of offerings will only complicate enrollees’ plan analysis.”

Additional studies have found similar results. A 2016 report from the RAND Corporation found that health insurance consumers are less likely to explore other options and change plans if other choices become available.

Giving OPM greater authority may allow the agency the opportunity to offer different types of health plans, such as value-based plan designs and accountable care organizations.

“One stakeholder also told us that OPM’s expanded authority would enable the agency to improve transparency by allowing plans to contract with OPM as the type of plan they actually are, rather than fitting into outdated statutorily established categories, which the stakeholder characterized as an ‘antiquated labeling system,'” GAO said. “Another stakeholder said that participation by new plans in the FEHBP would foster competition and keep health plan costs down.”

Yet some said the current nature of the FEHBP may prevent OPM from fully reaping the benefits of having more health plan options.

For example, some said the current formula set under law that determines the share that the government and the enrollee pays toward FEHBP premiums each year limits competition.

One stakeholder also told GAO that more plan options may increase OPM’s administrative costs.

At the same time, GAO found significantly different estimates for the financial impacts of expanding OPM contracting authority.

The president’s fiscal 2017 budget request, for example, estimated that adding different plan types to the FEHBP would save $88 million between 2017 and 2026.

“OPM officials told us that these savings were based on a number of assumptions, including an estimate of the number of enrollees that will migrate to new types based on previous FEHBP experience and projecting a medical loss ratio of 90 percent for the new plan types added to FEHBP,” GAO said. “However, in follow-up with the agency, OPM officials were not able to provide us with more detailed information about how these savings were calculated.”

The Congressional Budget Office estimates, however, ranged from $50 million in savings to $50 million in costs over 10 years.

A 2014 study from the Center for Health and Economy, which reviewed the impacts of introducing regional “preferred provider organizations” (PPOs) to the FEHBP, projected cost savings from $1.2 to $2.1 billion between 2015 and 2021.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED