How many feds does it take to …

The health insurance hunting season begins next month. This year for the first time, feds, postals and retirees will have a third option. In addition to being able...

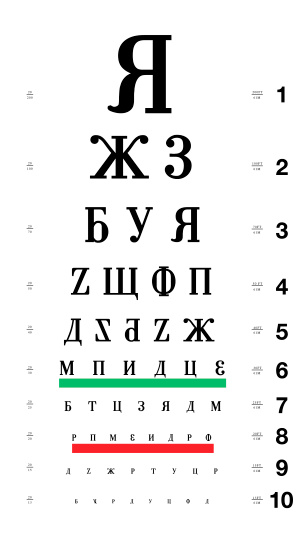

There are two sure-fire ways to confuse and panic current and retired federal workers. Force them to take their next driver’s license eye test using a chart with Russian letters, or tell them to find the best health plan from more than 40 bewildering choices, options, benefit levels and varying premiums — especially premiums.

The health insurance hunting season begins next month. This year for the first time, feds, postals and retirees will have a third option. In addition to being able to buy self-only or family coverage, people can also elect to buy self-plus-one (S+1) coverage. A family of two can save a little — in some cases very little — by going the S+1 route.

What the new (long-sought) S+1 option means is that tens of thousands of people have even more choices and decisions to make.

Although anybody in the program can change plans during the November-December open season, only about six of every 100 do so. Most stay in the same plan year after year, even if benefits change and premiums go up.

Many find it intimidating to shop among the many options and price levels. A growing number of federal agencies have tried to make it easier for workers. They subscribe to Washington Consumers’ CHECKBOOK software guide for health plans. Workers can access it at the office or home, and use it to narrow down plans based on their age, family status, health and price range.

While that’s a giant (and generous for the government) leap forward, many still find shopping a mini-nightmare. The “average” 7.4 percent indivdiual premium increase means little, because it is an average. For example one plan (the APWU high option family plan) is going up $69.37 per pay period for employees, and $150.30 monthly for retirees. By contrast the nationwide mail handlers plan (MHBP) will cut its standard family option $63.15 per pay period for employees, and reduce retiree premiums by $136.83. Averages can be very confusing because they cover such a broad range.

Many retirees are confused when they compare premiums because the chart makes it appear that retirees pay more. Not true. Active and retired feds pay the same premiums in the same plans. But on a different cycle. Working feds pay biweekly while retirees pay monthly,

Several readers commented on the apparent differences in premiums: Bob M. from the Social Security Administration said: “When I read your report … I was a little surprised to see the following. I thought retirees paid the same premiums as workers. When did this happen? Do retirees still pay the same as if they are still working?”

Common mistake, easy to make. Example: non-postal federal workers in the popular Blue Cross-Blue Shield standard plan next year will pay $238.24 biweekly for self and family coverage. Retirees in the same plan with the same option will pay $516.18 per month. It works out to the same premium for both groups on an annual basis. But it sure looks different (and confusing) on the chart!

During the open season we’ll try to help you through the confusing choices by having experts give advice and by answering your questions. It’s not rocket science, but picking the best plan for you could save you lots of money in 2016.

Feds Helping Feds: During the 2013 shutdown thousands of feds got emergency no-interest loans from the Federal Employee Education and Assistance Fund. It’s a feds-helping-feds charity (part of the CFC) that gets lots of generous corporate help. With another shutdown possible in December you should know about FEEA. Today’s Your Turn guest is Steve Bauer, the long-time executive director of FEEA. He’ll explain how it works and how it might help you. Or you help it!

Nearly Useless Factoid:

The ashes of Fredric Baur, the man who came up with the Pringles can design, are buried inside one of the iconic containers.

Source: Time

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED