Like floating on a cloud — 2017 TSP review

Timing the stock market, like breaking even in Atlantic City or Vegas, isn't easy. To properly time the market you need to know when to buy and when to sell, and to...

Timing the stock market—knowing when to buy and when to sell—is an art , not a science. It works in theory (especially in hindsight) more often than in practice. Did you predict the mistaken missile alert in Hawaii would happen and, if so, how the market would react to it?

Today’s guest on our Your Turn radio show (10 a.m. EST) is Arthur Stein. He’s a CFP in the Washington area. Many of his clients are active or retired feds. A couple are self-made TSP millionaires. Stein is going to review how the TSP did in 2017 and offer tips on what you should and should not be doing. He suggested the “Like Floating on a Cloud’ headline. Here’s his introduction for today’s show:

“Ah, floating on a cloud. Gradually going higher without many bumps. Like the TSP funds in 2017.”

“At the beginning of 2017, a common view among market commentators was that the stock market would not repeat the strong returns in 2016. Problems mentioned included political turmoil in the US, Brexit, conflicts in the Middle East, North Korea’s weapons buildup, Chinese debt, etc.”

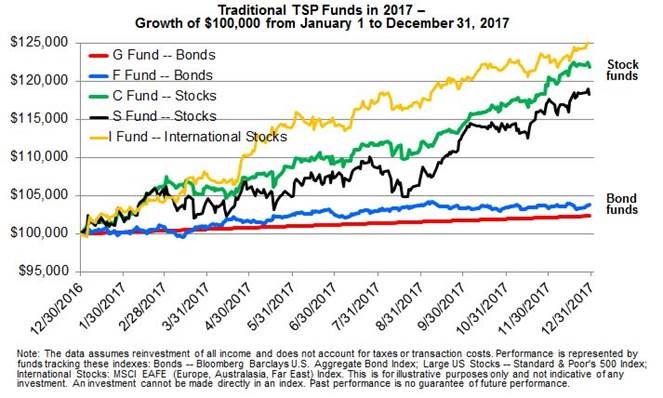

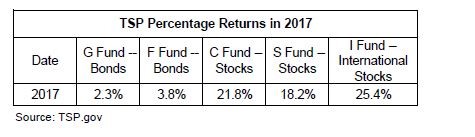

“But global stock markets defied predictions, even though those problems persisted. Major stock indices in the US and other countries posted strong returns for the year. Stock market volatility was at historic lows. The TSP Funds reflected this.”

“Important trends included:

- Solid returns for US stock Funds (C and S) but even better returns for the International Fund (I);

- Positive returns for bond Funds (F and G);

- Historically low volatility for US stocks;

- Little reaction by US stock markets to political and economic uncertainties;

- Continuing growth in the US and international economies;

- Faster than expected growth in corporate earnings; and

- Continued low interest rates and low inflation.”

“Returns were excellent for all the TSP stock funds. The I (international) fund outperformed all TSP funds; its first good year since 2013.”

“The not-so-good news is that stock markets are overdue for major and even minor stock declines. Based upon historical averages, the stock market declined 5 percent three times per year and more than 20 percent every 3.5 years. Currently, there has been no 5 percent decline in more than a year and no 20 percent or greater decline in almost nine years.”

“Bond prices are also at historic highs and have been for some time. That is why interest rates are low. If (or when) bond prices drop, the F (but not the G) Fund will decrease in value.”

“Past performance is no guarantee of future performance. The stock and bond markets could begin declining tomorrow or not for years into the future. We don’t know.”

“My approach is to deal with what has happened and not what I or market commentators think will happen. Attempting to predict markets requires investors to not only accurately forecast future events but also predict how markets will react to those events.”

“Market timing (selling in advance of a market decline and buying back in before stocks recover) requires two difficult forecasts: when is the market going to decline and when will it start going back up. No forecaster has a consistently good record predicting either event. It also requires the nerves to buy stocks when the market is crashing and other investors are selling.”

“Therefore, I use diversification and discipline rather than predictions and market timing. Instead of making predictions about future events, I help my investment clients choose an allocation between stocks and bonds and maintain it.”

“‘Maintain,’ as in:

• Selling stock investments (individual stocks, mutual funds and ETFs) when prices are so high that the stock/bond allocation is overweight stocks. Then use the proceeds to buy bond investments.

• When stocks decline to the point that the allocation is underweight stocks, sell bond investments and use the proceeds to buy stocks.”

“That means selling high and buying low. Sounds like a reasonable strategy to me.”

Arthur Stein, CFP®

Nearly Useless Factoid

Dr. Seuss wrote “Green Eggs and Ham” on a bet that he couldn’t write a book with fifty or fewer distinct words.

Source: Snopes.com

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED