From janitor to TSP millionaire

How do you go from being a janitor at the Veterans Affairs Department to one of the growing number of millionaires in Uncle Sam's TSP 401(k) plan club?

Thanks to the booming stock market, the miracle of compounding and a steady-as-she-goes investing plan, the number of federal workers and retirees with $1 million-plus Thrift Savings Plan accounts is rapidly expanding.

Except for a relatively small number of political appointees (many successful lawyers named federal judges) most of the millionaires are rank-and-file civil servants who did it the old-fashioned way. They invested from day one, took advantage of the government’s generous 5 percent match and stuck with the C and S stock funds through good times and bad. They didn’t flinch during the Great Recession and kept on buying the C and S funds when they were on sale.

One of the newest members of the Millionaires Club started out as a janitor at the Veterans Administration, spent 10 years in the Marine Corps and for the last 35-plus years has been a senior counsel at a federal agency. Here’s how he did it:

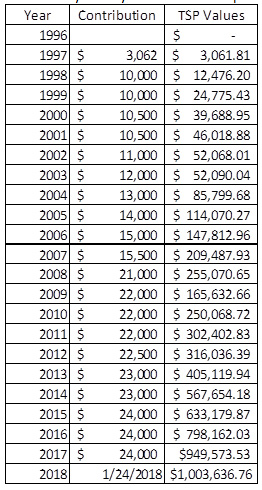

”You often discuss how government employees can become a millionaire in the Thrift Savings Plan. Below is how it worked for me. I think it is important to see a table like this. I was prior Marine Corps and then became a civil servant of the federal government in November 1996. I was ineligible for the TSP when I was in the Marine Corps. Federal employees were prohibited from making a TSP contribution during their first 12 months of federal employment in 1996-97. In November of 1997, I was finally eligible and started contributing to the TSP. I made the maximum allowable contribution every year. It was tough many years to make those contributions, especially with two children in college at the same time. I never took a loan or pulled any money out of the TSP.

“My total contributions to the TSP for the last 20 years and 2 months totaled $352,062. That is an average of about $17,600 per year. And as of today, my TSP account is worth over $1 million today ($1,003,636.76)! The average TSP millionaire takes 28 years to break $1 million. I did it in just 20 years and 2 months. I am feeling pretty good about that. I know it is hard to invest heavily for your future, but every person must do it. Scrimp and save everywhere you can. Have no shame in saving money because it is a worthy goal that will pay off. It also shows your children that they do not need to be instantly gratified with a new purchase when the old version is still working fine. Learn to cook and don’t go out drinking.

“It gets even harder to invest when you look at the below table showing the value of my account over the years. Note that for four years from 2000-03, I was investing over $10,000 a year. Yet, while investing $44,000, my account balance only went up $13,000. Those were tough years, but I kept putting the same amount into the TSP. Then in 2009, I lost over $90,000 of my account value while contributing $22,000 for a total loss that year of $112,000. I lost money in 2012 too, but then I also had some great years. Actually, I have had some astounding years. I always invest in the C, S, and I funds, because I know that without risk there will be no rewards.

“And so on Jan. 24, 2018, my TSP account was worth $1,003,636.76. I encourage every federal employee to maximize their TSP contributions. I hope to continue to contribute until I retire and I don’t want to take out any money until forced to. I plan to live on my pension and to work if my pension is not enough.” — Semper Fi

Nearly Useless Factoid

The surface area of a 12-inch pizza is 113.09733552923255 inches.

Source: Pizza Area Calculator

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED