Thanks to years of enforced belt-tightening at the Internal Revenue Service, life is getting less stressful for folks who are seriously tired of helping foot th...

Thanks to years of enforced belt-tightening at the Internal Revenue Service, life is getting less stressful for folks who are seriously tired of helping foot the bill for things like the military, national parks, food stamps, deep space probes and food safety inspection.

New data from the from the IRS shows that the audit rate, which has been in steady decline for years, was down again in 2018. The agency audited just over 892,000 individual tax returns during the fiscal year, a slight decrease from 2017. IRS says that of the nearly one million returns examined, about 22,000 taxpayers disagreed with the IRS. At the same time, additional refunds were made to about 30,000 taxpayers, giving them a surprise $6 billion in refunds. While the agency budget was increased in 2019, it is down from its 2010 level.

IRS managers say the strain on employees is increasing each year as fewer workers handle more returns from millions more filers. When most people think of audits they tend to picture wall street types, maybe silicon valley types, politicians or New York real estate tycoons, but according to CBS, people in poor rural areas in the south get the most attention. It said Humphreys County, Mississippi, median income $24,000 per year, is the most audited place. That, it said, is because so many low-income people claimed the Earned Income Tax Credit.

For the numbers checkout this piece about the IRS Data Book, which is assembled by its Statistics of Income Division:

By: Michael Cohn — Published: May 20 2019

The Internal Revenue Service’s audit rate went down again in 2018, according to data released Monday by the IRS.

The IRS Data Book for 2018 showed that compared to 2017, there were fewer audits during fiscal year 2018, from Oct. 1, 2017 to Sept. 30, 2018. The IRS audited more than 892,000 individual income tax returns during the fiscal year, down slightly from the previous year. The IRS audited 0.6% of all individual tax returns filed in calendar year 2017, and 0.9 % of corporate income tax returns, not counting S corp returns. The majority of fiscal year 2018 audits, 74.8%, were conducted by correspondence. The other 25.2% were conducted in the field. Of the nearly 1 million examinations of tax returns, more than 22,000 taxpayers didn’t agree with the IRS examiner’s determination, totaling an unagreed recommended additional tax of almost $10.2 billion.

On the other hand, of the nearly 1 million examinations of tax returns, almost 30,000 resulted in additional refunds to the taxpayer, totaling more than $6 billion. The IRS also examined 15,562 tax-exempt organization, employee retirement plan, government entity, tax-exempt bond, and related taxable returns in fiscal 2018.

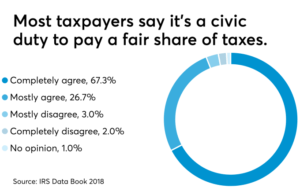

The IRS Data Book also includes information on a wide array of other subjects, such as tax returns, refunds, examinations and appeals. It comes with charts depicting changes in IRS enforcement activities, taxpayer assistance, tax-exempt activities, legal support work and IRS budget and workforce levels compared to fiscal year 2017 and previous years. Also included this year is a section on taxpayer attitudes from a long-running opinion survey. The survey indicated that most taxpayers continued to agree it’s not at all acceptable to cheat on their income taxes. This attitude has remained within a four-point range since 2009. Most taxpayers are still satisfied with their personal interactions with the IRS. Nearly half of the taxpayers who responded to the survey last year agreed that service and enforcement are properly balanced.

“Underlying the numbers in this year’s edition of the Data Book is the hard work of IRS employees,” said IRS Commissioner Chuck Rettig in a statement. “Our employees are the backbone of this agency, delivering our mission efficiently and effectively. They work hard to help taxpayers, and the numbers outlined in the Data Book reflect their commitment.”

Over the course of the fiscal year, the IRS collected nearly $3.5 trillion, processed more than 250 million tax returns and other forms, and issued over 120 million individual income tax refunds totaling almost $395 billion.

The IRS received and processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns; those filings declined slightly less than 1% compared to the prior year. However, filings by pass-through entities were up in fiscal year 2018. While partnerships filed nearly 5% more forms with the IRS in FY 2018 than in the prior year, S corporation filings were up almost 6% in the same time frame.

The IRS offered taxpayer assistance through over a half-billion visits to IRS.gov and helped more than 64.8 million taxpayers through various service channels, including correspondence, toll-free telephone helplines or at Taxpayer Assistance Centers. There were also more than 309 million inquiries to the “Where’s My Refund?” application, up 11% compared to the prior year.

Net revenue from delinquent collection activities rose to just over $40 billion, an increase of 1.6% compared to the prior year. IRS levies were up 8.3% compared to the previous year, but the IRS filed about 8% fewer liens than in fiscal 2017.

By Alazar Moges

With summer approaching, we are all going to be doing more swatting at mosquitoes, or itching if our defense wasn’t good enough. But did you know that only female mosquitoes bite people. They use the protein from our blood to develop their eggs. Male mosquitoes on the other hand, feed only on flower nectar.

Source: Library of Congress

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED