Outliving your TSP nest egg! What are the odds?

The TSP option is a nice but not absolutely essential thing to have for those under the more generous CSRS retirement program with its higher benefit and full...

Sobering thought: For most people who have or will retire from the government, the Thrift Savings Plan will provide anywhere from one-third to half of the money they have to spend for the rest of their lives. At least that’s what Congress estimated when it setup the 3-legged Federal Employees Retirement System (FERS) plan with its reduced civil service annuity, Social Security and the voluntary —but very necessary— Thrift Savings Plan option.

The TSP option is a nice, but not absolutely essential, thing to have for those under the more generous Civil Service Retirement System (CSRS) program with its higher benefit and full protection from inflation. But for people under the FERS plan, the TSP is a no brainer. Either contribute, at least enough to get the government match, for your full career or cultivate a taste for cat food cutlets in your golden years.

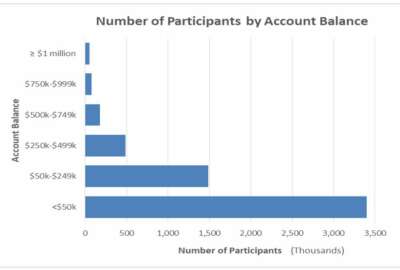

Most feds are contributing to the TSP, which is smart. Most who are under FERS are eligible to get some or all of the government match, which is a huge perk. Most are doing that. But for those who aren’t, retirement may be a problem. As in when they can retire and what they will be able to afford for the 10, 20 or 30 years of retirement. But in addition to not contributing more to the TSP, many workers are doing two things that may, and almost certainly will, haunt them financially when they retire.

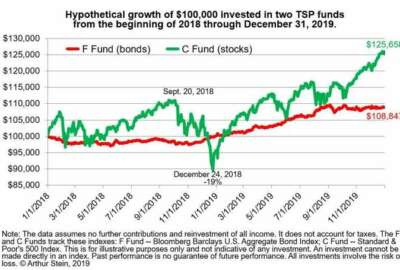

While it once had a good rate of return, the G-fund has slipped. Most years it has been far out-performed by the stock indexed C, S and I funds, and also the bond-index F fund. Meaning people exclusively in the G-fund could lose buying power. If they live long enough! Example:

One potential major mistake is not taking into account the impact of inflation over time. That’s not a major issue for the majority of current retirees, who are mostly under the old CSRS program. But it is a major standard-of-living issue for the majority of people who are still working for Uncle Sam. They will retire under the less generous FERS program which does not guarantee a full annual adjustment with inflation. That’s not a big deal when inflation is low, like now.

But how long can that last? Over the last decade, it averaged just 1.4% a year. Living costs in the future — as measured by the Consumer Price Index-W — could double in coming years. Approaching the recent norm of 4%. While CSRS retirees get full cost of living adjustments regardless of their size, FERS retirees with smaller annuities are under a diet-COLA system. This year both groups got a 1.6% COLA. But had the rate of inflation been 2.6% or 3.8%, the FERS retirees would have gotten only 2 or 3% respectively.

The exact amount of the 2021 COLA won’t be known until October of this year. That’s when the government compares the rise in the CPI-W for the third quarter (July, August, September) of this year, over the same period in 2019.

With months to go in the countdown, when inflation could also turn to deflation, the nonpartisan Senior Citizens League estimates the 2021 COLA, for Social Security and federal retirees, will be 1.5%. Slightly less than the 2020 COLA. But if it goes higher, and goes over 2% annually in the future, FERS retirees will suffer.

The second factor for current and future FERS retirees is when they start withdrawing from their TSP account and how long that account will last in retirement. Also, very important, how much they withdraw each year. Somebody who plans to retire early, say 60, under FERS and immediately begins withdrawing 10% a year, could run out of money, especially if it Is all in the G-fund. Financial planner Arthur Stein talked about it on Wednesday’s Your Turn radio show. He advised the woman who was planning to retire at 60 and take 10% a year not to retire. For a long time. It’s not “safe” he says to be exclusively or mostly in a low-growth fund that doesn’t take into account inflation. To listen to that, click here.

To look at the 21st century history of COLAs (CSRS/Social Security and FERS) checkout this chart from My Federal Retirement:

| Federal Retiree COLA History | ||

| Year | CSRS COLA | FERS COLA |

| 2019 | 2.8 | 2.0 |

| 2018 | 2.0 | 2.0 |

| 2017 | 0.3 | 0.3 |

| 2016 | 0 | 0 |

| 2015 | 1.7 | 1.7 |

| 2014 | 1.5 | 1.5 |

| 2013 | 1.7 | 1.7 |

| 2012 | 3.6 | 2.6 |

| 2011 | 0 | 0 |

| 2010 | 0 | 0 |

| 2009 | 5.8 | 4.8 |

| 2008 | 2.3 | 2.0 |

| 2007 | 3.3 | 2.3 |

| 2006 | 4.1 | 3.1 |

| 2005 | 2.7 | 2.0 |

| 2004 | 2.1 | 2.0 |

| 2003 | 1.4 | 1.4 |

| 2002 | 2.6 | 2.0 |

| 2001 | 3.5 | 2.5 |

| 2000 | 2.4 | 2.0 |

Imagine how much less FERS retirees would have received over time if inflation had been closer to its normal 4% level. Note: they did get less in years when the COLA and rate of inflation exceeded 2%. Over time that negative compounding can eat into your nest egg.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED