TSP thermometer: 2018 bad, 2019 good, 2020?

The S and I funds of the TSP had bad years in 2018 but bounced back big time last year. Mike Causey asked financial planner Arthur Stein why?

Stock markets, like people and wine, have good years and not-so-good years. Investors who try to buy low and sell high don’t have very good track records. But people try.

Take 2018, please! That year the C fund, which tracks the S&P 500 was down 4.4%. But investors who continued to buy shares got a pleasant surprise in 2019 when the C fund was up 31.5%. The story was the same for the S fund (small cap) and I fund (international stock index), which also had bad years in 2018 but bounced back big time — 28% and 22.5% last year, respectively. That means something, but what?

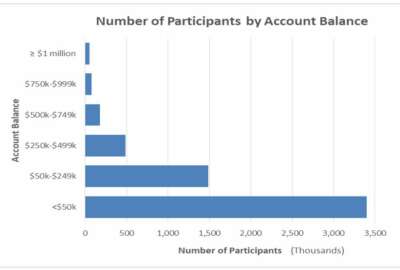

We asked Washington, D.C., area financial planner Arthur Stein for his take. He has several self-made Thrift Savings Plan millionaires among his clients. He’ll be my guest on today’s Your Turn show at 10 a.m. EST. You can listen at www.federalnewsnetwork.com or on 1500 AM in the D.C. metro area. The show will also be archived on our home page so you or a friend can listen later. If you have questions for Art Stein send them to mcausey@federalnewsnetwork.com before showtime. Meanwhile, he has this excellent example of good years and not so good years for TSP investors:

The yin and yang of TSP investing

Ying and yang, good and bad — TSP investors saw both over the last two years.

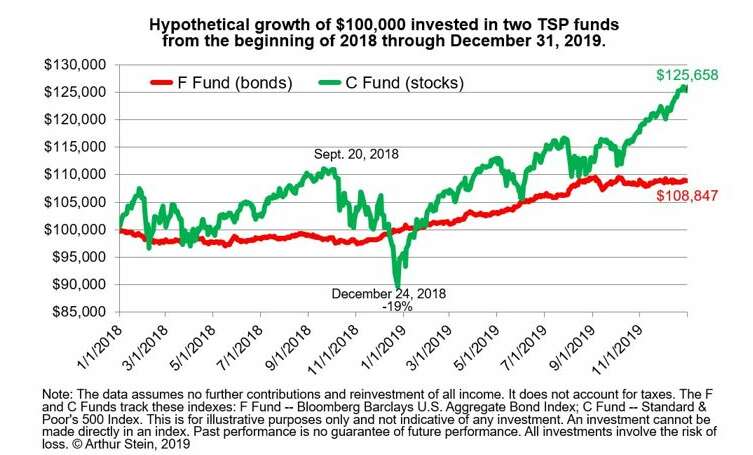

The bad news was 2018. The three stock funds declined and the F fund (bonds) was barely positive. The G fund outperformed the other four.

Not only were returns bad in 2018 but volatility was higher than 2019. For example, stock prices plunged between Sept. 20 and Dec. 24, 2018. The C fund had declined 19% by Dec. 24 — not a Merry Christmas.

The good news was 2019. TSP investors who did not withdraw from the stock funds in 2018 were rewarded. The 2019 returns for F, C, S and I were high enough to produce excellent returns over the last two years. During the two-year period, the C fund increased over 25%, the S fund 16% and the I fund 6%.

This is an example of the advantages and disadvantages of investing in stocks and bonds, including stock funds and bond funds. Historically, stocks were a good long-term investment but often a poor short-term investment. But over the last three, five and 10 years the stock funds outperformed.

Nearly Useless Factoid

By Amelia Brust

Long before fast food restaurants needed them for sides of mac ‘n cheese or coleslaw, the spork was patented by Samuel W. Francis nearly 150 years ago today. He came from an upper class background and thought there were one too many utensils on the dinner table. But the name “spork” was trademarked by Hyde W. Ballard in 1951.

Source: Vox

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED

Related Stories