Even in hot stock market TSP investors love super-cool G fund

Despite high returns for the TSP’s stock index funds last year, a majority of federal workers have most of their nest egg money in the G fund.

Despite 20-30-plus-percent returns for the TSP’s C, S and I stock index funds last year, a slight majority of federal workers investing for retirement have most of their optional retirement nest egg money in the super-safe, Treasury securities G fund.

The C fund, which tracks the S&P 500 index, returned 31.45% in 2019. The small cap S fund return was 27.97% and the international stock index I fund was up 27.97%. The F fund (bonds) return was 8.68% while the popular G fund returned 2.24% in calendar 2019.

As of Dec. 31, 2019, the TSP total value was $632.6 billion.

The ups and downs of the stock market are reason so many investors go with the G fund, which never has a loss or big gains. The record long bull market — 10-plus years without a correction of 20% — can cause investor heartburn for people who track changes and try to guess where events, like the current Coronavirus situation, will take the markets. Some investors consider a stock market downturn as a time to buy because stocks, if and when they go up, are on sale. Others believe in retreating to a “safe” investment like the G fund during a downturn, while they wait for the markets to rise. Some who did that in 2008-2009 to ride out the Great Recession still haven’t returned to the stock market.

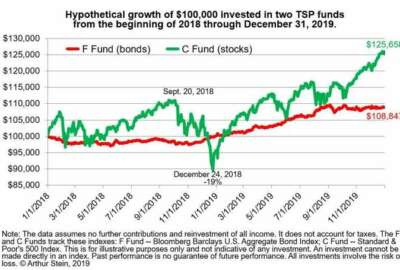

In 2018 the C fund was down 4.4%, the S fund was down 9.3% and the I fund was down 13.4%. The bond F fund was up 0.2% while the G fund was up 2.9%. Stocks took a nose-dive from Sept. 20 to Dec. 24, 2018, and the C fund was down 19% by Christmas Eve — almost at the magic 20% level which signals major downward correction. To compare 2018 and 2019 and hear financial planner Arthur Stein’s thoughts, click here.

As of Dec. 31, 2019, the G fund annualized return was 2.24% for one year; 2.49% over three years; 2.27% for five years and 2.23% over a 10-year period. The C fund’s one-year return was 31.45%; for three years it was 15.25%; for five years it was 11.71%; and over a 10-year period it was 13.59%.

Over the same time periods the S fund (small cap stocks) return was 27.97% for one year; 10.97% for three years; 8.84% for five years and 12.72% over 10 years.

Among the popular self-adjusting Lifecycle funds the L-income’s — with the smallest percentage of stocks and largest investment in treasury securities and bonds — return was 7.60% last year. The L-2030 fund return was 17.60% and the L-2050 returned 23.33% in 2018.

Nearly Useless Factoid

By Amelia Brust

The first African-American woman to enlist in the U.S. Army was Cathay Williams. She was born to an enslaved mother and free father in Missouri in 1844 and worked as a slave until 1861 when Union forces occupied her city. She was 22 when she joined the U.S. Regular Army, posing as a man with the alias William Cathay. Her sex was discovered after several hospitalizations and she was honorably discharged in 1868. But soon after she joined the all-black Buffalo Soldiers regiment. After the army she moved to Colorado and married, but when her husband stole her money and horses she had him arrested. Her story was first published nationally in 1876 but despite a precedent of giving military pensions to women who had served, she was denied her disability compensation and died likely around 1893.

Source: National Park Service

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED