How long will you live? How’s your cash flow?

For many people nearing retirement, running out of money is one of the top fears. Unless they work for the federal government.

For many people nearing retirement, running out of money is one of the top fears. Unless they work for the federal government.

With the Federal Employees Retirement System annuity, Social Security and cost of living adjustments the fear of running out of money is not a major worry for federal and postal workers. But does your retirement plan include maybe 20 or 30 years of doing things, needing things, without that regular paycheck every two weeks?

On today’s Your Turn radio show financial planner Arthur Stein talks about planning for what could be a very lengthy retirement. You may be retired for as long as you worked — think about that. You can listen at 10 a.m. EDT at www.federalnewsnetwork.com or in the Washington, D.C., area at 1500 AM. If you have questions for Art please send them before showtime to me at mcausey@federalnewsnetwork.com. Until then, here’s a column he wrote for the show:

Don’t Make This Retirement Planning Mistake

The biggest financial risk for federal retirees is not running of money — retired feds will always have their annuities plus Social Security for FERS retirees.

The biggest risk is exhausting their Thrift Savings Plans and other investments. When expenses exceed annuity plus Social Security payments, retirees are forced to withdraw from investments to pay the difference. These investment withdrawals need to last as long as the retiree is alive. If investments are exhausted, then investment income stops and expenditures must be reduced to whatever is received from annuity plus Social Security.

Because longer retirements are more expensive, life expectancy is one of the most important assumptions for retirement planning. A long, healthy life is usually a personal goal but, ironically, it is also a financial risk. The longer retirees live, the greater the chance that they will exhaust investments while retired.

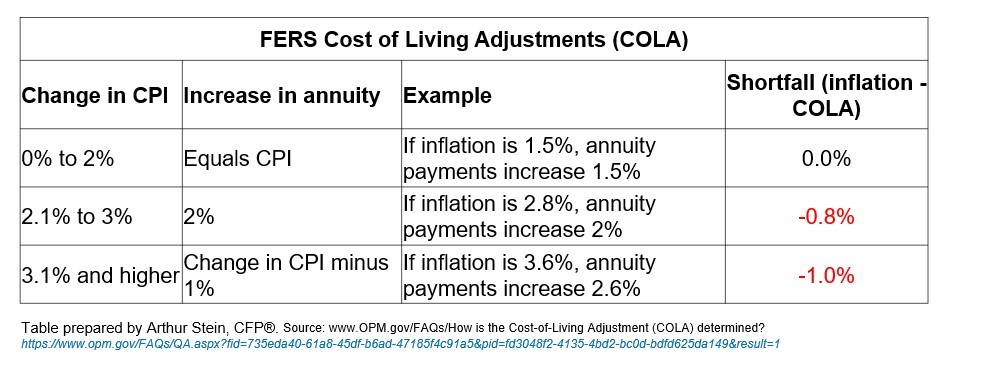

FERS retirees are likely to need investment income to supplement their annuities (pensions). One reason is that the FERS cost of living adjustment does not maintain purchasing power when inflation exceeds 2% ( a “diet COLA”).

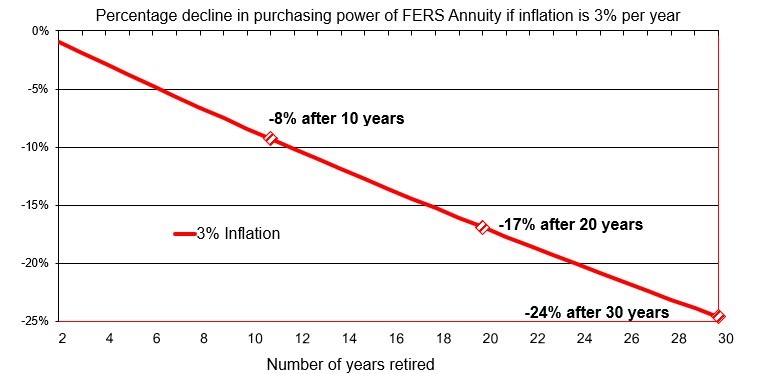

The loss of purchasing power compounds over time, becoming increasingly significant during long retirements.

Don’t underestimate how long your retirement might last. No one knows how long they will live but everyone needs to make an assumption for planning purposes. There are two reasons that cause us to underestimate potential lifespans

- Relying on averages

- Ignoring demographic differences in lifespans.

According to the Social Security Administration, the average life expectancy for a 65-year-old male is 84 and for a 65-year-old female 86.5. But it does not make sense for a 65-year-old to plan to live until their mid-80s. Average means that half of 65-year-olds live longer — that is how averages work.

According to the Social Security website, “About one out of every three 65-year-olds today will live past age 90, and about one out of seven will live past age 95.”

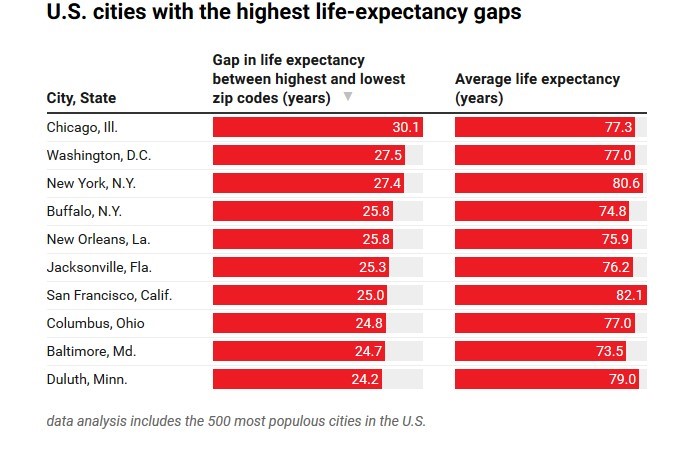

The second reason is that the national life expectancy averages ignore the large differences related to neighborhood, lifestyle, income, and other factors.

For instance, a study by City Health Dashboard, a collaboration between New York University School of Medicine, New York University Robert F. Wagner School of Public Service and the National Resource Network, found astonishing differences in average lifespans by zip codes in the same cities. In Chicago, the largest difference between zip codes is 30-years! In Washington, D.C., the largest difference between zip codes is 27.5 years.

The source for the above illustration is a Time magazine article by Jamie Ducharme and Elijah Wolfson, June 17, 2019. According to the article, differences caused by location include exposure to air pollution and toxins and reduced accessibility to healthy food, green space and medical care.

Usually this comes down to income. People reside in less healthy neighborhoods because they cannot afford better neighborhoods. And there are many other health-related items that the poor may not be able to afford: Medicare supplemental coverage, out of pocket expenses for health care and prescriptions drugs, gyms, hobbies, trainers, therapists, vacations, earlier retirements, etc.

Lifestyle also makes a difference. Smokers and the obese have shorter average lifespans, as do heavy drinkers. Exercise increases your potential lifespan.

If you would like to estimate how much your potential lifespan is affected by these factors, go to LivingTo100.com.

In my opinion, the average Federal retiree needs to plan for a much longer than average lifespan because they are unlikely to be poor: They have guaranteed lifetime income (annuity and Social Security for FERS) with a cost of living adjustment, subsidized health insurance and, hopefully, significant amounts of investments in the TSP. They can more easily afford healthier neighborhoods and lifestyles and better medical care.

Which means that they are more likely to exhaust investments during a longer retirement and become impoverished, despite their guaranteed income.

Nearly Useless Factoid

By Amelia Brust

Mr. Monopoly, the mascot of Hasbro’s boardgame, was originally named Milburn Pennybags and at one point had a wife named Madge. His name was changed when Hasbro bought Parker Brothers.

Source: MentalFloss

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED