The year 2020: So what happened again?

Lots of lessons can be learned from last year that can help you make better decisions for your financial outlook in 2021 and beyond.

It’s only a matter of time before somebody writes a book or does a TV interview saying he or she predicted most of the events of 2020 well in advance. To qualify as visionary of the century this combination of Nostradamus, Pinocchio and your favorite tarot card reader would have had to go on record as saying 2020 would mean:

- That there would be a once in a lifetime worldwide pandemic.

- That vaccines preventing it would be produced in record time.

- That America would lead the world with more than 300,000 reported deaths.

- Unemployment would hit record levels and the government would send people checks, while others made a bundle in the stock market.

- A record number of people would be working from home and kids would attend school via Zoom.

- That there would be a cultural civil war over wearing protective masks.

- That the longest bull market in history would end — to be followed by the shortest bear market in history — then resume to produce record portfolios and see the number of TSP millionaires jump from $27,717 in March to 49,620 by Dec. 30.

And so on…

Of course nobody actually did that. Nailed 2020 in that way. But just wait, they will. Somebody will claim they foresaw all this long before it actually happened. Those those who, long after the fact, warned of JFK’s assassination. Or the 9/11 attacks. Meantime, reality check. I asked financial planner Arthur Stein to review the past year. Many of his clients are current or former feds. A couple of them TSP millionaires. Congress has invited him to Capitol Hill to keep congressional staffers up to speed on the TSP. Art’s going to be my guest this morning on Your Turn (10am EDT). You can listen streaming live here or on the radio at 1500 AM in the D.C. area.

Meantime, he put together this guest column:

TSP Stock Funds Complete a Historic Comeback in 2020

2020 was the most tumultuous year in recent memory. The year included the COVID Pandemic, a recession, a Bear Market, the highest unemployment in at least 11 years, political turmoil and conflict in the U.S., and enormous damage from global warming. Investment volatility was high and concerns remain about current price levels for both stocks and bonds.

Real Gross Domestic Product (GDP, the total value of all goods and serviced produced, a widely accepted measure of the size of the economy) declined -5% in this year’s first quarter and -31% in the second quarter. The economy rebounded in the third quarter, with GDP increasing 33%. Estimates for the fourth quarter are for an increase in the 10 to 11% range.

Two consecutive quarterly declines in GDP are defined as a recession. Fortunately, the 2020 recession was short. However, third quarter GDP was lower than in the fourth quarters of 2019; so, the economy has still not recovered. Unemployment is much higher than previous highs.

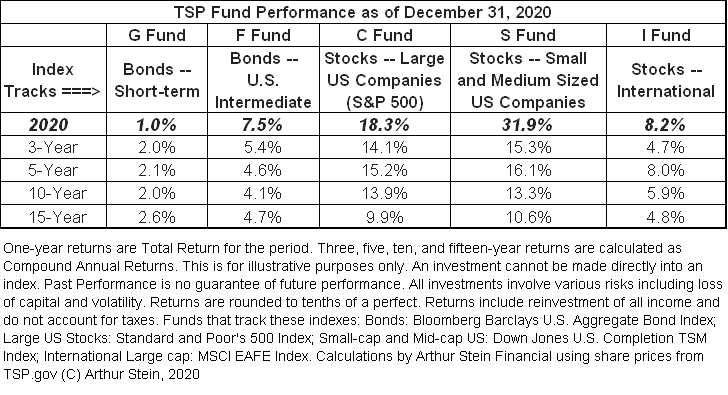

Despite those negative events, the TSP stock and bond funds did well.

The S Fund significantly outperformed the C Fund in 2020. Returns for the S Fund are now higher than returns for C for almost all time periods. Yet TSP participants allocate approximately three times as much to C as to the S Fund.

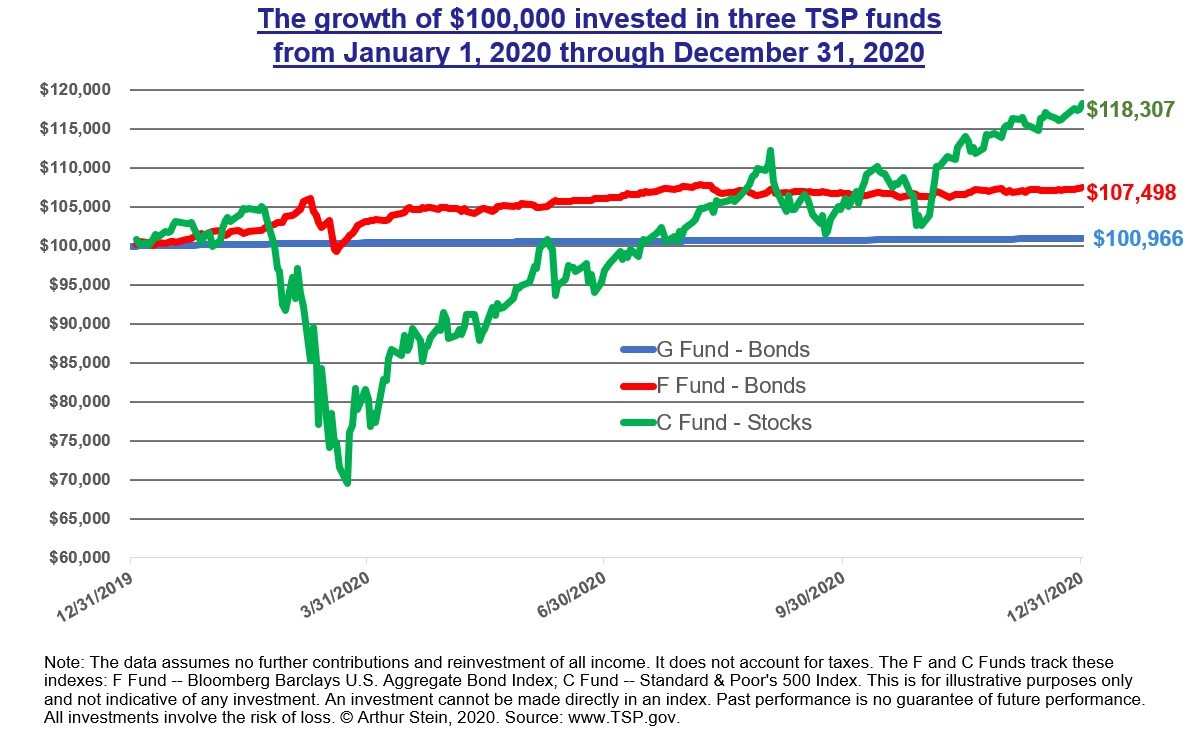

The twelve-month returns do hide the extreme stock market volatility during the year. For instance, the C Fund increased 5% at the beginning of the year, then quickly fell 34%: the fastest Bear Market in history. Many investment analysts thought market declines would continue but they didn’t. The market quickly recovered; for instance, the C Fund increased 70% from the March bottom until the end of the year.

In sum, stock markets ended a volatile and scary year at historic highs, boosted by the Federal Reserve’s actions to lower interest rates, Government stimulus programs, record-breaking vaccine development and an incredibly resilient corporate America. Those developments helped offset the worst pandemic in more than a century.

Nearly Useless Factoid

By Alazar Moges

Pez candies got their name from the German word for peppermint— Pfefferminz.

Source: Foodbeast

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED