Feds with Benefits: Open Season checklist for federal employees

With more expensive premiums and potential benefit changes, it’s important to evaluate whether your current plan still fits your needs during Open Season.

It’s Federal Employee Health Benefits Program Open Season, and federal employees have an opportunity to review and adjust their health plan for next year. With more expensive premiums and potential benefit changes, it’s important to evaluate whether your current plan still fits your needs.

This checklist will help you navigate this process, plus I’ve shared tips on how to save on healthcare costs.

- Confirm available plans

Plans in the FEHB program change each year, so it’s important to check what’s new and what’s being discontinued.

There are two new FEHB plans, both in California: Sharp Health Plan in the San Diego area and Western Health Advantage around San Francisco. Additionally, Compass Rose lifted enrollment restrictions and has two plans that are available to all employees for the first time.

- Check your plan premium

The average enrollee share of premium is increasing 13.5%, one of the largest hikes in recent memory. But this doesn’t tell the full story: Of the 144 FEHB plans that were available this year and next, 28 will see premium decreases, five will remain unchanged, and 111 will have a premium increase.

To avoid any unwelcome surprises in January, review your premium during Open Season and compare how your current plan stacks up against others. You can find premiums on the carrier website and in marketing materials, on the OPM plan comparison tool, and on the last page of any FEHB plan brochure.

- Check section 2 of the official plan brochure

The official plan brochure is a great resource to learn how your FEHB plan works. The one thing you should check every Open Season is section 2: “Changes for 2025.” This is where the plan will tell you important changes, like a cost share increase for a service, new preauthorization requirements, or new benefits for the upcoming year.

Here are a few examples of 2025 changes:

- All GEHA plans have added doula coverage

- BCBS Basic is increasing the member cost share for several benefits, including: emergency care, urgent care, specialist visits, inpatient and outpatient hospital, brand name prescription drugs and more.

- Check providers and prescription drugs

You always pay less by staying in-network, so check if your existing providers are covered by your plan. You can’t assume everything will remain unchanged from one year to the next, so look over the provider directory on the plan website.

Similarly, for any current medications you take, check to see if they’ll be covered. Many FEHB plan websites will have prescription drug cost tools where you can select your drug, dosage and preferred pharmacy to see its cost. Again, you can’t assume there won’t be any prescription drug changes in your current plan from one year to the next.

For example, I’ve heard from some federal employees that have received a notice about a formulary change in the BCBS Basic plan that will significantly increase their out-of-pocket prescription drug costs for Wegovy, a GLP-1 weight loss medication. Due to a tier change, a 28-day supply at a CVS in the Washington, D.C. area will rise from $60 this year to $767.38 next year.

- Use yearly cost estimates to narrow down plans

What you’ll pay is more than just the plan premium. While important, and a for-sure expense, selecting an FEHB plan on premium alone ignores what you’ll pay when using a healthcare service. In the most recent Federal Benefits Survey administered by OPM, 81% of federal employees indicated total out-of-pocket costs as the most important factor when selecting a health plan.

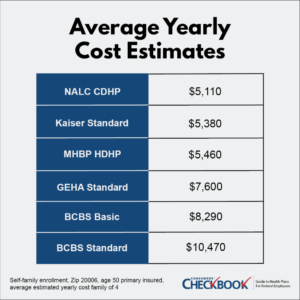

For 46 years, Checkbook’s Guide to Health Plans has ranked plans on estimated total yearly cost based on user information — age, family size, and expected healthcare usage — to help federal employees and annuitants see which plans offer the best value. The benchmark ranking shows big cost differences among plans.

For instance, a family of four in the Washington, D.C. area, with average healthcare and a primary policyholder aged 50, could save $5,360 in estimated total costs next year by switching from BCBS Standard to NALC CDHP.

- Take advantage of flexible spending accounts

With higher premiums on the horizon, federal employees should be looking for ways to save money on healthcare expenses. However, only about 20% use a flexible spending account, a for-sure way to save about 30% on predictable healthcare expenses, from dental and vision care to prescription drug refills to over-the-counter pharmacy items.

Contribution and rollover limits are rising in 2025. Employees can contribute up to $3,300, but you must be somewhat careful in budgeting as only $660 of unused funds can be rolled over into a new plan year. Employees with an HSA aren’t allowed to have a healthcare FSA, but they can still set up a limited expense FSA for dental and vision expenses, which is a good idea to help keep HSA funds invested.

You must renew your enrollment every Open Season to keep your FSA. You can enroll and learn more at FSAFEDS. FSA and FEHB Open Season ends on 12/9.

Send in any FEHB questions you have, and I look forward to answering them with actionable advice that might help save you money or help you better understand a confusing aspect of how FEHB works.

Kevin Moss is a senior editor with Consumers’ Checkbook. Watch more of his free advice and check here to see if your agency provides free access. The Guide is also available for purchase and Federal News Network readers can save 20% by entering promo code FEDNEWS at checkout.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.