Roughly 39 percent of federal employees said they were "unprepared" or "very unprepared" for the recent government shutdown, according to a survey from Clever R...

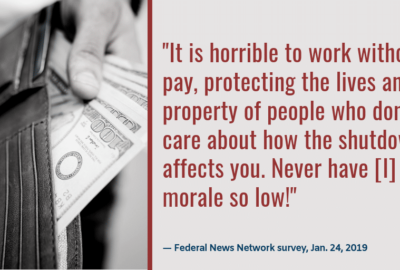

With the threat of another government shutdown over for now, the sting of the longest lapse in U.S. history will likely leave a lasting impact on affected federal employees, 39 percent of whom said they were unprepared or very unprepared for the last one, according to a recent survey.

Data from Clever Real Estate, a company that connects homeowners with real estate agents in their areas, a show a sample of federal employees who tapped into their general or retirement savings, borrowed money from friends and family and took on odd jobs in lieu of receiving a paycheck.

“The overall picture we see is one of people relying on their networks, relying on their own hustle and initiative to make ends meet through a really difficult period,” Luke Babich, Clever’s chief strategy officer, said in an interview.

Clever Real Estate partnered with Pollfish, an online polling software, to reach and survey 500 federal employees about the government shutdown’s impact on their finances and financial plans. It wasn’t the only real estate or financial institution to weigh in on the government shutdown’s impacts on their customers.

Zillow, an online real estate data platform, said furloughed and excepted federal employees working without pay during the government shutdown owed $438 million in mortgage and rent payments in the month of January.

A clear majority of federal employees — 84 percent — said the government shutdown ultimately didn’t force them to miss a mortgage or recent payment.

For those who did miss a payment, Clever noted some perhaps obvious demographic differences.

“Millennials were less financially prepared for the government shutdown,” Babich said. “Non-millennial federal employees were 22.7 percent more likely to say they were very prepared financially for the government shutdown. At the same time, because non-millennials are further along in life and have more major purchases that they are planning for, we also saw that they had a significantly higher likelihood to have those plans disrupted by the shutdown.”

Millennials, or federal employees ages 18-34, were more likely to miss a rent payment, while non-millennials were more likely to miss a mortgage payment, Babich added.

Millennials actually made up a greater proportion of respondents to the Clever survey compared to their share of the federal workforce population. About 32 percent of the survey’s respondents were millennials, while federal employees ages 34 and younger make up just 16 percent of the existing workforce, according to the most recent demographic data.

Meanwhile, just more than 17 percent said they had considered or had already taken out a loan during the recent government, while 18.6 percent said they had dug into their retirement savings, and 13.2 percent applied for a new credit card to open up a new line of credit, according to the survey.

In addition, 36 percent of federal employees turned to some other kind of work to supplement their income during the government shutdown, either with a full or part time job, online freelance work and miscellaneous odd jobs, the survey said.

The federal community will examine the impacts of the most recent government shutdown on the pace of federal retirements and recruitment and retention trends for years to come, but a small sample of Clever respondents may indicate the mindset for at least some in government.

The vast majority of federal employees — about 70 percent — said they planned to continue working for government.

But the rest said they were either looking for others jobs or were considering a job search. About 5 percent said they planned to leave their federal jobs or had quit already, according to the survey.

At the same time, one in 10 federal employees said their retirement plans were impacted by the government shutdown. Babich said it’s unclear whether the recent lapse meant employees were forced to delay or speed up their retirement plans.

Graphics provided by Clever Real Estate

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED