Exclusive

Poll: 1 in 3 feds says missing a paycheck is their biggest shutdown concern

Many respondents to Federal News Network’s poll said they’re also worried about the long-term negative impacts that a government shutdown poses.

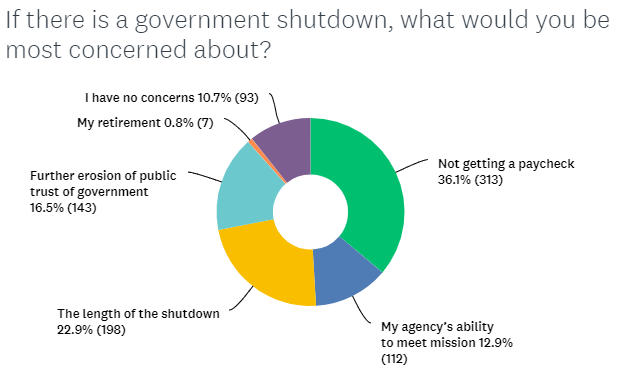

Not getting a paycheck is easily the top concern for many federal employees, as they inch closer to a pending government shutdown this week.

But the lack of a paycheck would be far from the only headache for feds, if a shutdown does happen. Many said they’re also worried about the more long-term negative impacts that a government shutdown poses.

In an online poll that Federal News Network conducted this week, about 36% of federal employee respondents said not getting a paycheck would be their biggest concern if a shutdown happens — it was the top answer in the poll results.

Federal News Network received 868 responses to our poll, which we conducted between Tuesday and Thursday this week.

Close to a quarter of respondents said they are worried about how long a shutdown would last. And many said their top concern would be even further erosion of the public’s trust in government — which has already been dwindling for years.

During a government shutdown, employees working at appropriated agencies are typically placed into one of two categories — furloughed or excepted. Furloughed employees have to stop working during a shutdown, while excepted employees continue to work throughout a shutdown. Regardless of the category, none of these employees get paid during a shutdown.

Thanks to a 2019 law, retroactive pay is guaranteed after a shutdown ends, but of course feds still have to live, and in many cases work, without pay for the duration of a shutdown. The longest government shutdown in history went on for about 35 days, from December 2018 to January 2019, during which time most furloughed and excepted employees had at least two paychecks withheld until after the end of the shutdown.

And it’s for good reason that the top concern for many feds is missing a paycheck, should a shutdown occur.

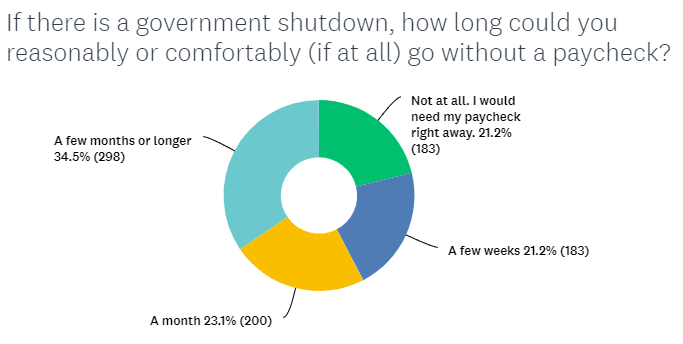

Although more than a third of respondents said they would be able to go a few months or longer without a paycheck, about one-fifth of respondents said they’d need a paycheck right away and cannot go reasonably or comfortably without one.

Of course, many of feds’ concerns can stem from the risks of being unable to meet personal payment obligations, such as a foreclosure, eviction or loan default.

There are currently no broad legal protections for federal employees against these risks. But many companies offer relief for feds during a shutdown and are already making preparations to do so.

Navy Federal Credit Union, for instance, said it will start offering loans to feds whose pay will be impacted by a shutdown, if it occurs. Federal employees have to meet certain eligibility requirements and the amount of the loan is determined by their most recent direct deposit.

If a shutdown happens, Pentagon Federal Credit Union (PenFed) similarly plans to offer federal employees several loan options and an option to skip a payment on certain loans.

The Federal Employee Education and Assistance Fund (FEEA) also offers small shutdown grants for lower-income feds, if they miss at least part, or all, of a paycheck.

Insurance company USAA will also offer a one-time, no-interest loan of up to $6,000 for feds who miss a paycheck in the event of a shutdown. The loan amount is equal to the value of one employee paycheck.

The case is similar for loans taken through the Thrift Savings Plan. TSP operations continue as normal during a shutdown, but if TSP participants miss a loan payment during a shutdown, they will not be placed in a default status on their loan. Automatic paycheck deductions for loans are also paused during a shutdown.

During a shutdown, TSP participants can also take out a loan or a hardship withdrawal from their accounts.

The Federal Retirement Thrift Investment Board (FRTIB) caps participants to two loans at any given time, so participants will only be able to take out a loan if they have no more than one loan already taken out.

FRTIB offers more details on its website about financial hardship options for TSP participants.

Amid concerns around pay, agencies are also making preparations for a shutdown by submitting updated contingency plans to the Office of Management and Budget.

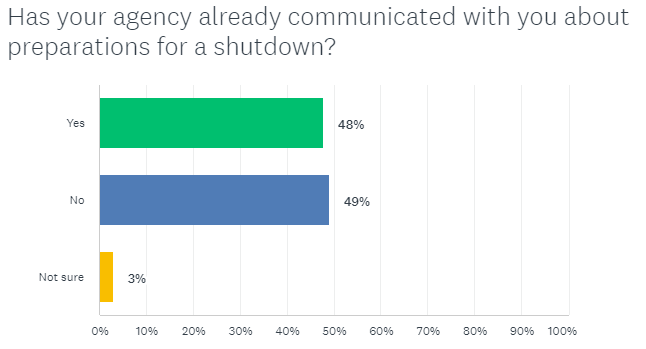

Part of these preparations involve informing employees of any potential changes or impacts.

But right now, it’s about a 50-50 split for whether agencies have directly communicated with their employees about their shutdown plans, according to Federal News Network’s poll results.

In their contingency plans, agencies usually designate how many employees will be considered “excepted” and therefore continue to work without pay during a shutdown.

Based on the most up-to-date data available from the Office of Management and Budget, Federal News Network estimated that roughly 659,000 federal employees would be excepted.

About 860,000 employees who work at agencies that are funded outside of congressional appropriations would be considered “exempt” and continue to both work and get paid throughout a shutdown.

That leaves about 783,000 feds who are likely, but not yet guaranteed, to be furloughed if a shutdown occurs. Importantly, this number is inexact because many agencies do not list a specific number of employees that they plan to furlough in their shutdown contingency plans. And many agencies have yet to update their contingency plans in 2023.

OMB began telling agencies last Friday to start preparing for a shutdown, but OMB officials are still calling on Congress to take action to prevent a shutdown from beginning on Oct. 1.

“It is up to House Republicans to do their jobs and prevent a needless government shutdown that would damage our economy, our communities, and our national security,” an OMB spokesperson said. “In the meantime, prudent planning requires that the government plan for the possibility of a lapse in funding.”

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED