Rep. Gerry Connolly (D-Va.) accused the Trump administration of politicizing the Federal Retirement Thrift Investment Board, which recently deferred plans to move...

The Thrift Savings Plan and politics aren’t technically supposed to mix.

Congress created the TSP — and the Federal Retirement Thrift Investment Board to independently manage and administer the plan — back in 1986.

Congress hasn’t paid the TSP much attention in recent years. Some members are participants themselves.

No doubt about it though, the TSP has grabbed their attention, and the recent decision to pause plans for the international fund isn’t sitting well with at least one member of Congress.

The FRTIB recently deferred plans to move the I fund to a new, China-inclusive emerging markets benchmark. The decision came after vocal criticism from a bipartisan group of lawmakers, but written opposition from the White House seemed to be a forcing factor for the board.

Labor Secretary Eugene Scalia wrote to the board earlier this month, carrying with him direct orders from White House economic and national security advisers and President Donald Trump himself. Scalia urged the TSP “immediately halt” the planned I fund changes, and the board did.

Now Gerry Connolly (D-Va.), chairman of the House Oversight and Reform Subcommittee on Government Operations, is looking for more answers.

“This administration has overstepped its authority and politicized a well-established, independent board whose sole mission is to help public servants maximize their retirement savings,” Connolly said in a May 28 letter to Scalia. “With all due respect, please keep President Trump away from the retirement plans of federal employees and service-members. He has done enough damage already.”

The board said they wanted to give the president’s new FRTIB nominees, which Trump named at the beginning of the month, a chance to come to their own conclusions on the I fund. The recent economic volatility and sheer uncertainty with the coronavirus pandemic was another factor in their decision, the board said.

But for Connolly, the FRTIB’s recent decision was made amid pushback from the administration. He questioned whether Labor and the Trump administration had violated the Federal Employees’ Retirement System Act, which designated the FRTIB as the independent entity statutorily charged with managing and administering the TSP.

“It is clear that FRTIB’s announcement to defer its 2017 decision was made under mounting and inappropriate political pressure from DOL and this administration,” he said.

The TSP on Wednesday took time during its regular meeting to recognize three of its members, who, presumably, are nearing the end of their time with the board.

FRTIB nominees are “privileged” under Senate rules, meaning they don’t need a hearing to be confirmed, Kim Weaver, the agency’s director of external affairs, said. A senator can , however, request a nomination hearing for the board nominees.

“As a result, we aren’t sure when the new nominees will be confirmed, and we didn’t want to miss the opportunity to thank our board for their service,” she said in an email. “They could still be on the board in June, we just don’t know.”

All five of the members remarked on the accomplishments of the TSP. The plan has added nearly 2 million more participants in the last decade, and TSP assets have increased by 140% during that time, said Ravi Deo, the executive director for the agency.

Participants are beginning to approach their activities with the TSP with some sense of normalcy, after the recent months of stock market volatility prompted a surge in withdrawals and a record number of inter-fund transfers.

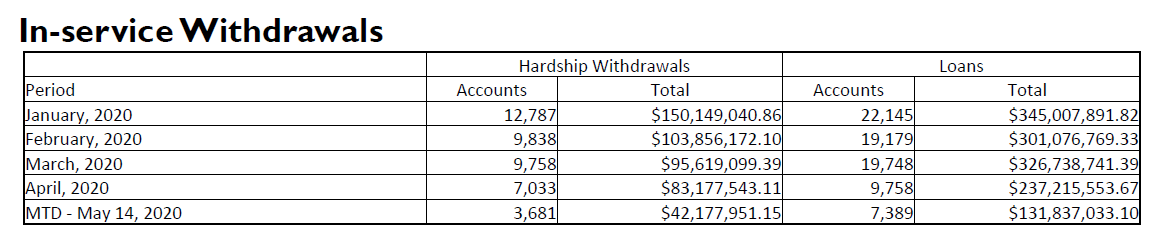

The volume of loans and hardship withdrawals is down 33% from the last month, the TSP said Wednesday.

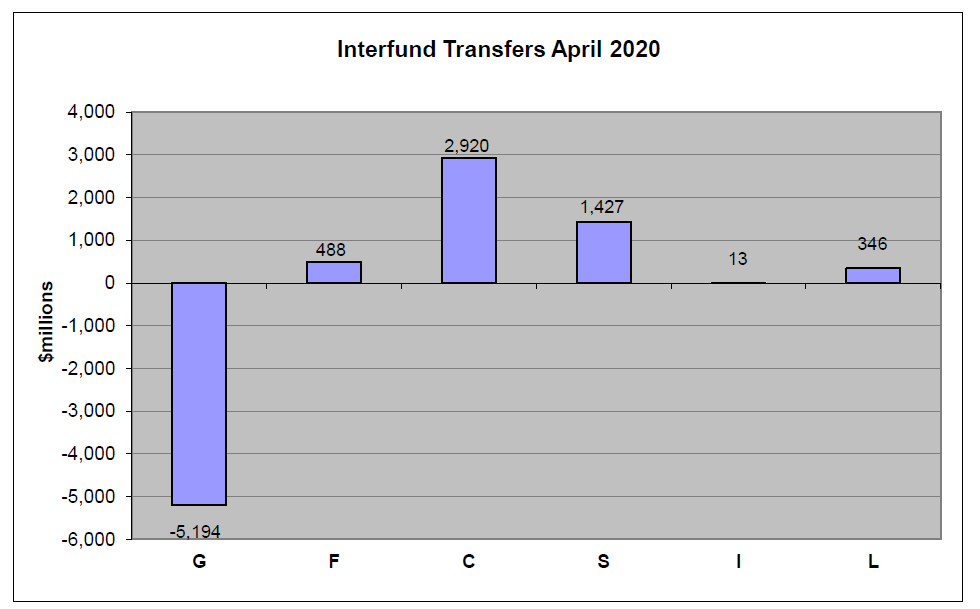

The FRTIB also noted several meaningful reversals in inter-fund transfers (IFTs).

Participants in April transferred more than $5 billion from the G fund to other TSP options, mostly into the C and S funds. In recent months, participants had taken the opposite approach, with a relatively small percentage transferring some $21 billion into the G fund from Feb. 24 and March 17.

“The pace of IFTs is slowing through the month of April, versus the pace we observed in March,” Sean McCaffrey, the FRTIB’s chief investment officer, said. “We’re also seeing the pace of IFTs through May so far has slowed from April.”

The month of April proved to be a new landmark for the TSP’s lifecycle funds. A record 2.5 million participants were invested in at least one of the L funds as of April 30.

L fund participation had dipped slightly in March but has since rebounded, McCaffrey said.

In 2010, Nicolas Cage purchased two plots in New Orleans’ famous St. Louis Cemetery No. 1, and used one of them to construct a nine-foot tall pyramid mausoleum. The only inscription on the pyramid is “Omnia ab Uno,” which is Latin for “Everything from one.”

Source: Atlas Obscura

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED